Private markets

Lifetime Advantage Funds make a broad range of investments available to you – around 15% of the funds are allocated to private market investments which are not typically available through other pension funds.

These investments can be infrastructure (such as roads and bridges), scientific research, renewable energy projects, property developments and more.

Private markets in numbers

The following illustration represents a £100,000 investment at the funds’ growth stage. If the investment was £50,000, for example, the financial values would be halved, but the investment categories would remain the same

![]()

Scroll down to see more examples of what these numbers mean in practice. You can also use the investment map.

Investing in entrepreneurship

As an asset manager, we have been an active supporter of the UK university ecosystems for over 10 years, partnering with universities across asset management, real estate development and supporting the scale up and commercialisation of UK science and innovation through investment in university spinouts.

- Over £14.5bn has been invested in UK university spinouts over the last 10 years with over £6.7bn in the last 3 years2

- L&G has committed over £7.5bn of support to the university ecosystems across its investments and partnerships3

- Established long-term partnerships with university spinout platforms across Oxford, Cambridge and the North East of England, giving exposure to 3 of the top 5 UK universities for university spinouts by volume4

Emerging markets and developing economies are vital to the transition to net zero -they account for a large and growing share of global greenhouse gas emissions.3 These emissions are often linked to global supply chains, which means progress in these regions benefits everyone. This shared challenge also creates significant investment opportunities: financing new infrastructure and industries can support growth while driving the transition. We’re already working with partners to help make this happen.

Helping developing nations to lower their carbon emissions

Large global infrastructure projects

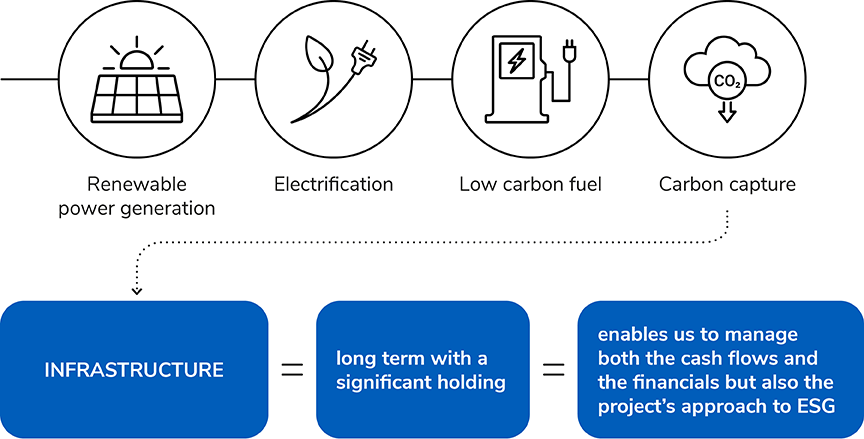

To contribute to the transition to a net-zero economy (where carbon emissions are balanced by removals), we work with partners to invest in core infrastructure assets based around four areas:

Harnessing the power of clean energy to help tackle climate change

We join forces with specialist renewable energy asset manager, NTR, aiming to attract more investments into clean power projects and initiatives.

- $9.2 trillion per year the estimated average global cost needed for physical assets and land-use systems to reach net zero by 2050.5 (equivalent to £7.2 trillion per year using 2024 average exchange rates. A trillion pounds is a very large sum, often used to refer to national debt, total market capitalizations of major companies, or government spending on a national scale)

- €840 billion per year the amount of money that the European energy transition represents in terms of opportunities for investors looking to put capital into sustainable infrastructure that aims to drive Europe’s de-carbonisation.6 (equivalent to £712.5 billion per year using 2024 average exchange rates)

Helping to address the UK’s shortage of high-quality affordable homes

We aim to help improve people’s lives and ensure that everyone has access to a safe and secure space to call their own.

- 15,000 the number of homes that Legal & General Affordable Homes has built

- 1.3 million families on local authority waiting lists across England alone7

- 145,000 new affordable homes needed a year8

- 52,000 average annual number of affordable homes built9

For illustrative purposes only. Source: L&G’s asset management business. Unless otherwise stated, information and data as at 30 June 2025 and is subject to change.

- Figures have been rounded to the nearest pound or percentage so may not add up in full.

- Beauhurst data, Spotlight on Spinouts 2024 | Free Report | Beauhurst; last 3 years is 2021-2023 inclusive.

- As at 30 June 2023, includes value of L&G direct debt and equity investments and aggregate commitments to be provided by partnerships with others. 3. Beauhurst data, Spotlight on Spinouts 2024 | Free Report | Beauhurst.

- According to the World Economic Forum this proportion is on a trajectory to reach over 95% in the next few years. 3 actions to accelerate emerging market climate transition | World Economic Forum (weforum.org)

- McKinsey & Company, 2022.

- Bloomberg New Energy Finance (2021), The EU Fit For 55 Plan Unpacked.

- Estimated average annual number over last 40 years. DLUHC, Local Authority Waiting Lists as at Jan 2024.

- Heriot-Watt University & National Housing Federation – Housing Supply Requirements across Great Britain, 2019.

- 51,980 affordable homes built a year in England over 12-year period. DLUHC, Affordable Housing Supply Statistics live tables as at June 2024.