Is life insurance worth it?

Life insurance can be worth it if other people rely on you financially. If you were to die, the payout from a valid life insurance claim could provide a financial lifeline for your family.

In this article we’ll take a look at why life insurance is important for many people to consider and what happens if someone dies without life insurance.

Is Life Insurance necessary?

Not everyone needs life insurance, but if your children, partner or other relatives depend on you financially, including parental responsibilities, taking out life insurance could be worth it to help provide for your family in the event of your death.

Main types of life insurance

There are different life insurance policies to serve different needs in the UK. These are the policies we offer directly. If these aren't for you, speak to a financial adviser.

- A standard ‘level term’ life insurance policy, such as Legal & General’s Life Insurance

- A Decreasing Life Insurance policy, where the amount of cover would reduce roughly in line with how a repayment mortgage reduces Legal & General’s Decreasing Life Insurance is one example.

- Cover for critical illnesses, such as Legal & General’s Critical Illness Cover, which can be added to a Life Insurance or Decreasing Life Insurance policy for an extra cost.

Which life insurance policy is worth it?

We offer different types of life insurance because our customers have different priorities. Choosing the right policy for you is what makes life insurance worth it. That's why it's important to think about what you need life insurance for before buying.

Life Insurance is for family and/or mortgage protection. The amount of cover and premiums stay the same, unless you make any changes. It can help protect your family's everyday living expenses, help pay off a mortgage or both.

Decreasing Life Insurance protects a repayment mortgage. The cover amount reduces over time, roughly in line with the way a repayment mortgage decreases. Your premiums stay the same. Because cover goes down, it's often cheaper than Life Insurance

Critical Illness Cover is an option when you take out one of our life insurance policies for an extra cost. It covers you if you're diagnosed with, or undergo a medical procedure for one of our specified critical illnesses. You need to survive for 14 days from diagnosis. The critical illnesses we cover can be life changing. It gives financial support for recovery time, treatment or adapting to a new normal.

Life insurance for partners

If you’re not the ‘breadwinner’, is life insurance worth it? Life insurance is not just for high earners – it can be invaluable for a range of households. If you look after the children at home, that takes time, energy and comes at a cost. Ask yourself, could your family manage if you were no longer around? Would your partner have to take time off work to look after the children? Your life insurance policy could help with some of these worries by paying a cash sum, which could be put towards the mortgage, for example, or covering everyday living costs such as childcare.

If you have a partner or spouse, you can decide whether to get single or joint life insurance. The latter pays out upon the death of the first insured person, at which point the policy ends. However, you can have two single policies as a couple, which means that even after the first death, the surviving partner still has their own policy.

What happens if someone dies without life insurance?

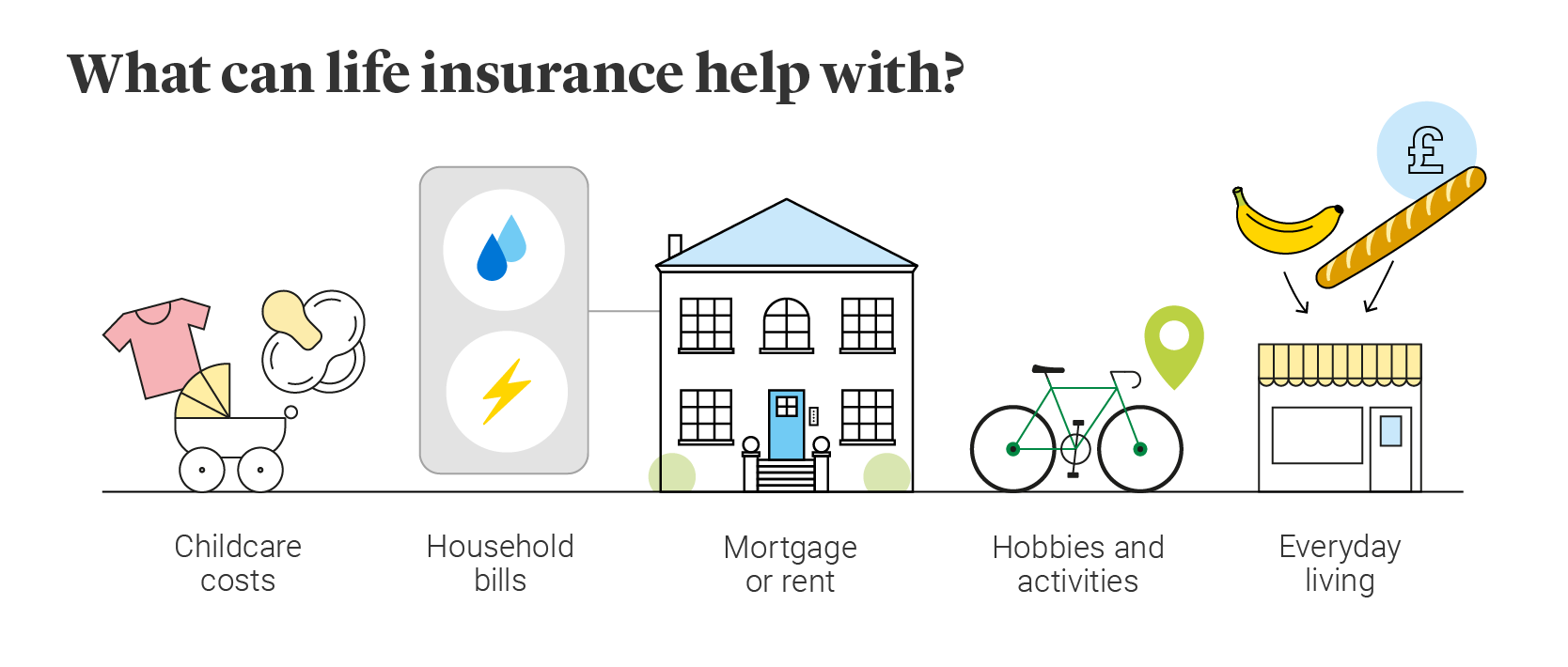

If you die without having a life insurance policy in place, how would your loved ones cope without you, whether that be financially or otherwise? Depending on your family’s circumstances, they would have to find funds from elsewhere in order to cover the costs of living. However, if you have a life insurance policy in place should you pass away, the payout from a valid claim would help with the following:

- Mortgage. If you have a repayment mortgage, Decreasing Life Insurance could contribute towards the remaining repayments if you were to die.

- Rent. If you rent, a life insurance claim could also help your loved ones make the monthly payments to the landlord in the event of your death.

- Household bills. There’s more to housing costs than paying the mortgage or rent. Being covered by life insurance means that in the event of dying, your dependants could still manage the ongoing cost of utilities like gas, electricity and water.

- Childcare costs. If you have young children, a life insurance payout could contribute towards the cost of nursery or a childminder if you were to die. And a life insurance payout can also cover the educational costs associated with older children – from independent school fees to trips, uniforms and tutoring.

- Hobbies and activities. Would your loved ones be able to pursue their hobbies and interests if you were to pass away? Many activities incur costs – from horse riding and football practice to buying musical instruments.

- Everyday living. There is no mandatory list of what someone can or can’t spend a life insurance payout on, and there are many daily living costs – from food to fuel – that a life insurance policy can help protect.

As the above examples suggest, dying without life insurance can lead to financial difficulties for your loved ones. However, that is not to say life insurance is for everyone. You may instead pass on other assets, such as property or savings and investments. Life insurance may also not be for you if you have nobody that relies on you financially.

Is Legal & General Life Insurance worth it?

Our Life Insurance offers peace of mind, no matter what the future may bring. We offer two types of cover:

Life Insurance – Your chosen cash sum could be paid out if you die during the length of the policy. It could be used to help protect the family's lifestyle and everyday living expenses or help to pay the mortgage.

Decreasing Life Insurance – This is designed to help protect a repayment mortgage so the amount of cover reduces roughly in line with the way a repayment mortgage decreases. This means your loved ones could continue to live in the family home without worrying about the mortgage.

Please remember that life insurance is not a savings or investment product and has no cash value unless a valid claim is made.

So, is it worth having life insurance? Every household has different needs, but if you want to help provide for your family at a difficult time, life insurance really could be worth it.

Want to learn more?

Related Articles

Does life insurance cover extreme sports?

10 Myths about life insurance debunked