Save an emergency fund

The earlier you save, and the more you save, the more your savings have a chance to grow. Nonetheless, even a small amount stashed away is good to have for an emergency or a rainy day.

Why is an emergency or rainy day fund important?

If you’ve ever written a budget or used the budget calculator, you may have thought about irregular but planned costs that come up throughout the year like birthday presents, Christmas, a holiday or the car MOT. But there will also be irregular but unplanned spending for emergencies like car repairs, a new washing machine or to pay your bills if you were unable to work for a time.

Sometimes these costs come out of your wages each time they come up which leaves you short for other essentials that month. Or perhaps you’ll need to take out a short term loan to cover it, which then ends up costing you much more over time with interest payments, meaning you have less income left over each month for some time.

If that’s the case it may be worth prioritising saving – no matter how small, to build up a fund to use for these adhoc costs – sometimes called a ‘rainy day’, ‘emergency’ or ‘slush’ fund.

Prioritising saving

Prioritising saving means putting it in the same category as your bills, so it goes out of your bank or pay without the option to ‘not save this month’.

The only difference is that this ‘bill’ is to yourself, for you to use when you need or want to in the future.

How much to save

MoneyHelper recommends saving three months of outgoings like your rent, bills and debts, so you could cover your living costs if you were unable to work in the short term.

This may feel like a lot of money to save, so start small and once you’re in the savings habit you may be able to increase your savings and your rainy day fund will start to grow faster.

Five short-term or emergency savings tips

- Your bank or building society may offer a basic savings account that you can link to your current account. By putting money into this savings account on a regular basis, either through a standing order or manual transfer, you can start saving straight away.

- When you spend, think about rounding up the cost and putting the difference aside. Some banks may offer this automatically when you pay by card.

- While you should try not to touch your savings, you should still be able to access your money instantly if you have a financial emergency.

- If you’re still feeling too stretched, calculate your budget to see where your money is going and find areas where you may be able to cut back to make some savings. You can also use our ‘Boost your savings’ tool.

- If you find it difficult to get into the savings habit and save every time you get paid, it may be worth checking whether your employer has a payroll savings plan. Savings are taken from your pay before you get the money, so it’s much harder to just think ‘not this month’. Do check the terms and conditions as there may be restrictions on how often you can change your savings amount, stop or start a savings plan.

MoneyHelper is part of the Money and Pensions Service.

More in this section

Achieve your saving goals >

Achieve your saving goals >

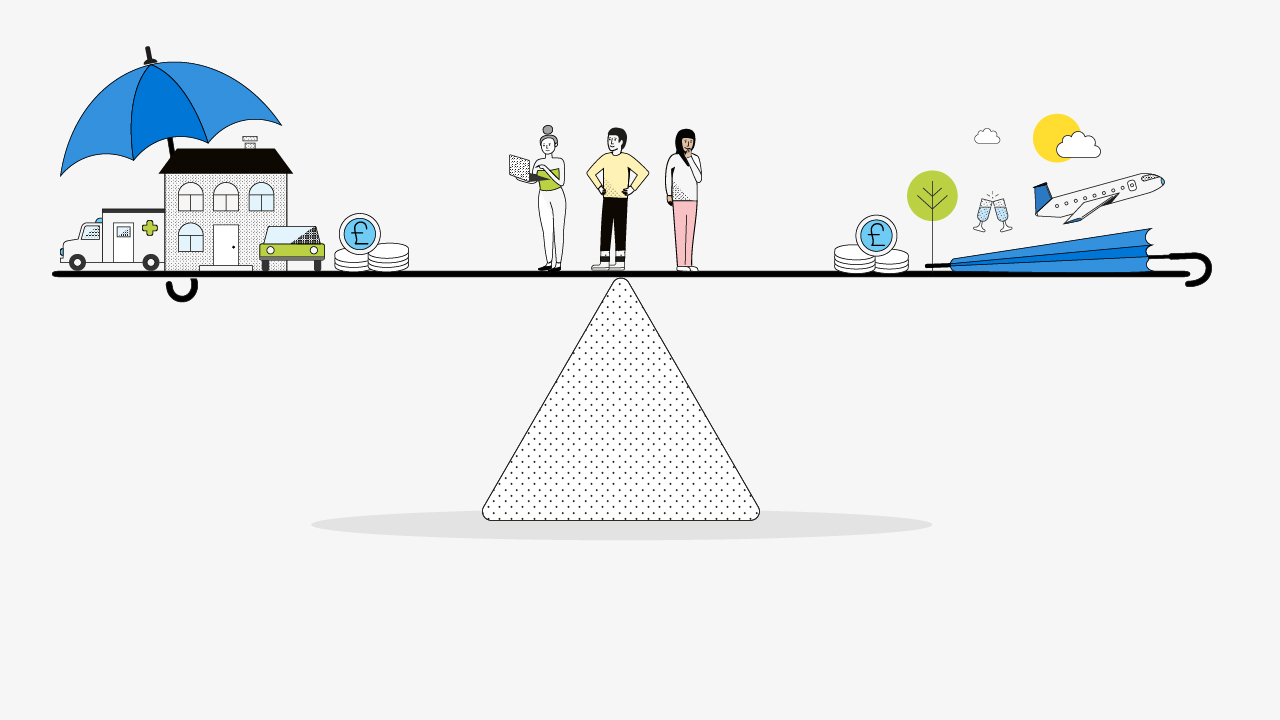

It pays to save. Whether it’s for a rainy day, or a big commitment like a deposit for a house, if we don’t save we can’t do the things we want to or cover unexpected costs.

Types of saving account >

Types of saving account >

Whether we’re saving for an emergency or for something special, we have a lot to save for. Here we cover tips for short-term and long-term savings and some key areas you need to consider.

Saving for children >

Saving for children >

Helping fund your child’s future has never been more important. Here we cover types of children’s savings accounts and a four step plan to achieve your goal.