Learn about saving for retirement

There are many ways you can save for your retirement. The first thing to come to mind might be your pension. But there are other options. We've put together a brief introduction to get you up to speed.

When should I start saving for my retirement?

The earlier you start saving, the better chance you'll have of growing your savings to make sure that you can live the lifestyle you want later in life. In fact, the cost of putting off saving for retirement can mean that you will need to save a lot more as time goes on.

How much should I save?

This depends on the lifestyle you want in retirement, when you want to retire, how long you have to save and hopefully see your money grow and how much you can afford to save.

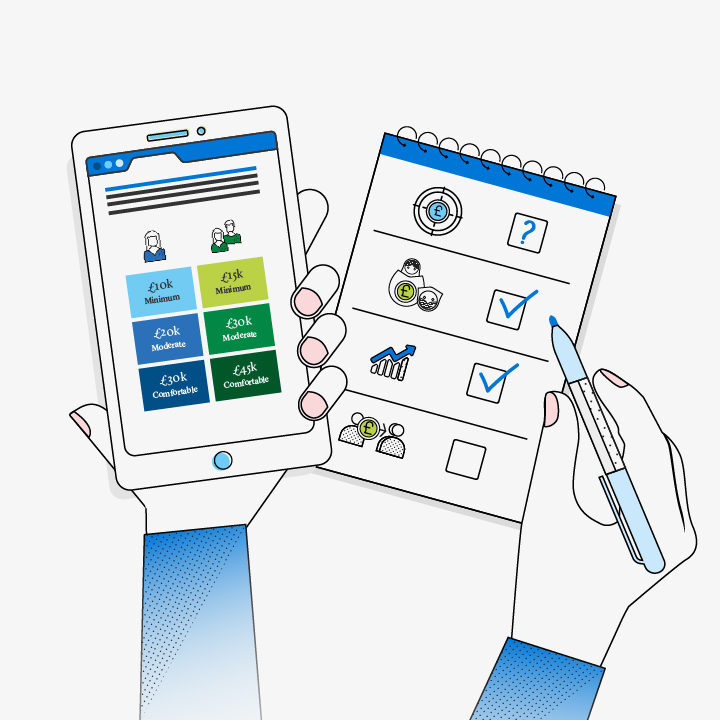

The Pensions and Lifetime Savings Association (PLSA) have created the 'retirement living standards' to give you practical guidance, helping you work out what your retirement might cost based on three lifestyles: minimum, moderate and comfortable. These lifestyles show you what your living costs might be across key spending areas such as your home, food and drink, transport, holidays and leisure, clothing and personal spending and helping others like buying presents for birthdays.

How much will you need in retirement?

Find out more about the retirement living standards and use our tool to think about what your expenses might be.

Go&Retire

You can also learn more about planning for the different phases of your retirement in our Go&Retire section.

Options to save for retirement

You can pretty much save into anything for your retirement; pensions, saving accounts, buy property, invest your money directly into company shares or bonds, or even try your hand at investing in fine wines or antiques. But only some of these will have Government incentives when you're saving for retirement.

Saving into a pension gives you tax relief which means some of your money that would have gone to the Government as tax goes into your pension instead. Plus if you're employed, your employer may be paying in some money too.

Saving into a Lifetime ISA gives you a 25% bonus, up to a set limit, on your savings each tax year directly from the Government.

These are tax efficient ways of saving for your retirement, but there are some key things to consider.

Saving into a pension

A pension is simply a way of saving towards your retirement. As the Government wants to encourage people to make their own provisions for later life, pensions come with incentives that other savings products don't offer – mainly that both your pension contributions and savings are tax-efficient. This is the main reason that saving in a pension plan is a good option for most people.

In general:

- Your plan is set up for you by your employer.

- You and your employer pay in, and the Government helps out in the form of tax relief.

- The money that you and your employer pay into your plan builds up your pension pot.

- Your pension pot is invested in one or more of investment funds.

- The aim of an investment fund is to grow the value of your pension pot.

- You can decide what to do with your money, and how you take it from age 55, whether or not you’ve stopped working.

This is different if you have a defined benefit pension scheme.

Saving into a Lifetime Individual Savings Account (LISA)

A LISA is a type of Individual Savings Account (ISA) which enables you to save for your first home or for your retirement. The restrictions on when you can start saving, access your savings and how much you can save are different to saving into a pension which means this option won't be right for everyone.

More in this section

Go&Save for retirement >

Go&Save for retirement >

If you're more than 10 years away from retiring we've got some useful information, tools and simple 'jobs to do' to help you make your savings work for you.

Picture your future >

Picture your future >

It's useful to have an idea of what different lifestyles might look like and how much they might cost. We have some simple tools to help you.

Learn about the State Pension >

Learn about the State Pension >

The State Pension is an important part of planning your retirement. Find out how it works and where you can find out what you'll get and when, in this short guide.

Get the most out of your pension >

Get the most out of your pension >

Your pension needs some love in order to get you to your goal but it needn't be time consuming. Find out more about the key jobs to do.