We have transferred the administration of our personal investing business to Fidelity.

What has happened?

Legal & General has transferred the administration of its personal investing business to Fidelity (Financial Administration Services Limited). If you invested with Legal & General before 4 December 2021, you may be impacted by this transfer.

The investments we have transferred are listed below:

- Individual Savings Account (ISA)

- Junior ISA

- Flexible Mortgage ISA (FMISA)

- Investment Account (also referred to as unit trust investments)

- Cash ISA

- Matured Fixed Term Investment (whether you originally invested through an ISA or an Investment Account)

- Matured Fixed Term Deposit Investment (whether you originally invested through an ISA or an Investment Account)

Note: Our Self-Invested Personal Pension (SIPP) and workplace savings pension schemes have not transferred to Fidelity. If you hold one of these investments, they are not affected by this transfer.

What does it mean for our customers?

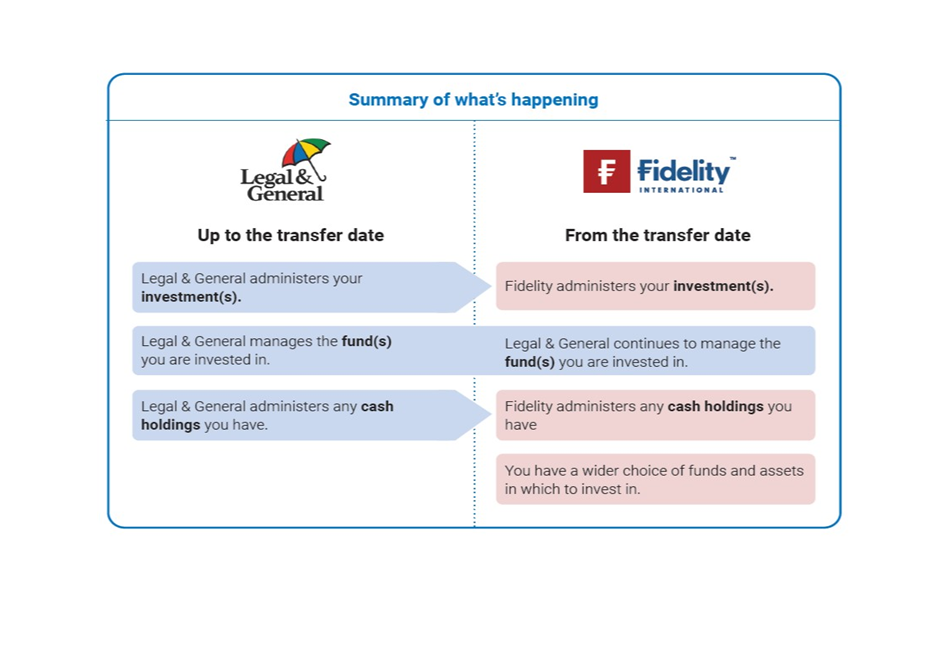

From the date of the transfer, Fidelity will administer your investment(s), including any cash holdings you have.

Importantly, if you currently invest in any Legal & General funds, the proposed transfer will in no way affect the management of these underlying funds which will continue to be managed by Legal & General following the transfer.

When did the transfer take place?

The transfer to Fidelity of all the investments held by our impacted customers was completed on 4 December 2021. If you invested with Legal & General before this date, you may be impacted by this transfer.

If your investment(s) has not been transferred to Fidelity, we will contact you again in the coming months to notify you of any service limitations, or if we need to make any material changes to your Terms and Conditions. We will also confirm what your options are going forward.

Why is Legal & General doing this?

Who is Fidelity?

Why did Legal & General choose Fidelity?

Will you still be able to use Legal & General's online account management facility?

Will there be any differences in the services provided by Fidelity if you live overseas?

Will your investment(s) continue to be protected under the Financial Services Compensation Scheme (FSCS)?

Why haven’t all my investments transferred to Fidelity?

Can I transfer my remaining investment(s) with Legal & General to Fidelity?

Can I transfer my ISA that has transferred to Fidelity back to Legal & General?

Why has my ISA transferred to Fidelity when I didn’t provide my consent?

Who do I need to contact in the future?

Next steps

The online consent portal is now closed and customers can no longer provide their consent to the transfer.

If your investment(s) has transferred to Fidelity, we recommend that you retain all the communications we’ve sent you, along with your other relevant documentation, so that in future you can refer to the changes that have been made to your investment(s).

If the transfer affects your investment(s), you will have been sent an information pack prior to your account being transferred, and if you were previously managing your Legal & General investment(s) online, using My Account, the value of your investment(s) will now show as £0.00. Following the transfer of your investment(s), Fidelity will send you a welcome pack within 2 weeks of the transfer, including details of how to access your investment(s).

If your investment(s) has not been transferred to Fidelity, we will contact you again in the coming months to notify you of any service limitations, or if we need to make any material changes to your Terms and Conditions. We will also confirm what your options are going forward.

You can still Get in touch with us if you have any questions about the transfer, or if you require details of historic transactions made while you were a Legal & General customer.

Important documents

Get in touch

If you have any questions about the proposed transfer to Fidelity, please call our telephone helpline on:

UK calls:

0370 998 0010

International calls:

+44 2920 276 998

Open Monday - Friday 9am-5pm. Call charges will vary. We will record and monitor calls.

Please have your information pack and your client number to hand when you call.

Please note that this helpline is for questions about the proposed transfer to Fidelity only. If you have any questions other than about the proposed transfer, please contact the customer services team in the usual way (see the contact details shown on your previous correspondence or contact us here.

Risk warning

Please remember the value of your investment and any income from it may fall as well as rise and is not guaranteed. You may get back less than you invest. Tax rules may change in the future and their tax advantages depend on your individual circumstances.