Responsible investing

There are financially material risks and opportunities across environmental, social and governance (ESG) areas. Our goal is to grow your pension responsibly by tackling such risks through the following approaches, which are incorporated into various parts of the Lifetime Advantage Funds. You can also head to our ESG Hub for more information on our general approach to responsible investing.

Engagement

We actively engage with companies, regulators, policymakers, industry peers and other stakeholders around the world to tackle systemic risks.

Read the annual Active Ownership report for more engagement details.

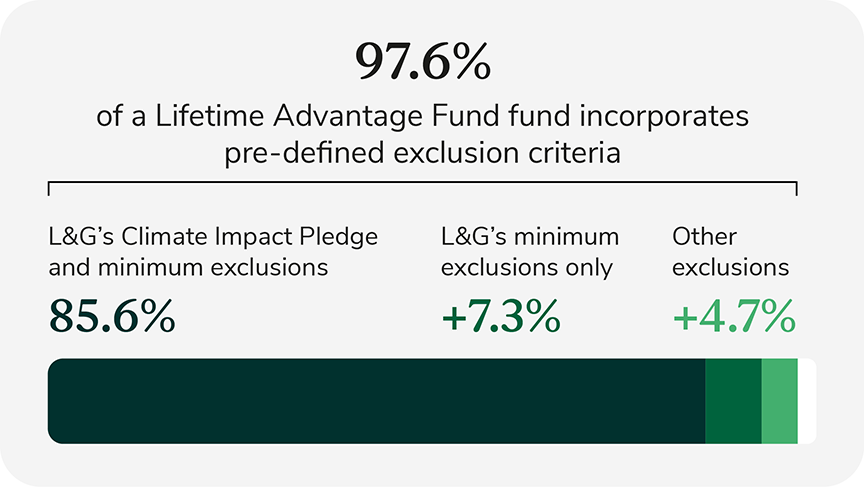

Exclusions

We may exclude companies from the funds based on pre-defined criteria, including:

- L&G’s minimum exclusions,

- Exclusions as part of L&G’s climate engagement programme (known as the Climate Impact Pledge)

- Other fund-specific criteria or those set by an external fund manager.

Read our Responsible Investing Fund Guide and annual Climate Impact Pledge report for further details.

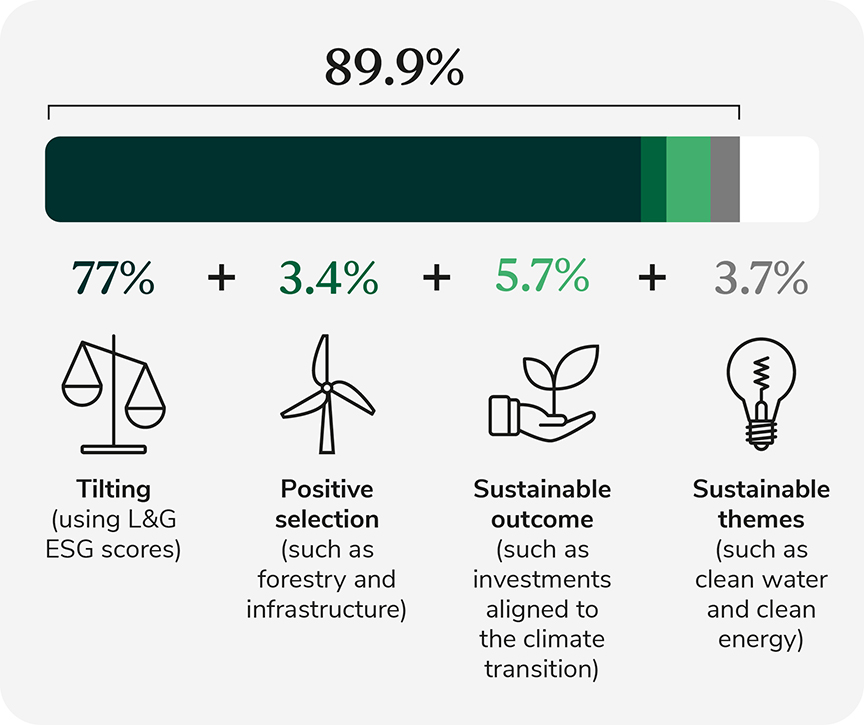

Enhancements

Using our in-house ESG scores, part of the funds tilt towards (invest more in) better-scoring companies. Parts of the funds may also consider the positive, sustainable credentials of investments.

The funds support global net zero by 2050 goals through seeking to lower the fund’s carbon footprint. Read our Responsible Investing guide for progress and target details until 2030.

Source: L&G’s asset management business. Information and data as at 30 June 2025 and is subject to change.