Loans Warehouse

Who we are

Established in 2006, Loans Warehouse is one of the UK’s leading specialist finance brokers. Authorised and regulated by the Financial Conduct Authority (FCA registration 713110). Our team of advisers have decades of experience.

We specialise in second charge mortgages and bridging finance and are often described as the UK’s master broker and an intermediary’s best friend. Our lender relationships and market knowledge mean that we can secure the right product for almost any scenario. Over the past five years we have won more than 30 industry awards, including Moneyfacts, Financial Reporter & What Mortgage Best Secured Loan Broker and Best Quality Packager at National Mortgage Awards – Second Charge, and our service is rated five stars on Trustpilot.

Loans Warehouse partners with over a thousand mortgage brokers each year. These partnerships recognise our expertise in regulated bridging and second charge lending and enable network advisers to access award winning solutions. In 2024 we saw a 400 % increase in leads from network partners and achieved a conversion rate exceeding 20%, demonstrating our ability to deliver for brokers and their clients.

What we do

Loans Warehouse makes specialist lending easy and accessible. We provide:

- Second charge mortgages: loans from £10,000 to £1,000,000 with options for borrowers with excellent credit and high net worth, to those with adverse credit and complex income. We compare rates from leading lenders to offer the lowest possible rate.

- Bridging finance: short term secured loans designed to “bridge” a temporary gap in finance. Bridging loans are typically used to purchase a new property before selling an existing one, finance auction purchases or fund refurbishments. Terms usually range from one to 24 months, with interest rolled up and repaid at the end.

Our aim is to support every broker – no matter how complex the case – so that you never have to turn a client away. We provide personalised quotes and decisions in minutes and compare offers across our lending panel to ensure clients receive the best value. We are proactive in embracing technology to improve efficiency; for example, the digitalisation of property title searches in Scotland now allows us to access title information instantly and reduces costs by around £3 per search, saving brokers thousands of pounds and speeding up secondcharge loan processing.

Loans Warehouse has dedicated business development managers and a network distribution team led by Nige Lewis, Greg Chase and Simon Ross. They provide training and guidance to help advisers identify bridging and second charge opportunities and ensure a consistent, high quality service from initial enquiry to completion. Our partnership specific referral process is simple and rewarding:

- Refer a client – submit a referral through the Legal & General Mortgage Club system.

- Broker Support Team – one of our team will contact you immediately to understand your clients need and discuss a suitable second charge or bridging option before contacting your clients.

- Track progress – you and your client receive updates throughout the process, and we use technology to make transactions as efficient as possible.

- Industry leading commission – once the loan completes, you receive your commission.

Ready to refer?

Earn commission on second charge mortgages and bridging finance. Simply complete the referral form and Loans Warehouse will contact you immediately and guide you and your client through the process (you’re both clients to us and equally important), keeping you fully informed along the way. Our award winning team will work to secure the right solution quickly and professionally.

Ready to refer?

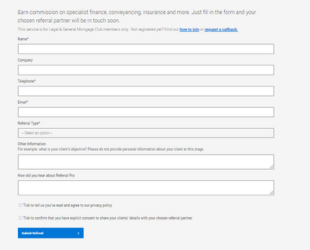

Earn commission on specialist finance, conveyancing, insurance and more. Just fill in the referral form and your chosen referral partner will be in touch soon.

Referral Areas

- Second charge mortgages

- Bridging finance

Refer client now

Earn commission on specialist finance, conveyancing, insurance and more. Just fill in the form and your chosen referral partner will be in touch soon.

Protecting your data

Learn more about how we collect, store and use your personal data in our Data Privacy Notice. This includes information about the General Data Protection Regulation (GDPR) and what it means for you – Privacy Notice.

Please note this content has been supplied by our referral partner and as such, the accuracy is completely their responsibility.