What is Life Insurance?

Think of life insurance like a safety net that helps protect your family financially when you’re no longer here. It pays out a lump sum of money if you pass away while covered by the policy or are diagnosed with a terminal illness and your life expectancy is less than 12 months. The payout from a life insurance policy can help your loved ones manage any outstanding debts and keep up with the monthly bills, childcare costs and the mortgage payments.

This page was last reviewed by our expert Lisa Redman on 09 April 2025.

Benefits of our life insurance

How does Life Insurance work?

Getting a life insurance quote online is quick and easy

Call us free on 0800 316 5591

8:30am to 8pm Monday to Friday

9am to 1pm Saturday

We may record and monitor calls

£100 gift card after you take out cover

What life insurance covers

Life insurance - cover at a glance

Things you need to know

Policy documents

See a full list of what is and isn't covered in our policy documents before you apply. If you are an existing customer please refer to your policy documents for details of your cover.

Why get life insurance with L&G?

We've been protecting families like yours for 190 years. You can trust us to provide expert cover and supporting benefits.

How to get a life insurance quote

It takes around 2 minutes to get your personalised life insurance quote. You'll need the following details:

- Your personal details - date of birth, contact details and smoker status.

- Details of the cover you need - what type of life insurance and how much do you need, how long you want cover to last.

- Who do you want to cover - is the life insurance policy for you alone or you and another person.

How much life insurance could you get?

Below you can compare how much life insurance our customers can access based on real life examples. This is based on customers who don’t smoke and have good overall health, and who pay £25 a month for a 25 year policy. We’ve rounded down the average premium and average length of cover our customers bought between Jan 24 and Jan 25.

| Age when cover starts | Life Insurance cash sum payout |

|---|---|

| 20 year old | £1,141,825 |

| 30 year old | £610,937 |

| 40 year old | £233,987 |

| 50 year old | £82,035 |

| 60 year old | £31,038 |

| 70 year old (maximum length of cover is 19 years) | £7,858 |

These quotes were taken from legalandgeneral.com on 5 February 2025. Decreasing Life Insurance could be cheaper, but this is specifically designed to protect a repayment mortgage.

You can get your own personalised life insurance quote if you give us some details about you and the cover you need.

Types of life insurance

We offer more than one type of life insurance to suit different needs.

Life Insurance

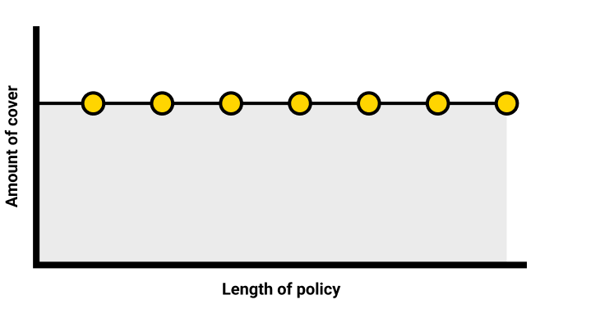

Life insurance, sometimes known as level term life insurance, is where the amount of cover you choose and the premium you pay will stay the same throughout the duration of your policy, unless you decide to make any changes. If you pass away while covered, your family will get a cash sum to help them financially. It could be used to help pay the bills or cover child care costs, for example.

Learn more about different types of life insurance.

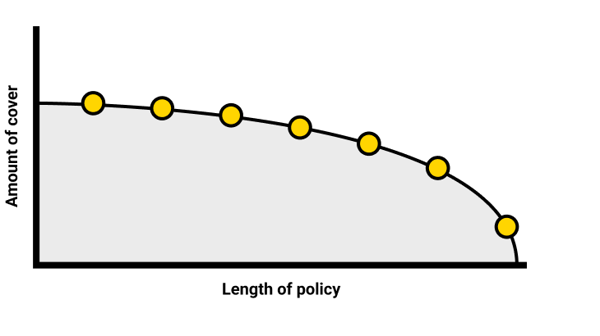

Decreasing Life Insurance

Decreasing life insurance is when the amount of cover you choose will decrease over time, roughly in line with the way a repayment mortgage decreases. This type of life insurance is often taken out to help protect a repayment mortgage. If you were to pass away while covered, your family would get a cash sum to help cover the mortgage, so they get to stay in their family home without the worry of mortgage payments.

Find out more about Decreasing Life Insurance.

Single or joint life insurance?

Not everyone knows the difference between single and joint life insurance, so how do they compare? Single life insurance covers one person, whereas joint life insurance covers two lives. The difference is that joint life insurance pays out upon the death of the first insured person, at which point the cover stops. Some couples prefer to have single life insurance policies, which ensures the surviving partner still has cover after the first death, but joint life insurance policies can be cheaper. Read more about single v joint life insurance policies to compare which is best for your needs.

Our life insurance claims process

Supporting benefits

Related information and products

Life Insurance additional benefits

When you take out our Life Insurance we include a number of additional benefits at no extra cost, such as Free Life Cover and Terminal Illness Cover (where life expectancy is less than 12 months), giving you extra peace of mind. Terms and conditions apply.

Critical Illness Cover

Get extra protection with Critical Illness Cover which can be added for an extra cost when you take out your life insurance policy.

Decreasing Life Insurance

If you're looking for life cover to specifically cover a repayment mortgage, take a look at our Decreasing Life Insurance where the amount of cover reduces roughly in line with the way a repayment mortgage reduces.

Life insurance news and articles

Our Life Insurance product reviews

As of 29 January 2026, 1,409 customers have rated our life insurance giving the product an average star rating of 4.3 out of 5 on Trustpilot. The score of 4.3 corresponds to the star label ‘Excellent’. It includes reviews from customers who’ve claimed on a policy.