Picture your future

It's useful to have an idea of what different lifestyles might look like and how much they might cost so that you can make sure your savings are working hard for your future

You may not have thought much about what your retirement might look like yet. That's ok, you don't need to have a detailed plan just yet. But it’s useful to have an idea of what different lifestyles might look like and how much they might cost so that you can make sure your savings are working hard for your future.

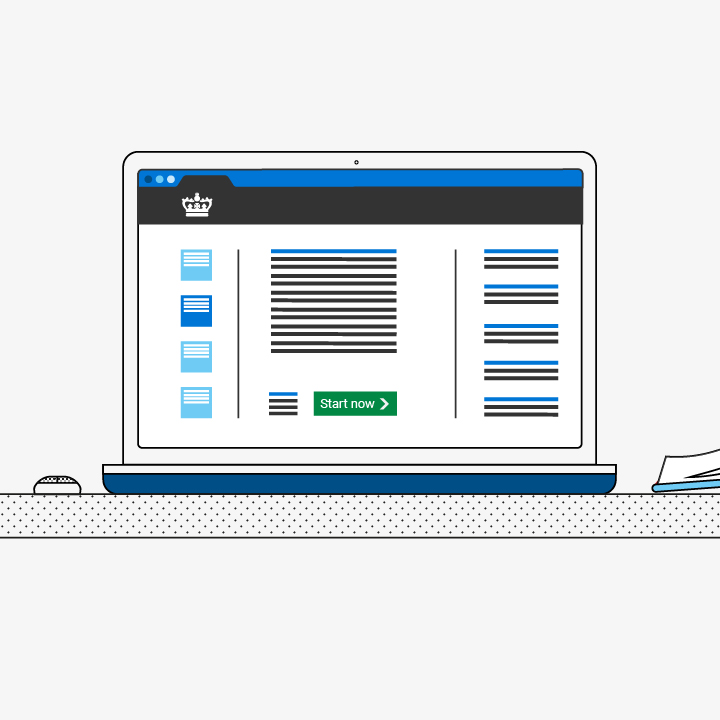

If you're within 10 years of your retirement, or just want to be more specific right now, head over to our Go&Retire section where we can help you picture your retirement in more detail.

We've got some tools to help you get a quick idea of what different lifestyles might cost.

Three ready-made lifestyles

The Pensions and Lifetime Savings Association (PLSA) have created the 'Retirement Living Standards' to give you some practical guidance, helping you work out what your retirement might cost based on three lifestyles: minimum, moderate and comfortable. These lifestyles show you what your living costs might be across six key spending areas.

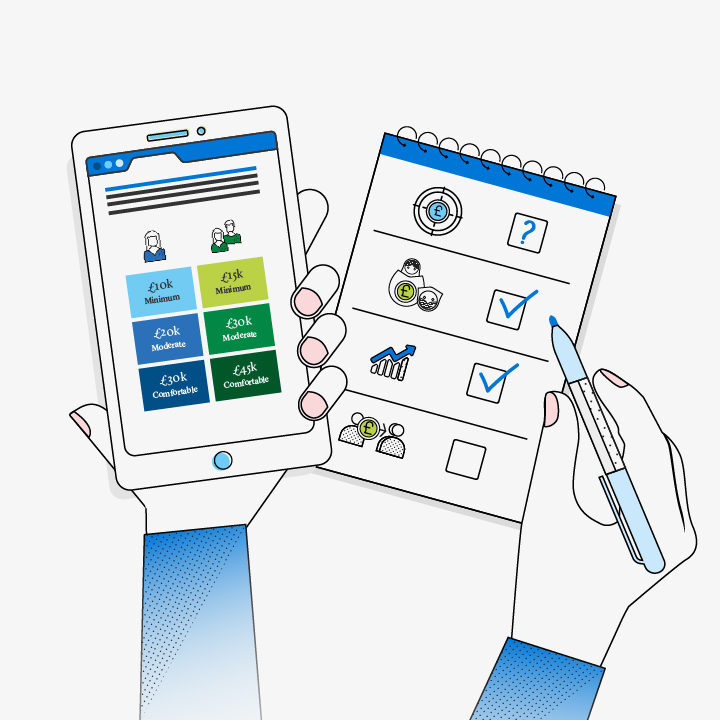

The standards show costs for both couples and individuals. They fit into the retirement income brackets of roughly: £14k - £31k - £43k for individuals and £24k - £43k - £59k for couples *.

This provides a useful 'rule of thumb' of how much money you'll need each year in your retirement to support the way you want to live.

Customise your lifestyle

We've got a tool to help you customise what your expenses might be in retirement. To help get you started, we've split this into 11 spending areas like household bills, food and drink, clothing, restaurants, holidays and hobbies. With this tool you can personalise the income level you might need depending on your lifestyle and what income you might have available.

What to do next

Once you have an idea of what different lifestyles in retirement might cost, you need a plan to get there.

You're already saving for your retirement with your Legal & General pension, plus you may have other pots from previous employers or other savings plans in place. Most people will also get the State Pension which goes some way to meeting the minimum Retirement Living Standards lifestyle.

But there may be things you can do along the way to improve your retirement lifestyle and your savings will need some love and attention from time-to-time to keep you on track.

It doesn't matter whether you're a money newbie or a money master, we've got some useful information, tools and simple 'jobs to do' to help you make your savings work for you and keep you on track.

- Try our retirement planner tool to find out what your current savings might give you in retirement and play around with making changes to see the difference this makes to your potential income.

- Learn more about saving for retirement.

- Learn more about the State Pension.

Get the most out of your pension

Find out more about important jobs to do.

More in this section

Go&Save for retirement >

Go&Save for retirement >

If you're more than 10 years away from retiring we've got some useful information, tools and simple 'jobs to do' to help you make your savings work for you.

Learn about saving for retirement >

Learn about saving for retirement >

There are many ways you can save for your retirement. If you're new to pensions, we've put together an introduction to get you up to speed.

Learn about the State Pension >

Learn about the State Pension >

The State Pension is an important part of planning your retirement. Find out how it works and where you can find out what you'll get and when, in this short guide.

Get the most out of your pension >

Get the most out of your pension >

Your pension needs some love in order to get you to your goal but it needn't be time consuming. Find out more about the key jobs to do.