Positive Lending

Who we are

Positive Lending, established in 2008, stands as a beacon of expertise and reliability in the financial realm, nestled in the heart of Ringwood, Hampshire. What sets Positive Lending apart is its unparalleled spectrum of offerings, catering to professional intermediaries across the UK. From market-leading second charge and bridging to commercial, development, and specialized residential and buy-to-let funding, their expansive portfolio addresses diverse financial needs. Their impact is vast, annually assisting over 3,000 intermediaries and facilitating loans surpassing £3 billion, empowering dreams and ambitions.

At the helm of Positive Lending’s success is an expert team, amassing over 400 years of combined experience from esteemed financial backgrounds. Our mission is clear—to ensure exceptional customer outcomes and provide genuine value to financial intermediaries. The bedrock of our operations lies in the fusion of cutting-edge technology and seasoned customer service, crafting an experience that's both efficient and personalised to suit the varied needs of our intermediaries and their clients.

Distinguished with multiple awards, Positive Lending is celebrated for its unwavering commitment to intermediaries and borrowers alike. Our prowess extends beyond accolades, resonating in our unwavering dedication to serving the intricate needs of the financial landscape.

What we do

Positive Lending are a specialist lending distributor offering a whole of market approach in all of their specialist sectors, for prime, near prime, light and heavy adverse applications. They offer you the VERY BEST solutions, exclusive & semi-exclusive products and award-winning service to ensure the best outcome for your specialist mortgage clients.

- Bridging loans - expect the best rates, AIPs within 4 hours, a specialist valuer panel chosen for speed, expert solicitors, and dedicated underwriters.

- Specialist residential & buy-to-let - Struggling to secure high street mortgages for specialist residential or buy-to-let cases? Positive’s Mortgage Desk experts are there to assist.

- Development finance - They ensure meeting project needs and delivering high investment returns through competitive pricing and prompt fund delivery.

- Second charge mortgages - With an extensive product range and transparent fees, they’re Positive about finding the best second charge mortgage outcome for your clients.

- Commercial mortgages – Positive’s lending experts provide access to a wide array of specialist lenders and private funders, ensuring the best available outcomes.

- Later Life Lending – Positive offers over 55s tailored financial solutions approved by the Equity Release Council, empowering them to make the most of their finances and property equity.

Positive offer 2 flexible processes depending on your scope of service: Packaged – You advise, they package or Advised – they advise and package.

Ready to refer?

Earn commission on specialist finance, conveyancing, insurance and more. Just fill in the referral form and your chosen referral partner will be in touch soon.

Referral Areas

- Specialist residential mortgages

- Complex buy-to-let mortgages

- Second charge mortgages

- Bridging finance

- Development finance

- Commercial mortgages

- High value mortgages

- Later-life lending

Refer client now

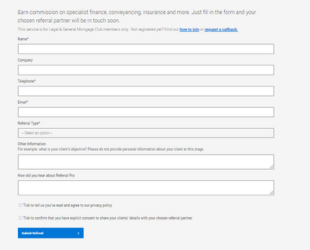

Earn commission on specialist finance, conveyancing, insurance and more. Just fill in the form and your chosen referral partner will be in touch soon.

Protecting your data

Learn more about how we collect, store and use your personal data in our Data Privacy Notice. This includes information about the General Data Protection Regulation (GDPR) and what it means for you – Privacy Notice.

Please note this content has been supplied by our referral partner and as such, the accuracy is completely their responsibility.