Level term life insurance

Life insurance is less complicated than it sounds, and level term life insurance is no exception. But what is level term life insurance and how do other types of policy compare? Find out more in our helpful guide, as we explain in detail how this type of life insurance policy can help to financially support your loved ones if you pass away.

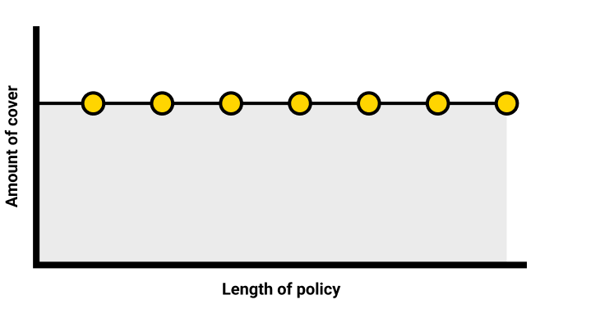

Level term life insurance is where the amount you pay and your cover stay the same during the length of the policy, unless you make any changes. This is regardless of whether the person covered passes away on the day the policy starts or the day before the policy ends. In other words, the amount of cover is ‘level’. L&G's Life Insurance is an example of a level term life insurance policy.

A level term life insurance policy can suit different needs and circumstances. If your loved ones would struggle to meet ongoing living costs without you, the peace of mind life insurance can provide is priceless.

Taking out level term life insurance could be a financial lifeline for your family if you pass away during the legnth of the policy. A level term payout could help cover not just the mortgage, but other expenses like educational costs, household bills and children's activities, helping your family to stay in their home and maintain their lifestyle.

While your level term life insurance comes with the possibility of a fixed cash sum payout, it’s worth bearing in mind that the amount won’t increase with inflation, so the value of the payout won’t keep pace with rising living costs.

Your life insurance policy could also form part of your estate, so could be subject to Inheritance Tax – read more about life insurance and tax.

In summary - L&G Life Insurance

Let's look at some features of our Life Insurance:

| Minimum age | 18 |

| Maximum age | 77 (Life Insurance), or 67 (with Critical Illness Cover). Policy must end by 90th birthday (Life Insurance) or 75 (with Critical Illness Cover) |

| Minimum term | 1 year (Life Insurance), 2 years (Critical Illness Cover) |

| Maximum term | 50 years (Life Insurance), 50 years (with Critical Illness Cover) |

| Payment frequency | Monthly |

| Percentage of applications offered on standard terms | 80% |

It's worth remembering that other eligibility criteria may apply, and you can read more in your Policy Summary and Policy Booklet.

Alternatives to level term life insurance

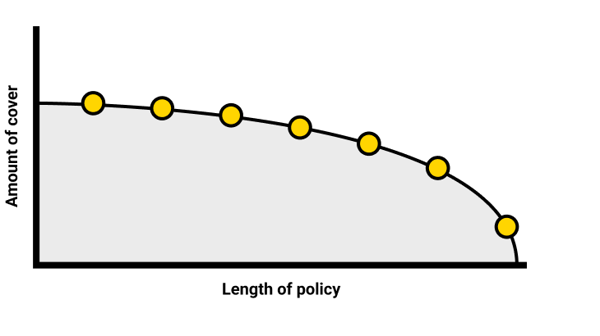

What life insurance could you consider if not level term? Decreasing Life Insurance can help protect a repayment mortgage. The amount you pay stays the same, but the level of cover reduces roughly in line with the way a repayment mortgage decreases. Decreasing life insurance can help your loved ones stay in the family home and avoid any further disruption if you were to pass away.

Level term versus decreasing life insurance

Many people will ultimately choose between level term insurance and decreasing life insurance. Here are three key facts about each type of policy to help you decide which is best:

Level term life insurance

Decreasing life insurance

Should I get level term life insurance?

Every household is different, and whichever type of life insurance you take out, the important thing is that your loved ones' financial future is protected. With premiums from just £5 a month, depending on circumstances, L&G Life Insurance caters to a range of budgets.

It's important to remember that ife insurance doesn't have a cash value unless a valid claim is made.

Want to learn more about Life Insurance?

Related articles

Single vs joint life insurance

Types of life insurance