Take stock of your money

It's vital to take time to assess what you'll have to work with to help you create your plan or make changes if you need to.

You'll need to take stock of what your retirement finances will look like to work out when you could retire and the lifestyle you'll have.

There are three stages:

- Calculating your potential income and assets from your pensions, State Pension and other savings/assets.

- Calculating your retirement expenses, working out what you have and need to live on, remembering to factor in all financial and family obligations.

- Comparing the two.

This might seem daunting, but you’ll be glad once you've done it!

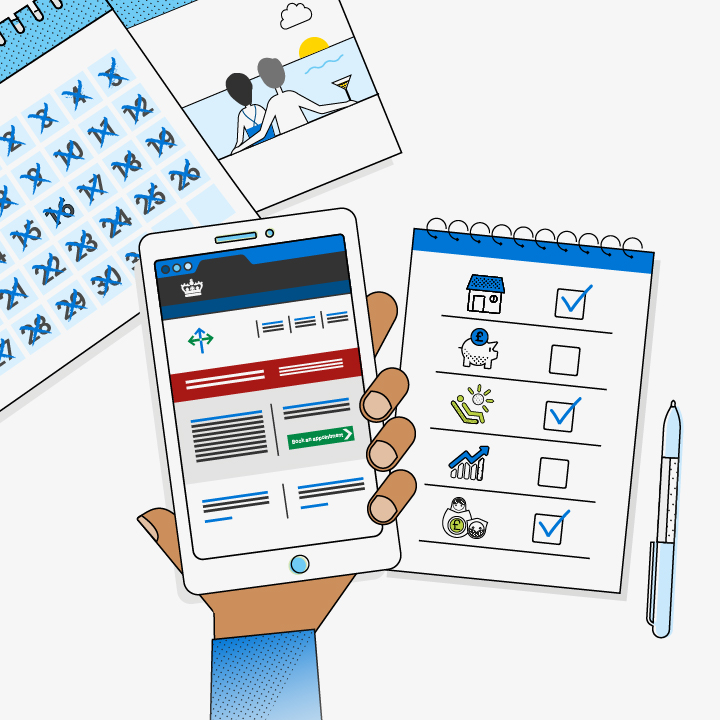

If you haven't done this yet we'd recommend you set aside some time to gather all your documents together, get the latest values for your savings and get some guidance or advice.

This could take a few days or weeks, especially if you've forgotten any log in details for online accounts or have missing documents you need to find.

- MoneyHelper has a useful Budget Planner to help you work out what income you might have compared to your expected expenses.

You need to know

✔️ What pensions you have and when you can access them - your partner's may be different

✔️ What your State Pension will be and when you'll get it – your partner's may be different

✔️ What other income you'll have in retirement

✔️ Whether you'll be entitled to any benefits in retirement

✔️ How long your income might need to last

✔️ What assets you have and how they could work for you

✔️ How you might be taxed on your income

✔️ What your expenses are likely to be

✔️ Whether you have any debts outstanding, or need to continue paying your mortgage or rent

✔️ Get advice if you need it

✔️ If you have a shortfall in the income you need and what you might be able to do to bridge the gap

1. Calculating your potential income and assets

The savings you'll have could be made up of:

The first step is to list all your assets, everything you have that is of substantial value like pension savings, bank accounts, other savings, Premium Bonds and shares. It may be worth using MyLostAccount, an online service that can find lost accounts with banks, building societies or National Savings, just to make sure no accounts have gone astray.

2. Calculate your retirement expenses

Now you need to work out what your expenses might be in retirement. This will depend on the plans you have for retirement.

You'll need to think about costs to run your home and transport and other expenses like food and drink, clothing, restaurants, holidays, hobbies and helping others like buying presents.

This is very similar to the household budget you may have now, so use that as a starting point.

Don't assume that your expenses will go down in retirement. With more time on your hands, and maybe a bucket list of experiences to tick off, your retirement expenses may be higher – especially in the first phase.

3. Compare your income to your expenses

Now that you know what your likely retirement income will be, you need to see how this compares to your expected expenditure.

It’s unlikely to be the final version of your plan right away – as you work through it, or as things change in the future, you may need to adjust some of your decisions, or even revisit or investigate other options and alternatives.

MoneyHelper is part of the Money and Pensions Service.

More in this section

Go&Retire - Retirement information >

Go&Retire - Retirement information >

If you're less than 10 years from retiring we've got some useful information, tools and activities so you can firm up your plan and go and have a colourful retirement.

Picture your retirement >

Picture your retirement >

It's time to start firming up what your retirement is going to look like and what lifestyle you can afford. We've got some hints, tips and tools to help you.

Your retirement plan >

Your retirement plan >

It's time to start firming up your plan, looking forward to how the next phase will work for you. In this short guide we'll help you break it down into the key phases.

Learn about accessing your pension pot >

Learn about accessing your pension pot >

Choosing when and how to take money from your pot is one of life's big decisions. Here we explain the main ways you can take an income or lump sums from your pension pot.

Releasing equity from your home >

Releasing equity from your home >

There may come a time when you need extra income to top up your pension or spend on something you need. Your home could be that source of income when you need it most.

Later life planning >

Later life planning >

As you get older your needs may change. Thinking about this in advance could help make your later years just as colourful as the decades that came before.