Your investment options

You have a number of choices for where to invest your pension savings. You can:

A Invest in one of the Lifestyle options

or

B Invest in one or more of the individual funds available

When you join the Scheme, you will be able to access Legal & General's secure Manage Your Account service where you can change your investments, review your fund value and see what contributions have been paid in.

A Lifestyle options

Lifestyling involves moving your investments automatically from higher to lower risk funds the closer you get to retirement.

This is done to try to protect your pension savings from the ups and downs of the stock market in the run up to retirement.

Moving your investments is done automatically for you free of charge and assumes that you will be retiring at your Selected Retirement Age. So, if you invest in this option and are not planning to retire at this age you will need to change your Selected Retirement Date online or by contacting Legal & General.

There are three Lifestyle options for you to choose from. The differences between them relate to when the transition is made from higher risk to lower risk funds, when the transition starts and what the lower risk funds invest and end in.

The charges that apply to the Lifestyle options will change as your money is moved between investments. You can see the charges that apply to each of the underlying funds that make up the Lifestyle in the below table. The Lifestyle Fund is made up of 50% Passive Global Equity (inc. UK) Fund and 50% Diversified Return Fund. The overall charge for investing in the Lifestyle Fund is 0.41%, and the cost of investing in the lifestyle profile reduces in the approach to retirement.

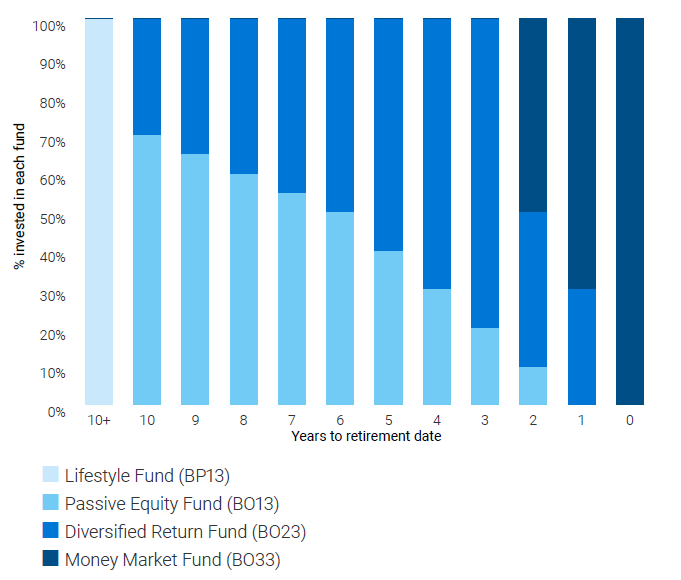

Lifestyle Cash Target (the default fund)

This involves moving your funds from higher risk investments to finally the Money Market Fund when you reach your Selected Retirement Age. The main difference is that this lifestyle option invests more in cash and money market instruments. This option has been created for members who are looking to take all their pension savings as cash in one go.

Lifestyle Annuity Target

This involves moving your funds from higher risk to lower risk investments 10 years before your Selected Retirement Age. This main difference is that this option invests more in corporate bond and fixed interest instruments as you reach your selected retirement age. This options has been created for member who are looking to take 25% of the final pot as cash and the remainder to purchase an annuity.

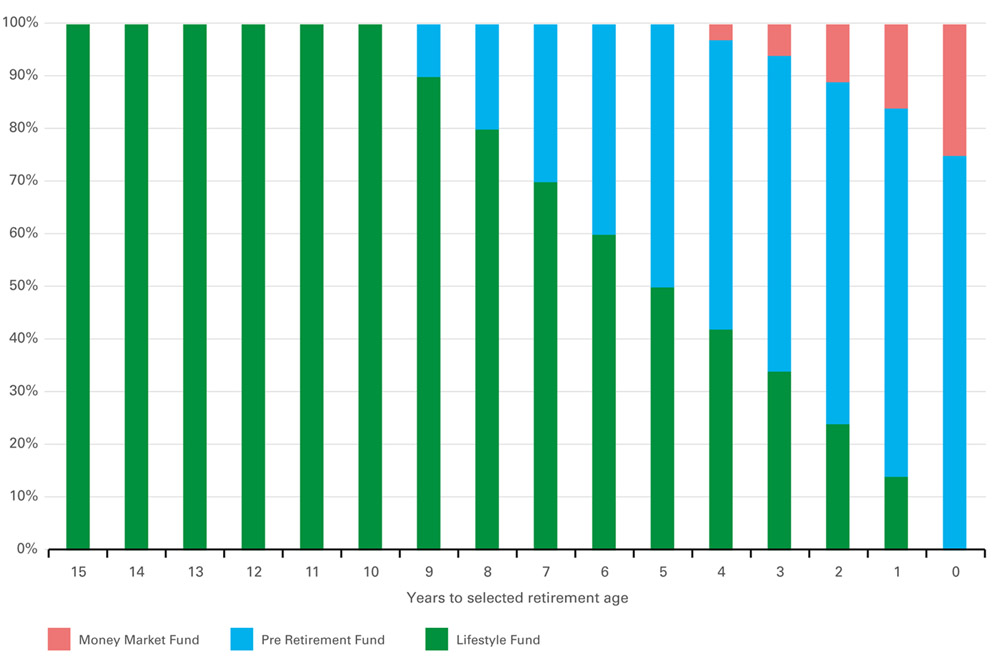

Lifestyle Drawdown Target

This involves moving your funds from higher risk to a fund that aims to provide long-term investment growth through a diversified range of asset classes 10 years before your Selected Retirement Age. This option has been created for members who are looking to take 25% of the final pot as cash and leave the remaining 75% invested to provide flexible income drawdown.

B Investing in a mix of funds

The table shows you the investment options you have within the Scheme. The funds available may change in the future.

A summary of the performance of all of the funds can be found in your Investment Report. Please see the fund factsheets for further detail on each individual fund.

Fund name

Asset Class & Investment approach

Fund description

You may want to invest in this asset class if you are concerned about

Total expense ratio (TER)

Global Equity & Passive

This fund invests in a combination of funds which invest in stock markets around the world. To reduce the impact of currency movements on the returns generated by the fund, 75% of its non-Sterling currency exposure is hedged back to Sterling.

Opportunity cost, inflation risk

0.43%

Multi-Asset & Passive

The investment objective of the fund is to provide long-term investment growth through exposure to a diversified range of asset classes (excluding physical property) while reflecting significant environmental, social and corporate governance (ESG) issues into the fund's investment strategy.

Opportunity cost, inflation risk

0.35%

Corporate Bond & Fixed interest & Passive

The Fund aims to improve potential outcomes for investors likely to purchase fixed annuities by providing a diversified exposure to assets that reflect the broad characteristics of investments underlying a typical traditional level annuity product, incorporating Environmental, Social and Governance (“ESG”) considerations as part of the investment strategy. The Fund cannot provide full protection against changes in annuity rates for individual members as these also depend upon a number of other factors (e.g. changes to mortality assumptions).

Conversion risk

0.28%

Index-Linked & Passive

The Fund aims to improve potential outcomes for investors likely to purchase inflation-linked annuities by providing a diversified exposure to assets that reflect the broad characteristics of investments underlying a typical inflation-linked annuity product, incorporating Environmental, Social and Governance (“ESG”) considerations as part of the investment strategy. The Fund cannot provide full protection against changes in inflation-linked annuity rates for individual members as these also depend upon a number of other factors (e.g. changes to mortality assumptions).

Conversion risk

0.28%

Cash & Active

This fund aims to provide a high level of security by investing in short-term money market instruments and fixed deposits. While this is a low risk fund, no investment strategy is without risk. As such there is a small chance this fund could have a negative return.

Conversion risk

0.29%

UK Equity & Active

This fund invests in shares of companies that meet a set of ethical criteria.

Opportunity cost, inflation risk

0.93%

Global Equity & Passive

This fund invests in shares of companies around the world whose practices are consistent with Shariah principles.

Opportunity cost, inflation risk

0.54%

Global Equity & Active

This fund invests in shares of overseas companies located in developing countries.

Opportunity cost, inflation risk

1.18%

Property & Active

The fund aims to get the best return from a portfolio of first class freehold and leasehold interests in commercial and industrial property.

Opportunity cost, inflation risk

1.60%

Charges

We want to help you make the most of your Scheme savings so we've negotiated administration and investment charges to help.

The total expense ratio, or TER, represents the total cost associated with investing in the fund. Some elements of the TER will be deducted directly from your Retirement Account, other elements will be deducted from each investment fund and is reflected in the unit price.

The TER can change from time to time, so make sure you keep an eye on how much it is and whether the fund you're in is still right for you. You can do that by looking at the fund factsheet for each investment.

For further information on your investment options, please see your Member Booklet. Before you make any investment decisions, make sure you understand what investment risk is and how you feel about it.

Please note Legal & General or the Trustee cannot provide financial advice. If you want help to make your own investment choices, you should speak to a financial adviser. You can find one in your local area at unbiased.co.uk. Financial advisers usually charge a fee for their services, but it will be personal to you and your circumstances.