When should I get life insurance?

Not everyone is clear about what age they should take out life insurance. And while there’s no ‘right’ age to get life cover, in this guide we’ll look at why many people get life insurance at a younger age when it's less expensive.

You might also be interested in...

Will my age affect my life insurance?

Age is certainly a factor when life insurance companies work out how much you should pay for a policy (also known as your premium). Simply put, our chances of dying increase as we age. Therefore, given the greater likelihood of a claim, it follows that life insurance premiums rise as we get older. However, it’s not just age that can affect life insurance costs.

What is the best age to get life insurance?

In truth, as long as you’re over 18 years-old, there is no ‘best age’ age to get life insurance. Life insurance is generally more expensive the longer you leave it - so, if you need cover, waiting can mean premiums are more expensive when you buy. If wish to take out life insurance, doing so when you're younger means you'll have lower premiums for the length of your policy. This may make the cost of protection more affordable. Regardless of age, many people get life insurance when other people depend on their money; for example, when they buy a property with a partner, get married, enter a civil partnership or have children. Take a look at the types of life insurance we offer.

What is the maximum age for life insurance?

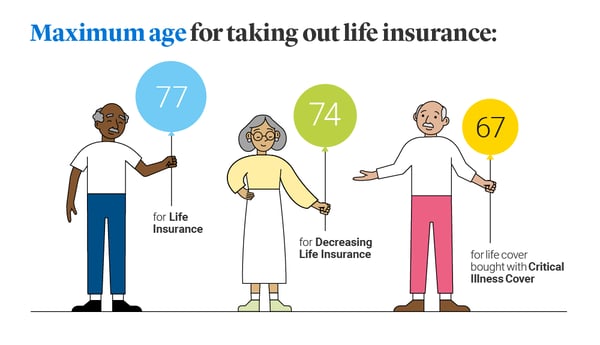

The maximum age for taking out Legal & General Life Insurance is 77 or for Decreasing Life Insurance, it's 74. However, if you choose to add Critical Illness Cover for an extra cost when taking out life insurance, the maximum age is 67.

These policies must end by your 90th birthday (Life Insurance or Decreasing Life Insurance) or 75th birthday (if you add Critical Illness Cover).

Of course, other eligibility criteria may apply, so refer to your Policy Summary and Policy Booklet for more information.

The cost of delaying life insurance

It’s human nature to put off life's big decisions, but when it comes to life insurance, taking too long to take out a policy can increase the cost of premiums if you delay arranging the cover you need. The example below illustrates the difference in premiums as you get older by comparing the premiums for a 35-year-old and a 45-year-old who've taken out a Life Insurance policy on the same day:

| £150,000 cover for 25 years | Premium |

| Age - 35 - non-smoker | *£12.19 |

| Age - 45 - non smoker | *£29.67 |

*All quotes taken from legalandgeneral.com on 12 September 2024. Premiums depend on individual needs and circumstances.

Why life insurance is important at any age

If loved ones depend on you financially, you may need to have a conversation about life insurance regardless of age. life insurance is there to offer peace of mind that if you were to pass away while covered by the policy, those you leave behind would have some financial protection in place. Or if you're responsible for a mortgage and you pass away before the mortgage is paid off, life insurance could help pay the remaining amount. And it's not just the age of the policyholder that's important; life insurance can give financial protection to dependants of all ages.

How to get the right life insurance for you

If you're healthy and eligible for cover, age should be no barrier to getting life insurance. Our life insurance starts from only £5 per month, depending on your circumstances and needs, which is equivalent to around 17p per day. See why we were voted Best Life Insurance Provider of the year (Direct) 2020- 2024

And, fortunately, getting a quote couldn't be quicker or easier. All you need is a couple of minutes, some basic information about yourself, and access to our online quote system. Please remember that life insurance is not a savings or investment product and has no cash value unless a valid claim is made.

Finally, a great way to find out how much cover you might need for your situation is to use our Life insurance calculator. You can also get a life insurance quote and find out in just a couple of minutes what your premiums could look like.