Learn about the State Pension

The State Pension is definitely an important part of planning and budgeting for your retirement, but it shouldn't be relied on as your only source of income when you stop work – it's unlikely that it will be enough to live on without other income as well.

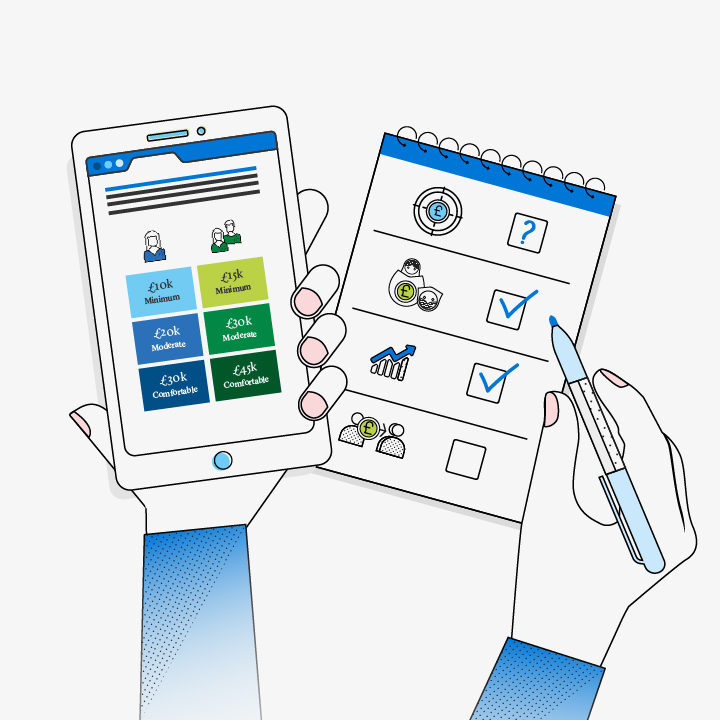

The Pensions and Lifetime Savings Association (PLSA) have created the ‘retirement living standards’ to give you practical guidance and help you work out what your retirement might cost based on three lifestyles: minimum, moderate and comfortable. The State Pension goes some way to meeting the minimum lifestyle.

On 6 April 2016 the new State Pension was introduced for those reaching state pension age on or after this date. It is a flat-rate amount subject to annual increases. When you’ll be eligible to receive it will depend on when you were born and the amount you receive will depend on National Insurance contributions.

If you are entitled to the full State Pension, for the 2024/2025 tax year it is £221.20 per week.

In order to receive the full State Pension you will need to have paid qualifying National Insurance contributions for 35 years. These don’t need to be consecutive and you may be able to pay voluntary contributions to fill any gaps in your record. The National Insurance record may also include National Insurance credits if you were on certain benefits.

When you reach your State Pension age, you can start to receive the payments from the Government or you can choose to defer it if you can afford to do so. Deferring it for a few years will increase the amount you get when you do choose to start receiving it, so could be something to consider as part of your planning.

More in this section

Go&Save for retirement >

Go&Save for retirement >

If you're more than 10 years away from retiring we've got some useful information, tools and simple 'jobs to do' to help you make your savings work for you.

Picture your future >

Picture your future >

It's useful to have an idea of what different lifestyles might look like and how much they might cost. We have some simple tools to help you.

Learn about saving for retirement >

Learn about saving for retirement >

There are many ways you can save for your retirement. If you're new to pensions, we've put together an introduction to get you up to speed.

Get the most out of your pension >

Get the most out of your pension >

Your pension needs some love in order to get you to your goal but it needn't be time consuming. Find out more about the key jobs to do.