How does a mental health condition affect life insurance?

These days, there is more awareness about the challenges that we all face from time to time. But if you've had difficulties with your mental health, what does it mean for your life insurance? In this guide, we'll explain why your mind matters when it comes to taking out a life insurance policy.

You might also be interested in...

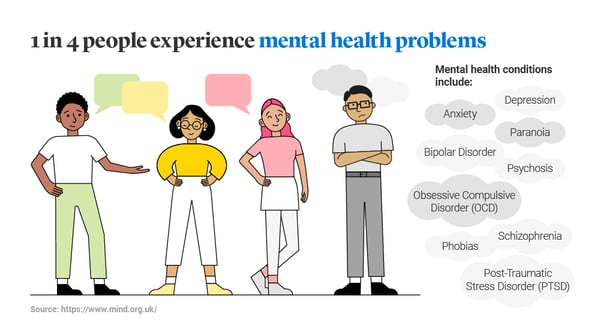

What is a mental health condition?

A mental health condition, sometimes referred to as a mental illness, refers to health problems or the every day challenges of life that can affect your wellbeing, emotions, thinking and behaviours. Symptoms of a mental health condition can include anxiety, stress, fear, anger, low mood, sadness and depression.

Examples of mental health conditions

There is a broad range of mental health conditions that can have an impact on our emotional wellbeing, psychological behaviour and mood. Here are just some examples:

- Depression

- Anxiety

- Paranoia

- Phobias

- Psychosis

- Obsessive Compulsive Disorder (OCD)

- Post-Traumatic Stress Disorder (PTSD)

- Schizophrenia

- Bipolar Disorder

- Eating disorder

- Postnatal depression

- Stress.

It's important that if you are experiencing a mental health condition, you get a diagnosis from your GP. An insurance company may ask for information about your condition if you want a life insurance policy. We will explain more about this later.

How does a mental health condition affect life insurance?

One in four people experience a mental health problem each year in England, so life insurance providers are used to assessing applications from people with a history of mental illness.

When you apply for a life insurance policy, an insurer will ask how much protection you want and how long you want to be covered. They may also ask about your medical and lifestyle history, including pre-existing conditions. The insurer uses these details to decide whether you can have a policy or whether further information is first required - and then how much it will cost. This is known as the underwriting process.

What can happen if I don’t disclose a mental illness in my application?

When you apply for life insurance its always important that you answer all the questions and truthfully as you can, this can help avoid any potential issues if a claim is ever made on your policy. Such issues could include:

- Legal & General can refuse to pay out following a claim if it is found that the information you supplied was not accurate or was incomplete.

- Your policy could be cancelled, with no refunds on the premiums you’ve paid.

- Your ability to get insurance in the future could be affected.

Can you get life insurance with a mental health condition?

- Yes, it is possible to get life insurance with a mental health condition, but the decision is made based on the nature of the condition and your most recent medical history. We currently offer 85% of customers who have told us about their anxiety or depressions a policy immediately.

- For others, we might be able to offer cover, but we would ask for more information before making a decision.

- Where the product applied for is either Income Protection Benefit or Totoal Permanent Disability, we may be able to offer you cover, but with an exclusion for Mental Illness-related disorders.

- Unfortunately, there are circumstances where your mental health would affect your life insurance eligibility; for example, we're unable to cover you where there has been a recent increase in the severity of your condition.

What is the best life insurance for mental health conditions?

f you’re struggling with your mental health, you may still be able to get financial protection to suit your circumstances. Our customers have different reasons for taking out life insurance, so we have a range of policies available. It’s possible to take out Life Insurance or Decreasing Life Insurance if you have experienced mental health challenges. It doesn’t always make a policy more expensive either.

Ultimately, to find out if Legal & General can offer you cover, you would need to get a quote and apply for a policy.

Will my life insurance provider discriminate against me?

You are protected against disability discrimination by the Equality Act 2010, so no life insurance provider can lawfully treat you differently for having a mental health problem without good reason. For example, a provider is not obliged by law to offer you life insurance after learning of a mental health condition, but they will need to operate on the basis of information that's reasonable, reliable and relevant. Furthermore, if you disclose a mental health condition and a life insurance provider wishes to contact your doctor for your medical records, they can only do so with your written consent.

What mental health information do I need to provide?

If you experience mental health problems, or have done in the past, then when you apply for life insurance, you'll need to share with us the following information:

- The name of the condition you've been told you have

- The date you were diagnosed

- Disclosure of hospital admissions and any specialist referrals

- The severity and regularity of your symptoms

- Information on how it affects your everyday life, such as absences from work

- Any medication you take as well as the date you started

- Any history of self-harm or suicide attempts

Life insurance and mental health - in summary

Having a mental health problem does not in itself mean you can't get life insurance, and Legal & General will consider all reasonable applications. If you're experiencing difficulties with your mood and wellbeing, mental health services are available through the NHS, but patients may need a referral from their GP beforehand.

Support is also available through the many Mental Health charities such as MIND, CRUSE and several others.

Want to know more?

Mental health services are available through the NHS, but patients may need a referral from their GP beforehand.

Sources

https://www.psychiatry.org/patients-families/what-is-mental-illness

Want to learn more about Life Insurance?

Related Articles

Life insurance with pre-existing medical conditions

Can you get life insurance with no medical?