Wanderlust in retirement

Life’s too short to stay at home forever. And retirement is the perfect opportunity to spread our wings and fly. But where do we actually want to go? To find out, we asked more than 2,000 UK people aged 55+ about their globe-trotting plans.

- Favourite destinations: Spain came in at number one, chosen by 46% of our respondents, followed by Italy (41%).

- Shared experiences: Just over half (65%) of the people we talked to plan on travelling (or already have travelled) with their partner.

- Careful budgeting: While 62% of people set money aside for their retirement travels, more than a fifth (21%) say they haven’t saved anything.

- Safety worries: 68% of men said they feel confident traveling solo, but just 43% of women do.

Our work and family lives are a big part of our identity. But after decades of hard graft, paying the mortgage or rent, raising children or looking after loved ones, retirement travel offers the chance for renewal and exploration.

“It was my choice to retire at 62. I looked at all my outgoings, my income and pension, and got my head round the fact that the savings that I had put away were money for me to use. Now is the time to enjoy life.” – Robert.

But what does that actually mean to people? And how does it influence their travel choices? Well, let’s see what our respondents told us:

Rest and recovery are high on people’s agenda, but with a notable gender split. 58% of women answered ‘relaxation’ compared to 47% of men. And 39% of women wanted to improve their mental wellbeing, while only 29% of men did.

And people in some cities need much more of a battery recharge. 84% of people in Sheffield put relaxation at the top of their holiday goals list, but only 37% of Cardiff and Glasgow dwellers did.

The trip of a lifetime

Once we’re ready to pack our bags, what does that big adventure look like? Well, everyone’s different. For our respondents, a dream trip can be anything from a weekend away just down the road to an actual, full-on, round-the-world tour. So we checked in to see:

We found out some interesting things:

- There’s no place like home. For many, the creature comforts of a UK-based long weekend are hard to resist. That’s particularly true for people aged 75-plus, almost half of whom (49%) have already enjoyed that kind of trip.

- Snow go? No go! Skiing is definitely not a later life thing. Few people over the age of 55 are planning on whooshing down any snowy mountains anytime soon. 91% said they either haven’t planned or just have no interest in a ski trip.

- Cruising into retirement. Going on a cruise is a later life thing. Just 4% of people in the 55-64 age group have been on one, but a fifth (20%) told us they’re planning to go. And more than a quarter (26%) of over 75s have made that cruising dream real.

Elizabeth and her husband wanted to book a last-minute getaway just before they retired, the only option was a cruise. “That’s for old people, oh no, we can’t do that!” was her initial response, but despite her misgivings she soon found out what people of all ages go on cruises. Starting in the Mediterranean, they toured seven countries and quickly made friends on board. They loved it so much they booked another and have since been on an American cruise to the Caribbean.

The destinations we dream of

And where do people look for their mind-broadening overseas adventures? Well, destinations across Europe top our later life leaderboard, closely followed by the USA.

Vamos! Spain was the top choice among people of all age categories we surveyed. It was also the number one travel destination in each region except Wales, where 53% chose Italy versus 46% Spain. And Northern Irish opinion was equally split between Spain and Italy (36% each).

And these are just the most popular destinations. There are many other wonderful places to visit. In fact, people who like to step off the beaten track might use them as a guide to where not to go!

“A few years back we went to Romania to stay with a friend who used to work on the farm in Spain. He’s gone back to Romania and we stayed with his family on their small farm. It was like going back 100 years – we had a wonderful meal cooked over an open fire and helped collect the wood with a horse and cart. To me that is what travelling is all about, sharing the lives that people live.” – June

We also saw travel goals change at different stages of retirement. For example, 36% of 55-64-year-olds say they either have or want to travel to Greece, but only 25% of people aged 75-plus do. And 33% of 55-64-year-olds selected USA, compared to just 24% of over 75s.

Even paradise needs a financial plan

Many of us dream of warmer climes and unforgettable memories. But when it comes to actually budgeting for that big getaway, most of the people we talked to manage to keep their heads out of the clouds.

Only a fifth (21%) said they’ve made no financial preparations for a trip. So millions of us know we need to have some solid finance behind all the fun and adventures.

The Retirement Living Standards recommends that couples have a combined income of around £43,100 a year to enjoy a ‘moderate’ retirement, living outside of London. This doesn’t include living costs like rent or mortgage payments.

In holiday terms, this would cover a 14-night holiday abroad each year in a 3-star hotel, plus a long weekend in the UK with B&B accommodation. And when you dig into the results, you see just how seriously most people take their holiday financial planning:

- Saving for a sunny day. A clear majority (62%) told us they’ll put money aside (or have already done so) to finance their trip. This was highest in Plymouth (71%) and lowest in Bristol (50%).

- Money matters. When asked what the biggest factor was when considering a travel destination, people were most likely to answer ‘overall cost’ (61%). This was ahead of ‘warm or sunny weather’ (55%) and ‘affordable accommodation’ (50%).

- Preparation makes perfect. Among those who wanted to travel during retirement, 59% said they carefully considered their finances – this was highest in Belfast (67%) and lowest in Leeds (50%). And men were more likely than women – 62% versus 56% – to say they gave serious consideration to their travel finances.

Travelling companions

We spend much of our lives working, saving money and fulfilling other responsibilities, so any holidaymaker could be forgiven for wanting a bit of alone time. But according to our survey, most of us love the idea of exploring with our nearest and dearest.

Many of us (65%) love the idea of travelling with a partner, and the most popular reason was to ‘make special memories or spend more time with this person’ (54%). This reason was more popular among women (58%) than men (50%).

On the other hand, a majority (55%) of respondents told us they have the confidence to travel ‘solo’ in retirement. But there’s a big gender difference there – almost three quarters of men are happy to travel alone, while only just under half of women are.

But on the plus side, 84% of people (including 80% of women) said that generally speaking, they have the confidence to travel in retirement.

What kind of explorer are you?

No two travellers are the same. So we thought we’d end by finding out what sort of traveller people see themselves as.

Away from the main stats, we uncovered a range of differences in our travelling personas.

- ‘Easy going’ was the most common option chosen by men (30%) compared to 26% of women.

- Women were more likely to say they’re a ‘budgeter’ – 18% versus 13% of men.

- People in Wales were the most likely to be ‘planners’ (31%) and the least likely to be ‘easy going’ (16%).

- Respondents in Northern Ireland were the biggest ‘budgeters’ (27%) while people in the West Midlands were most likely to put ‘adventurer’ (5%).

Memories worth budgeting for

And finally, what of those who did take the plunge and went on an epic adventure? With the benefit of hindsight, these travellers told us they have no regrets.

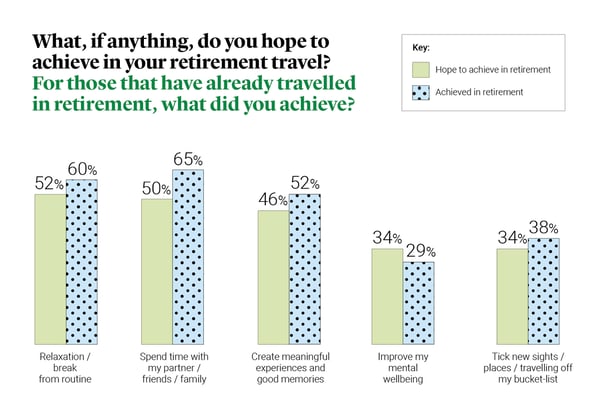

- 65% said they were able to spend time with their loved ones

- 60% said they were able to relax from their regular routine

- 52% were able to create meaningful experiences and memories.

So with careful planning, plus support and inspiration from friends, family and professionals, the world is truly our oyster.

“I always knew I wanted to travel. I had a couple of old school friends in Australia and it had always been my dream to go there, and New Zealand, so I let me apartment and went for six months. It was a real adventure, it was wonderful. I’m still in touch with some of them.” – Patrick

Lorna Shah, Managing Director, Legal & General Retail Retirement and CEO of Legal & General Home Finance:

“Planning for retirement is crucial not only for maintaining financial stability but also for enabling a fulfilling and enjoyable post-work life.

“As people phase into retirement, having a well-thought-out financial plan can make a significant difference. It provides the freedom to pursue long-held dreams, such as travelling to new destinations or engaging in much loved hobbies.

“At Legal & General, we have a range of different planning tools to help you financially prepare for your retirement such as the Retirement and Pension Income Calculator and a downloadable budget planner to see if your retirement plans are on track.”

Related articles

What happens to my pension if I move abroad?

Guide to buying an annuity

Happiness in retirement

Sign up to our newsletter

Subscribe to our newsletter for tips on how to make the most of your money now, and in the future.

Our team hand picks a selection of our latest articles and stories that we think you’ll find interesting. Subscribe to our newsletter and have the opportunity to enter exclusive prize draws, be invited to share your own stories, and be kept updated with tips and tricks to help you manage your finances.

By providing your email address you're giving consent for us to send you emails with news, information and offers on the products and services provided by Legal & General. Legal & General take your privacy seriously; this is why we never share your personal details with anyone else for their own marketing purposes. You can opt out of these emails at any time. Read our privacy notice to understand how we process your information.