Life insurance and cholesterol

High cholesterol is a significant health challenge in the UK. In fact, a majority of UK adults (54%) have high total cholesterol levels, according to an Our Future Health study in partnership with the NHS. But would high cholesterol impact your ability to get life insurance?

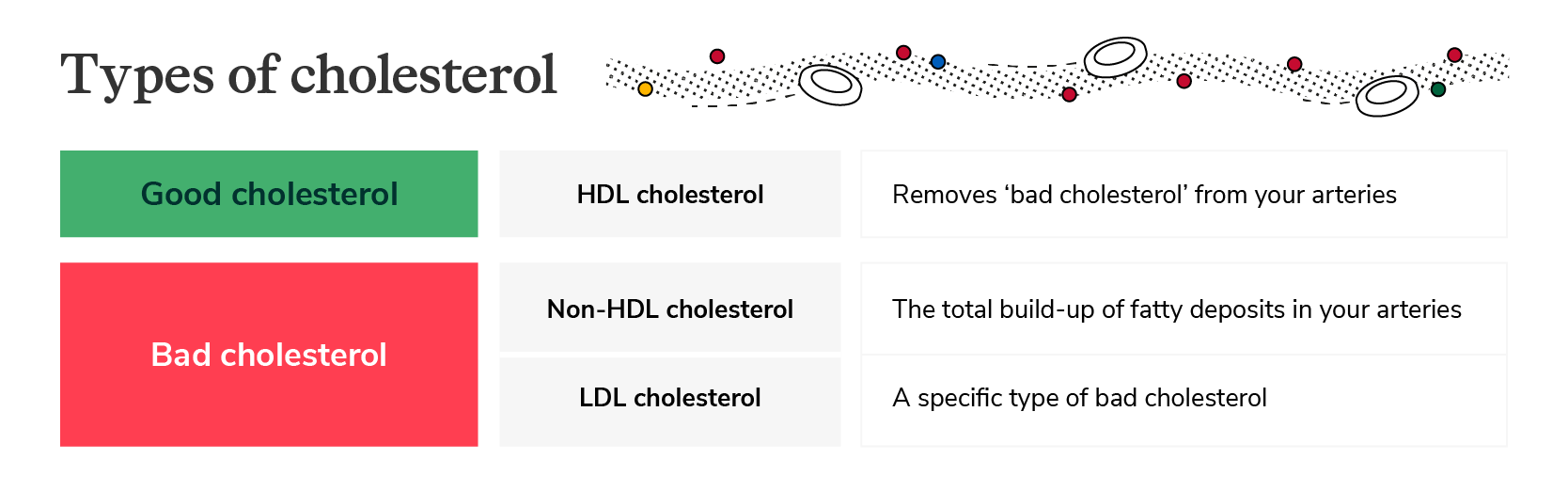

Cholesterol is a fatty substance, sometimes known as a lipid, which travels through our bloodstream. In the right quantities, cholesterol plays an import role in helping our bodies to build cells, digest food and create vitamin D. But high levels of cholesterol cause our arteries to narrow and increase our susceptibility to serious health problems like heart disease and strokes.

Yes, you can get life insurance with high cholesterol levels. When asking an insurer for a policy, they'll ask a standard set of health and lifestyle questions. This helps them understand your overall health. Conditions such as high cholesterol can increase the cost of life insurance.

When you apply for L&G Life Insurance, there is a range of health information that we would like to know, including:

We ask about cholesterol in medical history questions. Depending on the details you provide, we may ask you to complete a medical examination. This would help us decide if we can insure you and how much a policy should cost.

Is high cholesterol the same as being overweight?

No, having high cholesterol means you have high levels of cholesterol in your bloodstream, whereas being overweight means you have excess body fat. For example, you can have high cholesterol without being overweight.

Your Body Mass Index is relevant to your overall health. So, we’ll also include questions about your height and weight when you apply for a policy.

Is smoking linked to higher cholesterol?

Yes, smoking is linked to higher cholesterol because it can increase the level of LDL cholesterol – or ‘bad’ cholesterol – in your bloodstream. It can also reduce the amount of HDL cholesterol (‘good’ cholesterol).

How are cholesterol levels measured?

Your cholesterol levels will be recorded in terms of millimoles per litre (mmol/L). This is the unit used to measure cholesterol levels in the blood. If you’ve received treatment for cholesterol when you apply for a policy we could ask for these details.

What is a high cholesterol reading for life insurance?

According to the NHS, a healthy cholesterol level for adults is below 5mmol/L. A cholesterol reading of six or above is sometimes considered ‘high’ for life insurance purposes.

Yes, you can apply for Critical Illness Cover if you have high cholesterol. As with life insurance, your health history may affect eligibility or the price you pay for a policy.

Critical Illness Cover provides financial protection against a range of specifed illnesses. It's available at an extra cost when you buy L&G Life Insurance or Decreasing Life Insurance. You wouldn't be able to claim on your policy for cholesterol in isolation. However, it provides protection against a range of specified illnesses linked to high cholesterol.

If you have an existing medical condition when you apply it could limit a claim against a specified illness. If that affects you, we'll give details before you buy the policy. You’d be able to review alternatives or take financial advice.

Will a life insurance provider ask about high cholesterol?

If you apply for life insurance with high cholesterol, it’s possible that the insurer will ask a range of questions about your cholesterol levels. These questions could include:

What causes high cholesterol?

High cholesterol is partly caused by genetics, but also a range of lifestyle factors, including:

- Poor diet (too much fatty food)

- Lack of exercise

- Being overweight

- Smoking

- Alcohol consumption.

What are the risks of high cholesterol?

High cholesterol levels lead to an increased risk of heart disease and stroke. It can also lead to kidney problems and exacerbate health challenges like diabetes.

How to lower your cholesterol levels

If you’re applying for life insurance with high cholesterol and you’re keen to lower your cholesterol levels, here are some steps you could consider.

- Make changes to your diet – including more fruit and vegetables, and less fatty meats and hard cheese.

- Exercise regularly, including walking, swimming and cycling.

- Restrict alcohol consumption.

- Quit smoking (if you smoke).

- Consider taking medicine to lower your cholesterol in consultation with a doctor.

We hope these changes lead to a healthier you with reduced cholesterol levels. We can’t take planned lifestyle changes into account if you choose L&G life insurance.