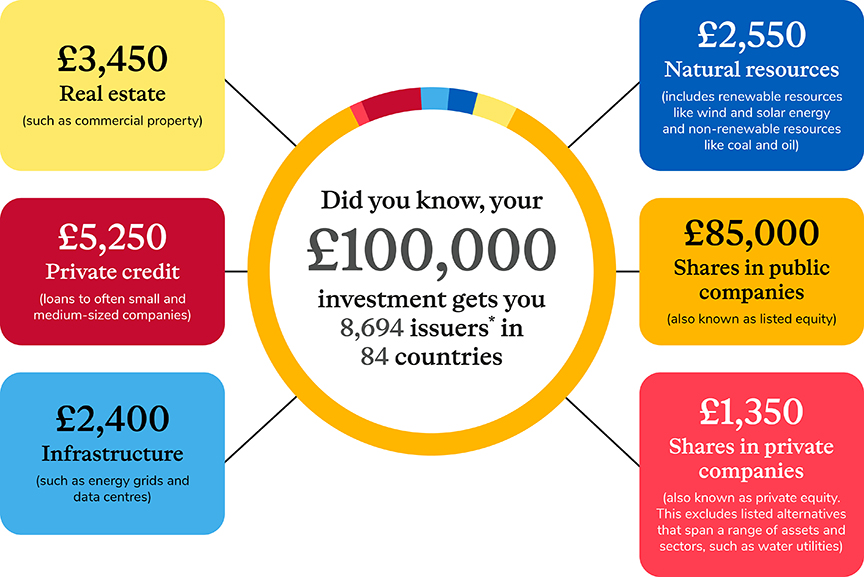

Investment in numbers

When you invest your pension in Lifetime Advantage Funds, it doesn’t work in isolation; it is pooled together with contributions from other pension savers in the same fund. The pooled investment is then spread across a wide range of opportunities such as companies shares, projects, and initiatives around the world.

To give you an idea of what this looks like, we have used an example of a £100,000 of investment at the funds’ growth stage. Scroll down to see more in detail.

The asset mix per £100,000 of investment

* Issuers provide (issue) shares or other investment opportunities. They can be corporations, or investment trusts.

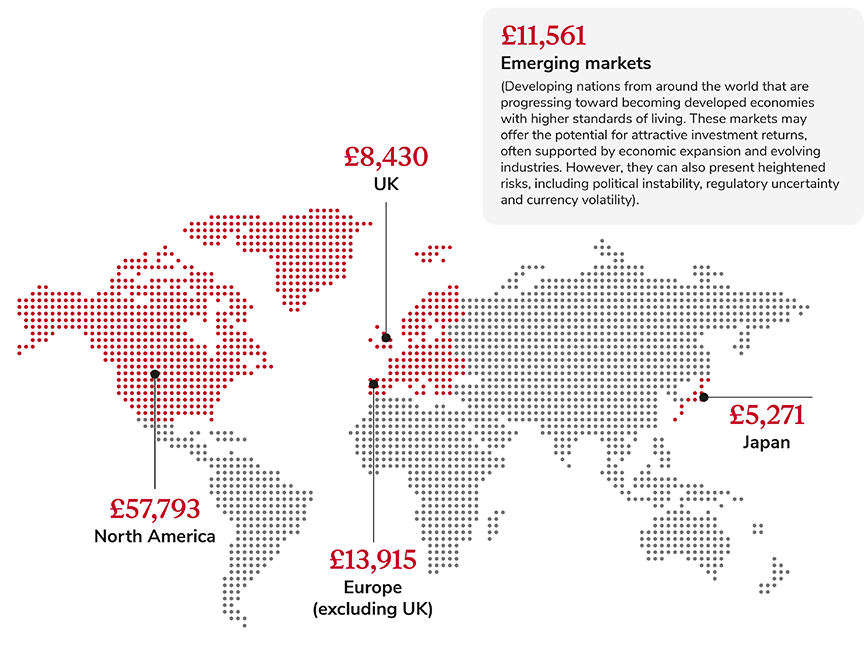

Top five regions invested in

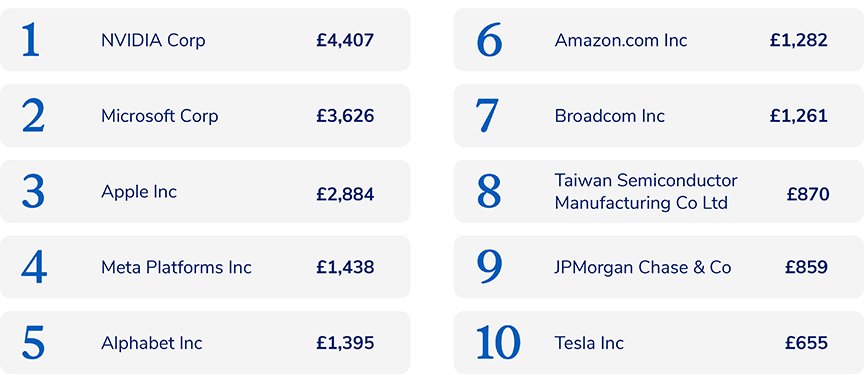

Top 10 companies invested in

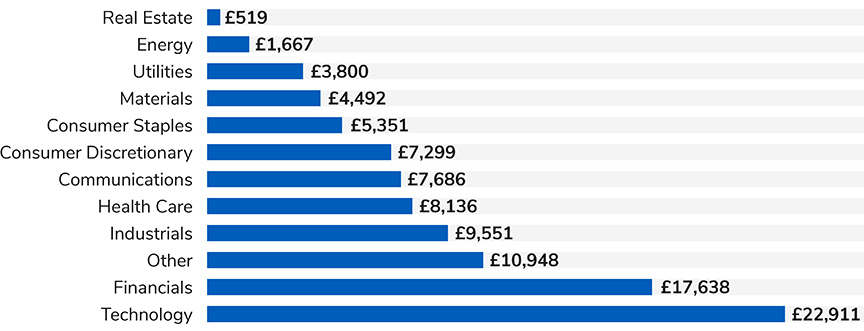

Sector breakdown

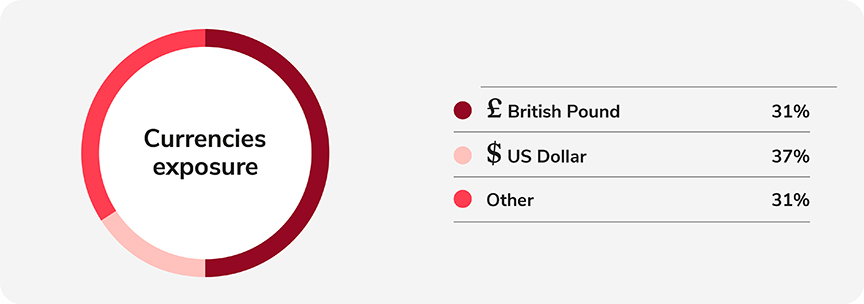

Currency exposure

Source: L&G asset management business. Information and data as at 30 June 2025 and is subject to change.

The information shown on this document is a representation of £100,000 investment. If the investment was £50,000, for example, the financial values would be halved, but the number of holdings and countries would remain the same.

For illustrative purposes only. Reference to a particular company is on a historic basis and does not mean that shares or bonds in the company are currently held or will be held within a fund or portfolio.

Figures have been rounded to the nearest pound or percentage so may not add up in full.