What’s the difference between critical illness and terminal illness?

Some of the language in the insurance world can be confusing, and many people ask us about the difference between critical and terminal illness. So we thought we’d take the opportunity to explain what these mean. There is also more information on our Critical Illness Cover FAQ page.

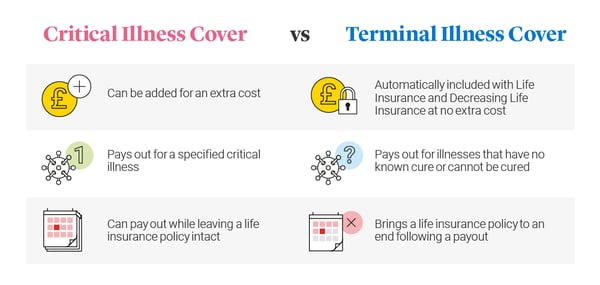

Terminal illness vs. critical illness

Both terminal and critical illnesses refer to serious medical conditions. But the difference is that a critical illness refers to a specified serious injury, illness or medical episode, whereas a terminal diagnosis means your hospital consultant expects the illness will lead to death within the next 12 months.

Critical Illness Cover

Our Critical Illness Cover can be added to Life Insurance or Decreasing Life Insurance for an extra cost. It could pay out a cash sum if you’re diagnosed with, or undergo a medical procedure for one of the specified critical illness that we cover during the length of your policy, and you survive for 14 days from diagnosis. The list of illnesses we cover include many types of cancer, heart attack and stroke.

It’s important to note that some types of cancer are not included and you need to have permanent symptoms to make a claim for some illnesses.

This is not a savings or investment product and has no cash value unless a valid claim is made.

These are just some of the illnesses that are covered, but see the complete list of critical illnesses here, and more information is available in the Critical Illness Cover policy booklet.

Terminal Illness Cover explained

Terminal Illness Cover is automatically included at no extra cost on all our Life Insurance and Decreasing Life Insurance policies with a term of at least 2 years. It could pay out the full amount of cover if you are diagnosed with a terminal illness during your period of cover.

A terminal illness is one that has no known cure or has progressed to a point where it cannot be cured, and in the opinion of your hospital consultant and our Medical Officer (a qualified doctor employed by Legal & General), it's expected to lead to death within 12 months.

Your cash sum would be paid on receipt of a valid claim, and you can decide how the money is spent. Like Critical Illness Cover, it’s important to note that life insurance is not a savings or investment product and has no cash value unless a valid claim is made.

You should also note that no claim for terminal illness cover can be made after the insured person has passed away.

Do I need Critical Illness and Terminal Illness Cover?

Anyone can be affected by a life-threatening illness, so having the right protection in place could help to alleviate stress at a difficult time. You should initially consider whether you need life insurance. If you decide that is the case and you require this type of cover for more than two years, we will automatically include Terminal Illness Cover. A valid claim for terminal illness cover could mean you receive the cash sum earlier when you require financial assistance. Or if you choose to add Critical Illness Cover, a successful claim could help pay for childcare costs, household bills and lifestyle commitments.

Related Articles

Coping with terminal illness