Life insurance vs Income Protection

We all want to financially protect the things that matter most. But insurance comes in many forms, and that includes life insurance and income protection insurance. So what are the main differences between these policies?

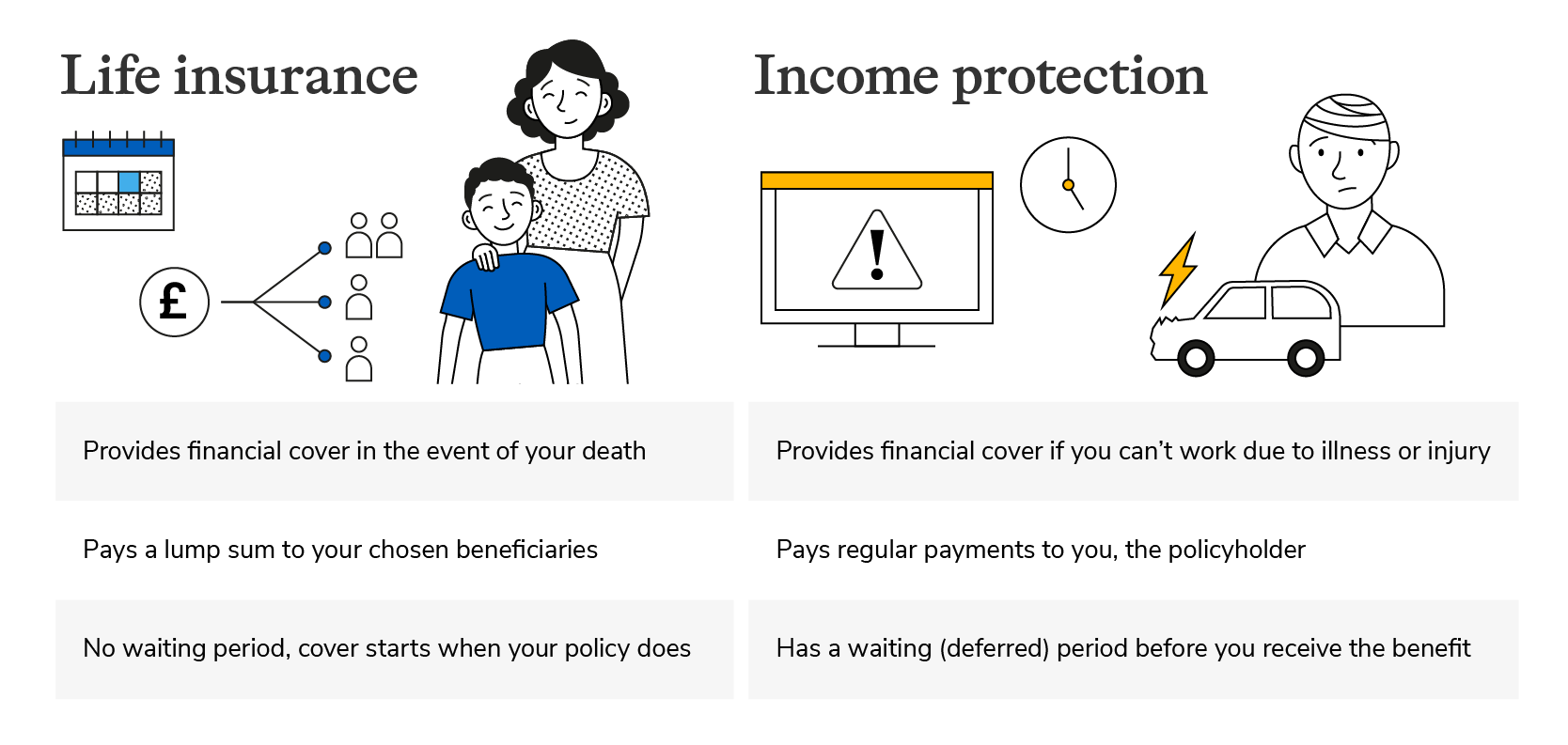

Life insurance and income protection compared

Income protection and life insurance both provide financial protection. It could be easy to get them confused so we've compared them for you.

Speak to an adviser if you need help deciding what type of protection is right for you.

Speak to an adviser if you need help deciding what type of protection is right for you.

Life insurance vs income protection: the key decisions

Not every life insurance and income protection policy are the same. So before you get covered, there are some key details to think about.

When you take out a life insurance policy, you decide how much cover you need and how long the cover should last. You’ll base this decision on your priorities. For example your mortgage or the support your financial dependents need.

You will also need to choose which type of life insurance suits your needs. This will usually be one of the following:

- Level term life insurance – where your monthly payments (and payout) remain fixed

- Decreasing life insurance – where your payout reduces over time (monthly payments remain fixed).

But how does the process differ when choosing life insurance vs income protection insurance?

If you take out income protection, the process is different. Unlike life insurance, this type of policy is only available through a financial adviser. There are various decisions to make, including:

- What percentage of your income do you want to cover? L&G’s Income Protection Benefit lets you cover 60% of your annual income for the first £60,000 and 50% of your annual income over £60,000.

- How long do you want the policy to pay out for? For example, with L&G’s policy, the monthly benefit is paid until you’re well enough to return to work, your policy ends, your chosen limited benefit period (12 or 24 months) has been reached or you die.

- When would you like to receive your benefit? With L&G you can choose a waiting period of between 4 and 52 weeks, the monthly benefit would then be paid monthly in arrears.

Life insurance vs income protection – which is right for me?

Everyone’s situation is different, but life insurance may feel increasingly important if the following applies to you:

- You have a mortgage or pay rent

- You have children or other dependants

- You’re married or in a long-term relationship.

In each of these scenarios, a life insurance payout could provide your loved ones with a financial lifeline if you were to pass away, during the length of your policy.

So compared to life insurance, who can income protection insurance benefit?

- If you don’t have sick pay or the usual employee benefits.

- If you have limited savings.

- If you need a monthly benefit in the event of being unable to work due to illness or injury.

Yes, you can take out life insurance and income protection insurance. This is because each product provides a different type of financial cover.

L&G’s Critical Illness Cover can be taken out as an add-on to your Life Insurance or Decreasing Life Insurance for an extra cost. This is where you receive a payout if you’re diagnosed with (or undergo a medical procedure for) a specified critical illness, and you survive for 14 days from diagnosis, following a valid claim.

There’s one key difference between this type of cover and income protection insurance. Following a valid claim, Critical Illness Cover provides a one-off, tax-free lump sum, whereas with income protection insurance you receive a regular monthly benefit if you’re unable to work due to illness or injury.