Is cheap life insurance better?

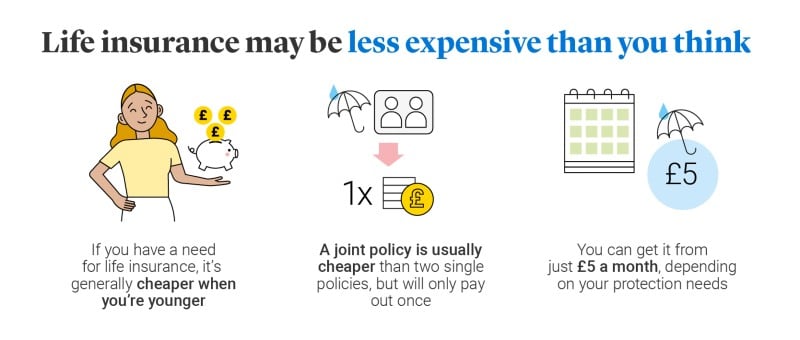

Losing a parent is a tragic reality that many children have to bear as they grow up, but for peace of mind, life insurance can protect your family's financial future even if you're on a budget. Even a modest amount of life cover provides some financial support, and not everyone realises that you can get Life Insurance with L&G from as little as £5 a month, depending on your needs and circumstances. But what are the best options for those looking for budget life insurance? In this guide, we explore how to get affordable life insurance that provides the cover you need.

How to get cheap life insurance quotes

As with many things in life, getting the cheapest life insurance doesn’t necessarily mean you’re getting the best. In order to get low cost life insurance that still reflects your requirements, you’ll need to make an honest assessment about how much money you would like to leave your loved ones. Here are some ways that could help you to calculate the cover you require:

- What is your annual salary multiplied by the number of years you wish to cover your loved ones?

- If you have a mortgage, how much is still outstanding? Or if you rent, what are your monthly repayments and how long would you likely live in your current home?

- How much would you need to pay off any debts?

If you want some assistance, try our life insurance calculator – it’s a simple way of deciding how much cover you need before you get a life insurance quote. Remember that the cheapest life insurance quote isn’t necessarily the best, you’ll want to make sure you have sufficient cover should the worst happen.

Why can’t I get cheap life insurance?

There are various factors that will determine whether you can access life insurance, regardless of your budget. The cost of life insurance is based on the likelihood of you making a claim while covered by the policy. Once you know what cover you need, your ability to get cheap life insurance depends on a number of circumstances including your age, smoker status, Body Mass Index, occupation and hobbies. For example, you’ll be classified as a smoker if you’ve recently used nicotine or nicotine replacements in the last 12 months, so will face higher premiums. But regardless of your own personal circumstances, you can always shop around for the best deals and review your bank statements to get an accurate picture of your living costs. If you’d prefer, you can speak to us to discuss any queries you may have.

Is joint life insurance cheaper?

Yes, if you have a partner, a joint life insurance policy is usually cheaper than getting two single policies. However, a joint life insurance policy normally only pays out once – upon the death of the first policy holder – so it may be worthwhile to take out two single policies despite the extra cost.

Life insurance when renting

Contrary to what many people assume, life insurance is not just for homeowners, but renters on a budget too. Life insurance is designed to cover your life as an individual – or couple – rather than a property, so if you rent and other people depend on you financially, life insurance is worth considering.

Evaluate your circumstances

Remember that life insurance is ultimately designed to protect those who rely on your income. So life insurance could be cheaper for those who have fewer financial dependents, such as children, a partner, or parents with care needs, as a lower amount of cover might be needed when there are less people to protect. This is only one factor to consider when evaluating your circumstances and overall protection requirements.

And of course, life insurance on a budget doesn’t necessarily always offer the right cover for you. There are a range of life insurance products out there and finding the one that matches your needs and circumstances can be just as important as the cost. Look out for product features that appeal to you, and the reputation of the insurance provider; for example, Legal & General Life Insurance has a 5-star Defaqto rating.

Want to learn more about Life Insurance?

Other related articles

Can you have more than one life insurance policy?

Do I need life insurance if I’m single?