Single vs joint life insurance

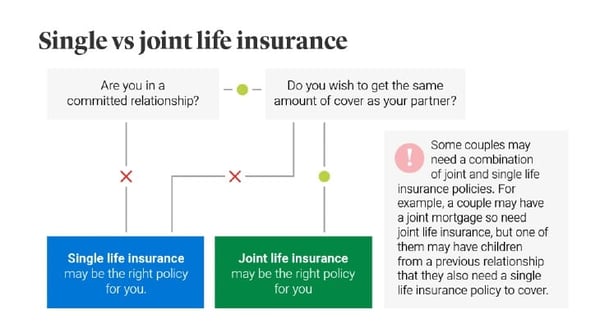

So, you're in a relationship - married or coupled up - and you're talking about taking out life insurance as a couple. Which option do you choose? Single or joint life insurance? You even find that as a couple, you need a combination of both.

You might also be interested in...

What is single life insurance?

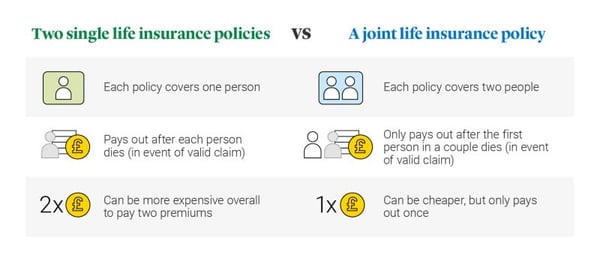

A single life insurance policy covers one person only and pays out the chosen amount of cover if that person dies during the length of the policy. If a couple holds two single policies and one partner dies, then the surviving partner still has their own policy.

What is joint life insurance?

A 'joint' life insurance policy covers two lives, which sounds obvious but it’s important to note that the cover usually operates on a 'first death' basis. This means the chosen amount of cover is paid out if the first person dies, during the length of the policy, after which the policy would end. This is a key point about joint life insurance: the policy pays out only once, leaving the surviving partner without cover under that policy.

Joint life insurance for unmarried couples or friends

Applying for joint life insurance follows the same process whether you’re married or unmarried. It’s sometimes referred to as couple’s life insurance, but in fact, you don’t need to be in a relationship. It's possible to get joint life insurance where one person would suffer a financial loss if the other person died. So friends with a shared financial responsbility, such as a joint mortgage, could consider joint life insurance.

A life insurance payout is paid to the legal owner (or owners) of a policy, whether you’re married or unmarried. If the policyholder is deceased, the cash sum is paid to their personal representative, which is often the executor of the will.

Regardless of your marital status, with Legal & General you can get a quote for single or joint life insurance.

Which would be the best life insurance for couples?

Some people may think it makes sense for the sole breadwinner of the family to take out a single life insurance policy in their name to protect their family from the possibility of financial hardship if they died. Of course, this ignores the fact that the loss of someone who takes care of the children and the household can also have a huge financial impact on a family.

Nowadays, there are often two breadwinners in the family, so if you decide to take out life insurance it’s even more likely that both partners will need cover. You have options available – single life policies, a joint life policy or a combination of both.

Consider your needs

If you have loved ones who depend on you financially you may have a need for life insurance. Life insurance can be set up on a single life or joint life basis where an insurable interest exists between the applicants. When deciding which of these options is right for you, take stock of your present needs and, though it’s not nice to think about, prepare for worst-case scenarios. You may want to think about the following:

Is it better to get single or joint life insurance?

Even though you are in a relationship or friendship, it doesn’t automatically mean that you have the same protection shortfalls. Whether joint or single life policies are suitable will depend on what each of you wants to protect and for how long each of you want the cover to last. Depending on individual circumstances, this could make a joint life policy, single life policies or a combination of both the right choice for you.

Joint life policies could be a good choice if you both need the same level of cover for the same length of time e.g. to cover a joint mortgage where the cash sum only needs to be paid once. Both policy holders would receive the same level of cover under a joint life policy, so if you have different protection needs, this may leave one partner with too much or too little protection.

Single life could be considered if there are differences in the level of cover that you both need, how long you need cover for or whether you want the cash sum paid twice should you both pass away during the length of the policy.

Is joint life insurance cheaper than single?

A joint life insurance policy can be cheaper than two single policies designed to provide the same amount of cover over the same period of time. However, a joint life policy pays out only once, leaving the surviving partner without cover under that policy, whereas single life insurance policies can offer more protection because each partner has individual cover.

How changes in personal circumstances can affect joint life insurance

Your needs may change in the future, it may be a good idea to review or change your cover in order to make sure that you have the correct level of protection in place.

If a relationship breaks down, it's possible that an insurance provider would not be able to divide a joint life policy into two single policies.

If you claimed against a joint life policy, the surviving person would be left without life cover under that policy. Applying for life insurance later in life can be expensive because premiums increase with age. If health deteriorates it may become more difficult to obtain cover.

As you work through your options, you can get a good idea of how much cover you might need with our Life Insurance Calculator.

What happens to life insurance after divorce?

Whether you have single or joint life insurance, your policy won’t change automatically after a divorce. If you wish to make changes to your life insurance policy, your decisions may depend on which of the following applies to you.

- If you have a joint life insurance policy, you might be able to split it into two single policies. However, this isn’t always possible, so it’s worth taking a look at your policy booklet.

- The ownership of the marital assets, including the family home may change in the divorce settlement.

- If you have single life insurance, you may encounter less financial complications following a divorce, as you can retain your own single policy.

If you have a mortgage life insurance, it could be a good time to review the policy.

For more on this topic, read our guide to life insurance after divorce.

Can I get joint life insurance if I am over 50?

Yes, we want to help as many different customers as possible and we have different types of life insurance to meet different needs.

Life insurance - could pay out a cash sum if you were to pass away while covered by the policy and can be used to help your loved ones financially. It can used for things like child care costs, household bills or even mortgage or rent payments.

Decreasing life insurance - Our Decreasing Life Insurance is a type of insurance that's designed to help protect a repayment mortgage and is a common consideration when buying a home. Mortgage life insurance could pay out a cash sum if you were to pass away while covered by the policy. With this type of insurance, the amount of cover reduces roughly in line with the way a repayment mortgage decreases.

Both life insurance and decreasing life insurance can be taken as joint or single policies. The maximum age for taking out Legal & General Life Insurance is 77 or for Decreasing Life Insurance, it's 74 and the policies must end by your 90th birthday

We also offer Over 50s Fixed Life Insurance, but this can only be taken out as a single policy. It can be an affordable way for you to leave some money for your loved ones after you die and could be used to help settle unpaid bills, as a gift or to help towards the cost of a funeral. It has guaranteed acceptance with no medical questions for UK residents aged 50-80.

Read our guide to life insurance for senior citizens.