What is Decreasing Life Insurance?

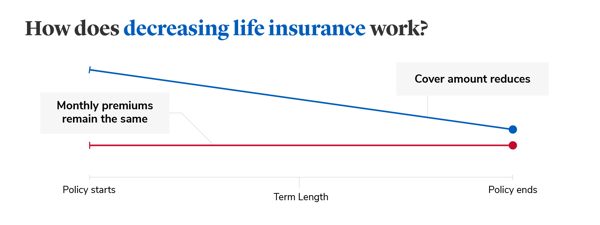

Our Decreasing Life Insurance, often called mortgage life insurance, is designed to help protect a repayment mortgage when you buy a home. It pays out a lump sum of money if you pass away while covered by the policy or are diagnosed with a terminal illness and your life expectancy is less than 12 months. With this type of insurance, the amount of cover reduces roughly in line with the way a repayment mortgage decreases. The payout could mean your loved ones get to stay in their family home without the worry of mortgage payments after you're gone.

This page was last reviewed by our expert Lisa Redman on 10 July 2025.

Benefits of Decreasing Life Insurance

How does Decreasing Life Insurance work?

Getting a life insurance quote online is quick and easy

Or call us on 0800 316 5591

8:30am to 8pm Monday to Friday

9am to 1pm Saturday

We may record and monitor calls

£100 gift card after you take out cover

Restrictions apply - www.amazon.co.uk/gc-legal

What Decreasing Life Insurance covers

Life insurance - cover at a glance

Things you need to know

Policy documents

See a full list of what is and isn't covered in our policy documents before you apply. If you are an existing customer please refer to your policy documents for details of your cover.

Why get life insurance with L&G?

We've been protecting families like yours for over 185 years. You can trust us to provide expert cover and supporting benefits.

How to get a decreasing life insurance quote

It takes around 2 minutes to get your personalised decreasing life insurance quote. You'll need the following details:

- Your personal details - date of birth, contact details and smoker status.

- Details of the cover you need - what type of life insurance and how much do you need, how long you want cover to last.

- Who do you want to cover - is the life insurance policy for you alone or you and another person.

Decreasing Life insurance FAQs

You must be a UK resident and at least 18 years of age at the time of applying and the policy must not end before your 29th birthday. The maximum age for buying a Decreasing Life Insurance policy is 74, and your policy must end before age 90. The minimum length of the policy is 5 years, and the maximum length is 50 years.

Please read our Policy Summary PDF for more details. If you are an existing customer please refer to your policy documents for details of your cover.

We recognise that sometimes your protection needs change, so you can request any of the following changes to the policy:

We also offer 'Joint life policy separation'. This allows a joint policy to be split into two new single policies if a couple divorce, dissolve their registered civil partnership or change a joint mortgage into one name or take out a new mortgage in one name. Your request must be made within 6 months of the event being finalised.

These changes could affect the premiums that you pay and we would have to assess any change based on your circumstances at the time.

Terms and conditions apply. Please read the Policy Booklet PDF for full details. If you are an existing customer please refer to your policy documents for details of your cover.

You can add Critical Illness Cover for an extra cost when taking out Life Insurance or Decreasing Life Insurance. It could pay out a cash sum if you’re diagnosed with or undergo a medical procedure for one of the specified critical illnesses that we cover, and you survive for 14 days from diagnosis. We cover many types of cancer, heart attack and stroke. However, some types of cancer are not included and to make a claim for some illnesses, you need to have permanent symptoms.

Please remember that these policies are not savings or investment products and have no cash value unless a valid claim is made.

If you buy Life Insurance or Decreasing Life Insurance with or without Critical Illness Cover directly from L&G, you could be eligible for a gift card six months after your policy start date provided you haven’t cancelled your policy and your payments are fully up to date. If you have previously held and cancelled a L&G life insurance policy, with or without Critical Illness Cover within the last 18 months, you will not be eligible for this offer.

This offer is only available if you apply directly to L&G. If you apply through a Financial Adviser, or any website other than L&G’s, such as a comparison site, you will not be eligible for the gift.

Yes, you can cancel your life insurance policy at any time. After applying for cover you'll have 30 days to contact us to change your mind if you decide not to continue with the policy. You can also do this if you register and login into My Account, however this must be done within the first 30 days of your policy starting.

If you cancel within 30 days we will return any premiums paid. If you cancel after 30 days you won't get anything back.

If you’d like to discuss your cancellation, you can speak to a member of our team on 0333 242 7101. You can write to us at: Cancellations Department, Legal & General Assurance Society Limited, City Park, The Droveway, Hove, East Sussex BN3 7PY.

When you applied for protection, you told us how long you needed cover to last. Your policy will remain live for this length of time as long as your premiums are up to date.

The easiest way to view and manage your policy is to access My Account where you can log in or register. Or use the Policy Documents Request Form to get a policy summary by email. We can only send to the email address that we currently hold on our records. Find out more about our Privacy Policy.

You could also check your bank statements for payments to other insurance companies.

Even though your policy may have been set up at the same time as you took out a mortgage, or made another financial commitment, they are separate products.

Your policy would pay out in the event of a valid claim during your policy term, whether or not you still have that mortgage or financial commitment in place.

It is at the discretion of your beneficiaries how they choose to use the proceeds in the event of a valid claim.

Related information and products

Critical Illness Cover

Get extra protection with Critical Illness Cover which can be added for an extra cost when you take out your life insurance policy.

Life Insurance additional benefits

When you take out our Life Insurance we include a number of additional benefits at no extra cost, such as Free Life Cover and Terminal Illness Cover (where life expectancy is less than 12 months), giving you extra peace of mind. Terms and conditions apply.

Life Insurance

If you're looking for life cover that doesn't decrease over time to help protect your family or mortgage, take a look at our Life Insurance where the amount of cover stays the same throughout the length of the policy.

Life insurance news and articles

Life insurance calculator

Use our life insurance calculator to help you work out how much cover you might need.

Life insurance news and guides

From information about different types of life insurance to articles about looking after your health and well-being - check out our wide variety of articles and guides.

Making life insurance quotes easy

Getting life insurance quotes is one of those things that probably gets pushed to the bottom of the list. You may think it's going to be too complicated or time-consuming or you simply keep putting it off because it's not something you want to think about.

Our Life Insurance product reviews

As of 10 July 2025, 1,079 customers have rated our life insurance giving the product an average star rating of 4.3 out of 5 on Trustpilot. The score of 4.3 corresponds to the star label ‘Excellent’. It includes reviews from customers who’ve claimed on a policy.