At a glance

The Tesco Retirement Savings Plan

- How you invest your savings can make a big difference to how much money you’ll have saved by the time you retire.

- When you join, your savings are automatically invested in the Tesco Lump Sum Lifestyle.

- Depending on how you wish to take your savings, you can select from three different Tesco Lifestyle Options. These options are designed in the same way, but the key difference is that your investments target either taking your savings all as cash when you retire, as a regular income or a bit at a time (drawdown).

- In addition to the Cash, Regular Income and Drawdown Tesco Lifestyle Options, we also offer a lifestyle option that aims to grow your money while only making investments that comply with the principles of the Islamic faith and Shariah Law. Find out more about the Islamic Lifestyle Option and Islamic Investment.

- We’ve designed the Tesco Lifestyle Investment Options to be low-cost and to help maximise returns and minimise risk, while investing responsibly.

- If you want to stay in the Tesco Lump Sum Lifestyle you don’t have to do anything.

- Alternatively, you can make your own investment choice. This can help you to invest your savings to reflect your own circumstances.

- You can choose from nine different funds, as well as lifestyle options. To view the complete list of available funds, visit the Your investment range page.

What happens to the money I pay in?

When you join, your savings are automatically invested in the Tesco Lifestyle Cash Option.

Unless you chose to put your retirement savings in a different investment option, this is where your contributions will continue to go. Remember, you can watch a short video about how the Tesco Lifestyle Investment Options work.

Although the Tesco Lifestyle Cash Option is considered an appropriate choice for most colleagues, it doesn’t take into account your personal circumstances or your future plans. You have other investment options available, but you should be aware of risk and reward before making your choice.

More information is available in the sections below on this page.

Find a fund to suit you

Before you decide if you want to choose a different investment fund to your default you should understand more about investment funds.

Asset classes

Investment funds invest in a range of different asset classes. Company shares, commercial property, bonds and cash.

Shares and property prices can be very volatile. This means they can go down or up in value sharply. Sometimes, by large amounts compared to other less volatile investments. Property prices may take a long time to recover. In return, they both offer the potential for growth over the long term

Bonds are sensitive to interest rate movements and inflation. The value of your investment is likely to fall if interest rates rise and could increase if interest rates fall. They have moderate to high volatility.

Cash is widely regarded as the least volatile investment asset. Although it is less likely to go up and down in value, investment returns are likely to be low. If interest earned fails to keep pace with the rate of inflation, the value of your money will fall in real terms, although any fall in value is likely to be limited.

Risk versus reward

Your preferred level of risk can have a big impact on your retirement savings. Be aware you may not get back as much as you put in.

Before making an investment selection, you should be comfortable with the amount of risk you wish to take. You should consider how long you will be investing for and how you feel about the value going down and up. As well as how much the value changes and how often.

Our guide to risk and reward will help you understand how you feel about investment risk and how you might identify with one of our five customer risk profiles.

Learn more about investing by following the accessible links listed below.

Learn more about investing

Some of the things you should be thinking about when making your own choices.

Other ways to invest your retirement savings

You can find out more about the different types of investments available to you.

Your investment range

For more detail on your investment options

Responsible investing

Find out how our investment management business incorporates a responsible investing approach, considering environmental, social and governance (ESG) issues in their investment process.

Planning tools

Our planning tools can help you manage your retirement savings.

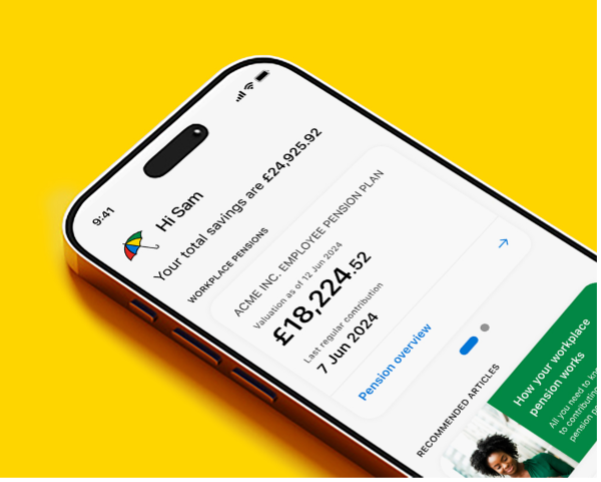

L&G app

Keeping track of your pension has never been easier. Our app lets you view your online account anytime, anywhere.

You’ll be able to check your fund value, see how your investments are performing and much more.

Download the app below or search 'Legal & General' in the App Store or Google Play.

Google Play is a trademark of Google LLC.