The new Consumer Duty aims to bring about a fairer, more consumer-focused and level playing field, whereby firms prioritise the consumer’s needs above all else, ensuring good customer outcomes.

Firms need to consider the diverse needs of their customers, including those in vulnerable circumstances, and make allowances where necessary. The new regulations ensure consumers get products and services which are fit for purpose, provide fair value, that they understand how to use and are supported in doing so at every stage of the product/service lifecycle.

In essence, the regulator wants to see firms putting themselves in their customers’ shoes, asking themselves questions such as ‘would I be happy to be treated in the way my firm treats its customers?’, or ‘would I recommend my firm’s products and services to my friends and family?’.

Useful Dates

27 July 2022: FCA publishes consumer duty rules and guidance

By 31 October 2022: Management must agree plan...

By 30 April 2023: Lenders (Manufacturers) should have completed all the reviews necessary to meet the outcome rules for their existing open products and services.

31 July 2023: Implementation deadline for new and existing products or services that are open to sale or renewal.

31 July 2024: Implementation deadline for closed products or services.

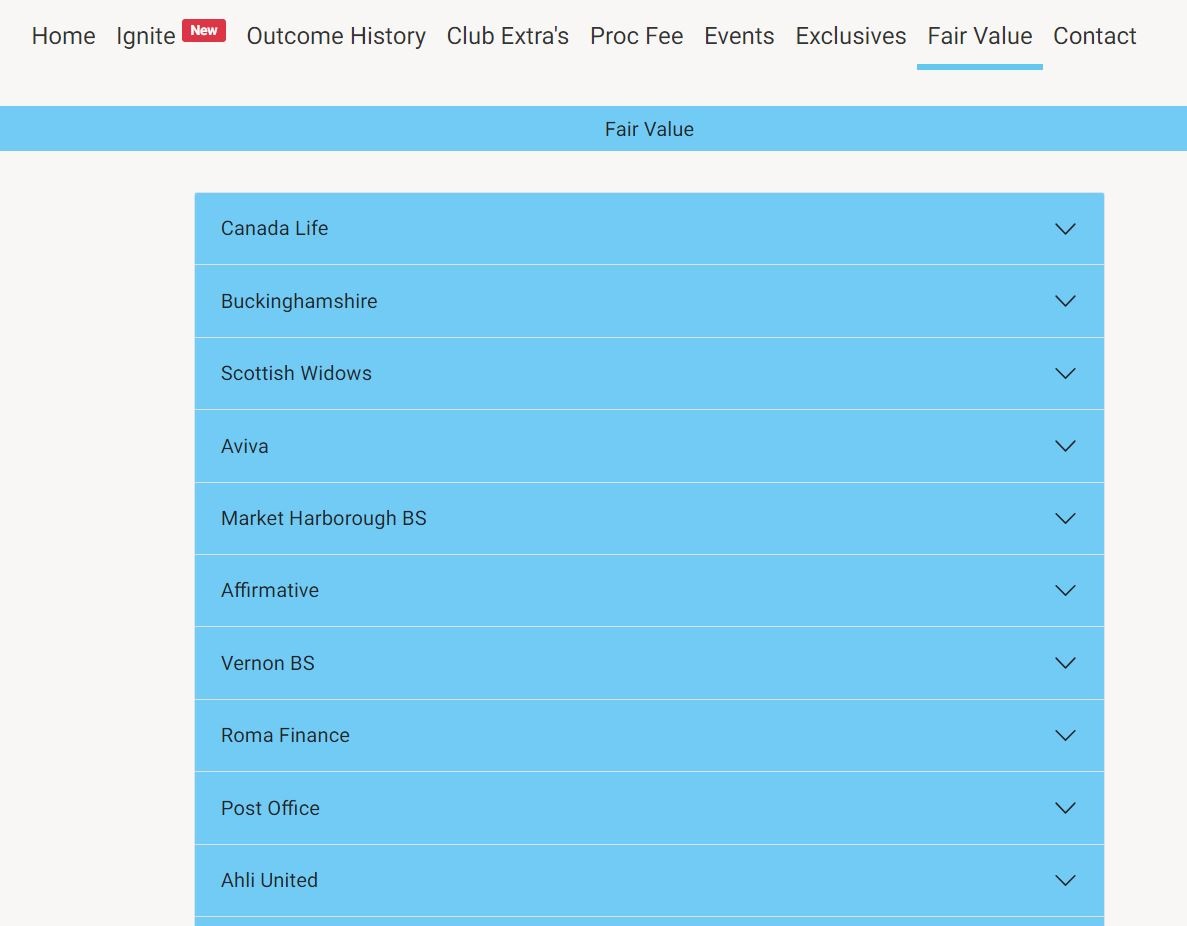

Fair value statements

How to access lender's Fair Value Statements

Useful Resources

Inside FCA Podcast: Understanding the Consumer Duty products and services outcome

Inside FCA Podcast: Explaining the Consumer Duty consumer understanding outcome

Inside FCA Podcast: What does the Consumer Duty consumer support outcome mean?

Inside FCA Podcast: What the Consumer Duty means for authorisation

Call of Duty: How putting customers front and centre will help industry innovate

Consumer Duty Webinars

Catch up on our Consumer Duty focussed video content