What is this report about?

This report explains how the Trustees manage risks and make the most of opportunities linked to climate change, protecting nature, and supporting society. The report covers the year up to 5 April 2025.

Read the full report

More information about the activity undertaken by L&G as the primary investment manager for the Mastertrust can be found on the ESG Hub and in the Mastertrust Responsible Investing Guide.

The role of the Trustees

The Trustees have two long-term sustainability objectives: to improve outcomes for members and to build a better society.

They focus on three main areas: climate (efforts to tackle climate change and transition away from carbon-emitting activities), nature (addressing the causes of nature loss), and people (factors that impact people and society, including members of the Mastertrust).

The Trustees meet with L&G twice each year to discuss climate, nature and people. Once to discuss L&G’s priorities for engaging with companies that the Mastertrust invests in over the year ahead, and once to review the outcome of these activities.

Managing investments responsibly

The Trustees use a strategy called ‘Exclude, Enhance, Engage’.

- Exclude: Avoid investing in companies that don’t align with goals on environment or society, like those involved in coal mining or making controversial weapons

- Enhance: Invest more in companies that align with sustainability goals, like clean energy or water projects, and less in those that don’t

- Engage: Work with companies to encourage them to improve their behaviour, especially on climate and social issues

Growing coverage

This year, the Trustees included more funds in their review, including those managed by outside investment management companies, not just L&G. The number of funds covered in the report has also grown, as the scheme is getting bigger as savings increase and new employers and employees join.

Over the year, the Trustees added new funds to the Mastertrust, like the Lifetime Advantage Funds, and more options for members with specific needs, such as Shariah-compliant funds.

Cutting carbon emissions

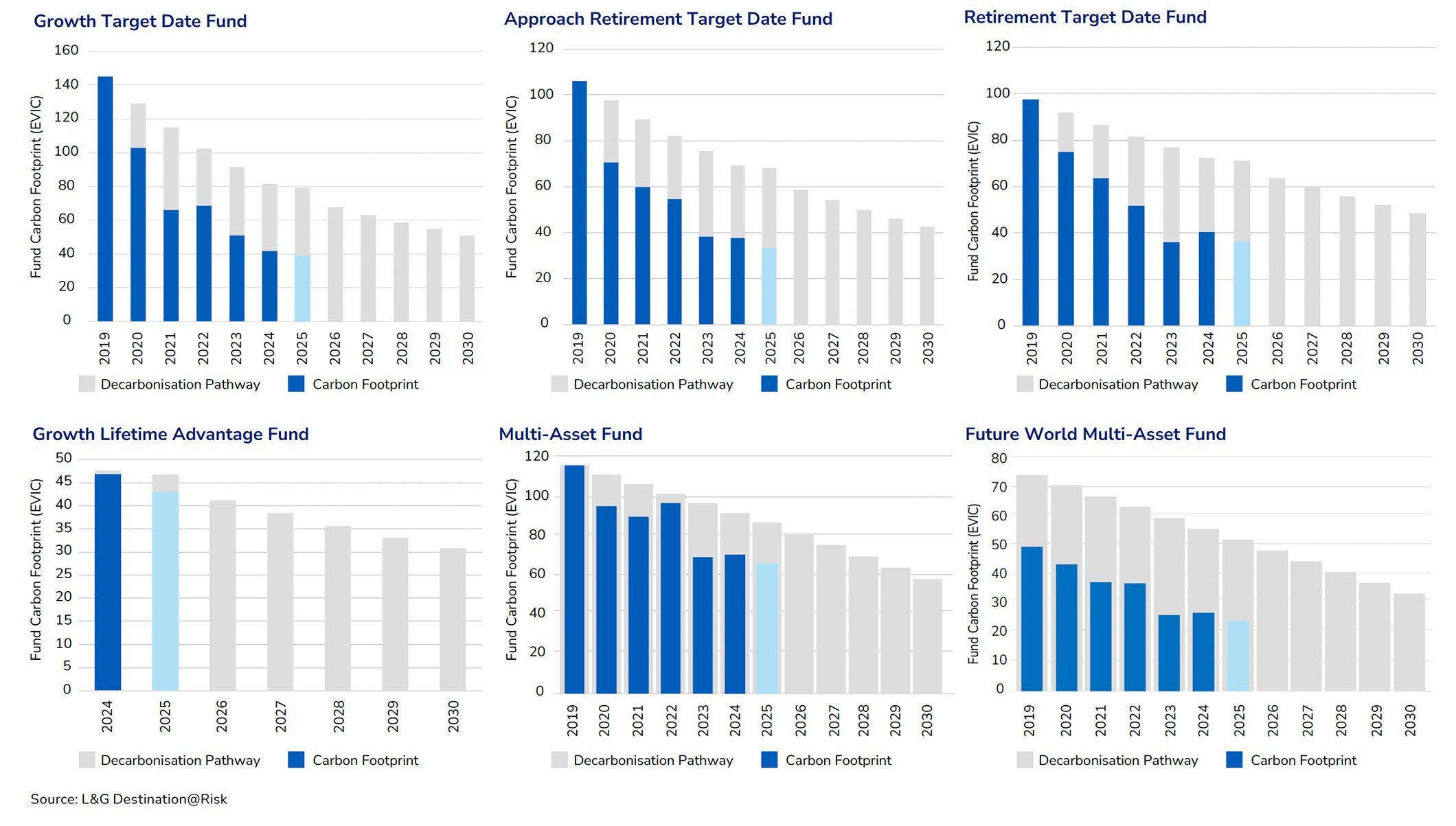

The reported carbon footprint of most of the funds in scope, based on Scope 1 and 2 emissions, has gone down over the year. All the default investment options have beaten their 2025 targets for cutting carbon emissions, and the Target Date Funds are already meeting their 2030 goals. Most of the reduction came from changing what the scheme invests in, like putting more money into technology companies and less into high-pollution sectors like energy and materials.

Only a small amount of the reduction in carbon footprint can be put down to companies reducing their carbon emissions in the real world over the year. As emissions in the real economy have continued to increase, the Trustees remain concerned that members and their savings are exposed to the systemic risk of climate change.

Scope 1 emissions are owned and controlled directly by a company. For example, emissions through company vehicles, company office space and equipment, and the energy used in production of goods or services.

Scope 2 emissions are made indirectly by a company through use of purchased heat, steam, cooling, or electricity. These emissions are a result of a company’s activities for its own operations – for example to heat its buildings – but are not owned or controlled directly by it.

Carbon footprint is the amount of emissions as a result of the associated activity.

Supporting nature and society

The Mastertrust invested in several strategies that aim to achieve investment returns for members while also investing in projects that protect rainforests, improve clean water supplies, and build affordable homes. You can find out more in the full report.

Sustainability Report

Read our full report on climate, people and nature-related risks and opportunities to the Mastertrust

Statement of Investment Principles

The Statement of Investment Principles sets out the Trustees’ investment policy and what they hope to achieve from the investments they choose.

Implementation Statement

The Implementation Statement sets out how the Trustees believe they have followed the Statement of Investment Principles during the most recent scheme year and reflects their performance against the principles set out in it.