Complex buy-to-let mortgages

Buy-to-let mortgages can be complicated in the best of times. And many, such as non-standard construction types and ‘houses of multiple occupancy’, have always been considered complex.

Market changes mean it’s currently even more complex to place buy-to-let cases. If you’re struggling to find a solution for your client, you can lean on the expertise of our referral partners.

You can earn up to 50% of the enhanced lender procuration, depending on the partner and the type of service that you choose.

The average commission for complex buy-to-let mortgages is £976 – please contact your referral partner for more information.1

Why refer with us

Referral Pro simplifies the referrals process, making it easy for you uncover new referral opportunities, expand your offering and help more clients achieve their financial goals.

Each of our partners is a known industry expert, checked by us before inclusion in this service. Each operates under a contractual ‘no cross / repeat sale’ policy, protecting your business and income streams. And some are rated 'Advisers Choice' by advisers like you to reflect good experiences.

Ready to refer?

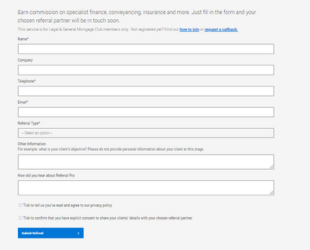

Earn commission on specialist finance, conveyancing, insurance and more. Just fill in the referral form and your chosen referral partner will be in touch soon.

Refer client now

Earn commission on specialist finance, conveyancing, insurance and more. Just fill in the form and your chosen referral partner will be in touch soon.

This website is designed to help professional mortgage and financial advisers diversify and develop their business, and shouldn't be relied on by private investors, customers or any other persons. It remains the responsibility of the regulated firm or adviser using this service to select the partner they wish to work with, assess any client fees and commissions and to agree terms of business and or contracts directly with them. It is also the adviser’s responsibility to make sure that the information and/or advice provided by Legal & General’s referral partners provide is accurate and in line with FCA (Mortgages and Home Finance) conduct-of-business rules and guidance. If you’re unsure, you can contact our support team at referralpartnerservices@landg.com

Advisers who are employed, are an appointed representative of a network and/or have contracts in place with any party linked to Legal & General who also have an interest in these referral areas should check their permission to use this service before engaging with any of our referral partners.