Life insurance for smokers

The number of smokers in the UK has decreased over the years. But there are still around 6.4 million smokers in Britain, according to the Office of National Statistics data released in 2022. While the harmful health implications of smoking are well known, there are other downsides to being a smoker as well. One of them is that life insurance will almost certainly cost you more if you’re a smoker.

Learn more about life insurance and get a quote in just 2 minutes...

Why does smoking affect life insurance?

Insurance companies rely on simple facts and statistics to decide whether they can provide a policy and how much it will cost. When it comes to smokers, the fact is that they're statistically more likely to risk ill health, disease and death at an earlier age. As an insurance company is more likely to receive a life insurance or critical illness cover claim from a smoker, the premium (what you pay each month) is more expensive.

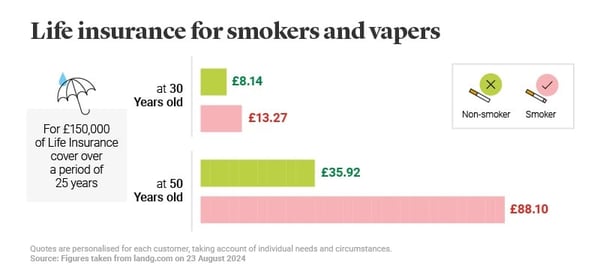

How much more is life insurance for smokers?

Smoking comes at a cost – not only to your health, but your life insurance premiums. But what might you expect to pay for a life insurance policy as a smoker compared to a non-smoker?

What is considered a 'non-smoker' for life insurance?

To be considered a non-smoker for life insurance purposes, you’ll need to have not used any tobacco or nicotine replacement products in the last 12 months. This includes the use of electronic cigarettes.

Will occasional smoking affect how much I pay?

Whether you get through a few packs a day or just find yourself tempted by the occasional smoke when out with friends, it amounts to the same thing for insurers. They work to a very simple model – if you’ve recently used tobacco (in the last 12 months) you’re classed as a smoker. That includes any cigarettes, the occasional cigar and even nicotine replacements, e.g. patches.

Does vaping count as smoking to insurance companies?

29% of smokers believe that vaping is less harmful than smoking, according to 2021 Public Health England data, but ultimately, it is still nicotine replacement. That means, at least for now, insurance companies treat vaping the same as any other form of smoking and it will influence monthly premiums in exactly the same way, making them higher than for non-smokers.

Why is vaping classed as smoking?

While e-cigarettes can help people quit smoking, they also note that these products are “not completely risk free”. Until there is more evidence about the health implications of using e-cigarettes, vaping will be judged by insurers in much the same ways as life insurance for smokers.

How do life insurance companies know whether you smoke?

While it might be tempting, especially if you’re only an occasional smoker, to be less than fully forthcoming when applying for life insurance, it’s not the wisest course of action. Insurance companies may ask for medical information when an application is made. If you do become ill and need to claim, your medical records could soon make it clear that you’re a smoker.

What happens to my life insurance if I lie about smoking?

If you put false information about your smoker status on your life insurance application, then once a claim is made on your policy, any cash payout could be reduced, or the policy invalidated altogether.

If I quit smoking, will this affect my life insurance policy?

If you have a policy with us and you have stopped smoking, that wouldn't affect your current policy or premiums in anyway and the policy would still be valid. However provided you meet our definition of a non-smoker you could be eligible to take out cover as a non-smoker after 12 months, which may affect the cost of a new policy. When cover is being replaced, it is normally a good idea to wait until your new cover starts before cancelling existing policies.

Our definition of a non-smoker is no use of any cigarettes, cigars, a pipe (including shisha/hookah), vapes, e-cigarettes, or nicotine replacements at all in the last 12 months, even if the product used did not contain any nicotine.

What diseases are associated with smoking?

Tobacco usage is associated with a range of diseases, including:

- Various cancers, such as lung cancer, and other parts of your body including mouth, throat and bowel cancer.

- Coronary heart disease.

- Peripheral vascular disease, meaning damaged blood vessels.

Moreover, smoking can also increase your risk of experiencing life-threatening events such as a heart attack or stroke, as well as damage to your lungs that leads to pneumonia. The NHS has published more information on smoking related diseases and the benefits of stopping.

Does it matter how much you smoke?

Whether or not you smoke is ultimately a personal decision, but in terms of your health, it’s fair to say that the more you smoke, the more you put your health at risk. For example, research from 2021 published in JAMA Oncology found that smokers who quit before the age of 40 can avoid 90% of the excess risk of dying from cancer that they would otherwise face.

Help with quitting smoking

No matter how determined you may be, or how much you might want to reduce your premiums, giving up smoking is notoriously difficult for many people. Though help is available – check out the NHS website for practical, quick and simple steps to help you quit. You can also read the Legal & General guide to kicking the habit.