The Great Home Renovation

Home is where the heart is, and we all want the places we live to feel warm, inviting and to reflect who we are. More than one in two UK homeowners renovated their property last year (2024), so we wanted to scratch beneath the ceiling of the Great Home Renovation.

We surveyed 2000 homeowners across the UK who have carried out a renovation to discover how their home improvements shaped their finances, relationships and wellbeing.

You might also like...

Building for the future

In 2024, Britain’s home improvements market was valued at £29.7 billion – a 5.1% increase on the previous year. And with 41% of those we polled having completed their renovation in the past year, there’s still a big appetite for getting our hands on a ‘doer upper’.

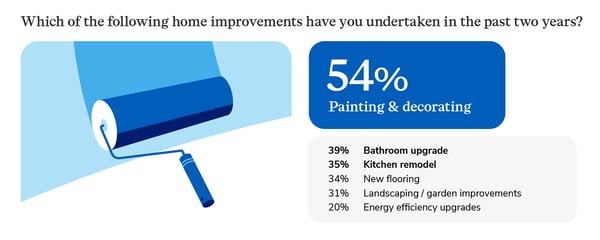

As our survey shows, many homeowners are prioritising lighter, less labour intensive (and less costly) home renovations.

But ‘small and often’ seems to be the way – 85% of homeowners said they carry out renovations either ‘always’, ‘often’ or ‘sometimes’, with a sizeable 36% saying ‘often’.

And some cities have seen particularly high renovation activity recently. For example, a majority of homeowners in Norwich (52%) and Bristol (51%) have undertaken renovations over the past year.

Why Britain is staying put

Of course, a home is so much more than a roof over our heads. There are many factors we consider, whether it’s proximity to work or family members, or the social opportunities on our doorstep.

According to recent data, many Brits are reluctant to get a move on. In October 2025, estate agent Zoopla reported the first annual decrease in new property sales in two years.

So we asked the public why they’ve chosen to improve rather than move:

- Almost half (48%) said they simply preferred to renovate than up sticks – a positive preference for their current home.

- However, 30% revealed that financial reasons have been their rationale for staying put, climbing to 43% among 45-54 year-olds.

- Men (52%) are more likely than women (43%) to answer that they simply preferred to renovate than relocate.

And while no one has a crystal ball, less than one in ten (9%) homeowners said they would prefer to relocate than renovate in the future.

Judging by our survey, our renovation decisions are often influenced by where we are in the ‘life cycle’.

The most obvious trigger for starting a renovation is simply buying a new property, which was cited by 46% of respondents. But homeowners between 25 and 34 years old were most likely (37%) to cite ‘having a baby or growing a family’. And more than a fifth (22%) of people aged 55-plus said they had taken on a renovation during retirement.

Funding a future, brick by brick

As much as we love letting our imagination run wild, if we’re not careful, that dream renovation can come with a nightmare price tag.

More than three-quarters (77%) of respondents told us they’d funded their renovation through savings, while almost a quarter (23%) used a credit card – rising to 38% among young millennials aged 25 to 34.

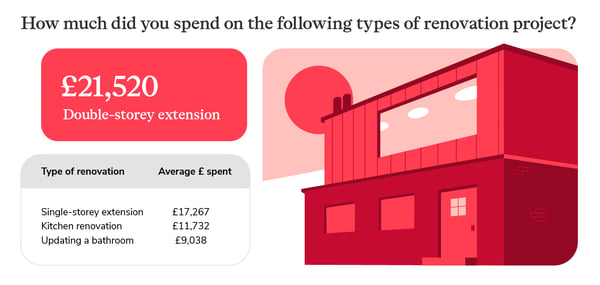

According to our survey, the average spend on a kitchen renovation generally increases in age – from £11,482.30 (18 to 24 year-olds) to £12,514.20 (35 to 44 year-olds).

Northern Ireland was the region with the highest average bathroom upgrade spend (£11,630.43) while people in Wales were the most partial to a kitchen extension (£14,102.56).

But while no one loves forking out cash, just 16% of respondents said they would delay or postpone future renovation plans due to financial pressures. Instead, the majority of renovators we polled believe it was money well spent.

Creating a happy home

As we all know, home renovations aren’t cheap, and almost a quarter (23%) of homeowners told us that staying within budget was their biggest stressor when refurbing a home.

But money isn’t the only thing on our minds when creating our dream home.

- A quarter of people (25%) said ‘disruption to everyday life’ was their biggest source of stress – including 29% of women and 22% of men.

- Just 7% of people said the renovations had a ‘significant’ negative impact on their relationships (with a partner, family or housemates). However, this rose to 10% among 18-24 year-olds.

- Overall, 36% of people said the renovations caused ‘some tension but manageable’ in their relationships, rising to 46% among 35-44 year-olds.

But while home renovations can sometimes mean ‘trouble in paradise’, when the dust settles, homeowners generally feel it was worth it in the end.

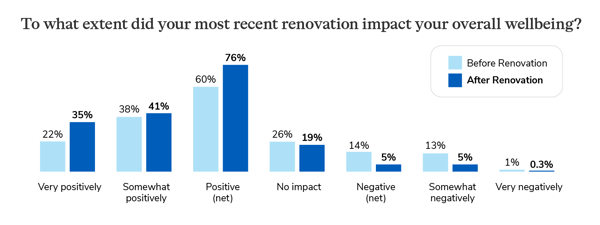

We found that the post-renovation boost is felt across all ages but is strongest among 25-34 year-olds (87% positive). Regionally, Londoners feel the most positive after the works are completed, with 87% reporting a positive impact.

And while women were slightly likelier to report a ‘negative’ experience than men – 6% versus 3% – overall women expressed a high level of positivity (74% net) which was comparable to the response among men (78% net).

Renovation nation

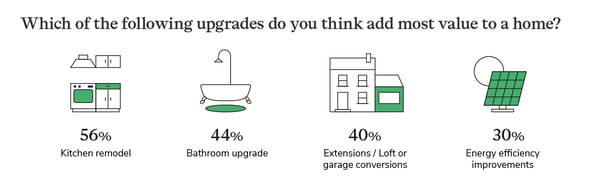

Whatever the ups and downs of doing up a property, our survey shows that UK homeowners love adding a lick of paint – or maybe a new loft – to create a special home.

And while the home renovation market may face uncertain times, we found that people still have a strong appetite for creating their ‘forever home’.

- 41% of people we polled said they’re open to renovating in the future if needed.

- Enthusiasm for future renovations was highest in Yorkshire and the Humber (48%).

- Just 8% said they don’t plan to renovate again, whereas 27% are ‘excited to take on new projects’.

Related articles

Do I need life insurance for a mortgage?

How to keep your house warm in winter

Ways to keep fit at home