How do life insurance payouts work?

If you have a life insurance policy and you sadly pass away while the cover is in place, your loved ones could receive a payout if they make a valid claim. The money could be used to help them cover everyday bills, childcare costs or even pay off the mortgage.

In 2023, we paid out £519 million in life claims, helping over 13,000 people and their families when they needed us most.

You might also be interested in...

A life insurance payout is an amount of money that is paid out when the policyholder dies while covered by the policy, providing a valid claim is made. When you apply for life insurance, you will need to work out how much money your loved ones would need if you were no longer around. Our life insurance calculator can help you work this out.

Yes, as long as the claim is valid. For example, the monthly premiums (the amount you pay) will need to have been paid, you will need to have provided accurate information during the application, and you won't be covered if within the first year of the policy you die as a result of suicide, or an event where in our reasonable opinion, you took your own life. Other terms and conditions may apply.

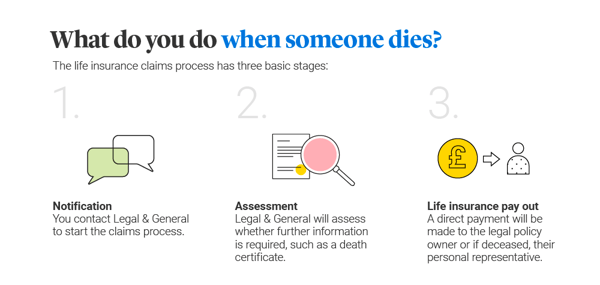

If you're making a life insurance claim, you should contact Legal & General as soon as possible after the death of the insured person. As explained below, you will need to allow time to find documentation to support your claim.

How to claim on a life insurance policy

Funeral pledge

We realise that sometimes families can experience significant financial demands at a time when they've recently lost a loved one. That's why we offer our Funeral Payment Pledge - we agree to pay part of a claim amount early and advance up to £10,000 on any valid life claim to cover the cost of the funeral. This is available for customers making a bereavement claim on a valid life insurance policy. Find out more about our Funeral Payment Pledge. Find out more about our Funeral Payment Pledge.

Does the pay out stay the same no matter when you die?

That depends on what type of life insurance you apply for. If you take out a Life Insurance policy with Legal & General, your potential pay out stays the same for the duration of your policy, unless you make any changes to it.

If you take out Decreasing Life Insurance, your cash sum decreases roughly in the same way your repayment mortgage decreases.

Remember that life insurance is not a savings or investment plan and will only pay out if a valid claim is made.

How long does a life insurance pay-out usually take?

We aim to pay all life insurance claims as soon as possible, but the exact time it takes can vary. We often have to ask other parties for information to help us consider your claim. We'll do all we can to get everything we need as quickly as possible.

What can cause delays in the pay out?

Delays can be experienced when claiming if the life policy was not placed under trust. If the deceased policyholder had made a will, the executor will apply for a Grant of Probate. This is a legal document which confirms that the executor has the authority to deal with the deceased person's assets. If the deceased policyholder died without the will then they are deemed to have died intestate and again the administrator would apply for a letter of administration also known as a grant. This could cause, not only a longer delay in paying the claim, it could mean that the policy proceeds being passed to an unintended beneficiary. Learn more about putting your life insurance in trust.

Who can claim on a life insurance policy when someone dies?

Depending on the type of life insurance policy, certain people will be able to make the claim. For example:

Joint policy in trust - the pay out would be paid to the surviving policyholder. However, half of the value of the sum assured would form part of the policyholder's estate. If both policyholders died, the lump sum would be paid to the trustees for either distribution or for use of the lump sum for the benefit of the beneficiary (or beneficiaries) of the trust.

Joint policy not in trust - the pay out would be paid to the surviving policyholder. However, half of the value of the sum assured would form part of the policyholder's estate. If the policyholder died with a will or without a will (intestate), the lump sum would be distributed according to the deceased's will or the rules of intestacy, this could mean that the pay out would be paid to the beneficiary/beneficiaries that the policyholder had not wanted to benefit from. If both policyholders died at the same time, the younger person is deemed to have survived the older person, which in turn would form part of their taxable estate and could be liable to Inheritance Tax (IHT)

Single policy in trust - the pay out would be paid to the surviving trustees who would then either distribute or use the pay out for the beneficiary or the beneficiaries of the trust.

Single policy not in trust - the pay out would form part of the deceased's policyholder's taxable estate and may be liable for IHT.

Need to make a claim?

For anyone making a claim on a life insurance policy, we understand that it's likely to be a difficult time for you. That's why we try to make the life insurance claims process as straightforward and stress-free as we can. Find out how to make a claim and get the support you need.