What is a letter of wishes?

A letter of wishes is a document which accompanies your will and provides guidance to the people dealing with your estate after you've passed away.

In this guide we’ll explain how and why you might want to put your farewell wishes in writing.

We all want to ensure our money, assets and possessions are passed on faithfully to our beneficiaries when we’re no longer around. By writing a letter of wishes, you can make your feelings known and guide those managing your estate on how you’d like your assets to be dealt with.

Your farewell wishes are not simply about who gets to keep what. It’s a chance to put in writing any reflections and words of encouragement for your family members – and could be a priceless memento for years to come.

Unlike a will, a letter of wishes is not legally binding, and the executors are not legally obliged to follow any requests made in the letter. Therefore, if you wish to ensure that certain personal possessions go to certain beneficiaries, perhaps because these items have sentimental value, this should be dealt with in your will.

No – a letter of wishes is no substitute for a will, but the two documents can be kept together. Your letter of wishes can provide practical and emotional support to your executors, family members and trustees created in the will.

While some laws regarding wills and inheritance differ throughout the UK, you can write a letter of wishes to accompany a will whether you live in England, Scotland, Wales or Northern Ireland.

Preparing your letter of wishes

Before you put pen to paper, here are some ways you could prepare your letter of wishes.

Find a letter of wishes template

If you need inspiration, you can search online for a letter of wishes template. This will give you a recommended structure for the letter.

Choose a format

Your letter of wishes can be handwritten or typed and printed – there is no set format.

Consider a draft

Before writing the final version, you might want to draft a first attempt, which you could show to a close confidant to get their opinion.

How to write the letter of wishes

Your letter of wishes should be expressed in simple, jargon-free English so that you leave no room for misinterpretation.

As your farewell wishes may contain sensitive information about people’s right to an inheritance, you may wish to write about these in a considerate, matter-of-fact style, rather than inflaming any tensions.

It’s also important that your letter of wishes doesn’t contradict anything in your will, otherwise even your most important goodbye wishes may have to be disregarded.

As the letter of wishes is not legally binding, you must take care that the letter of wishes does not contain anything that could conflict with your will. The letter of wishes should support the clear instructions in your will as the will takes precedence as it is a legally binding document.

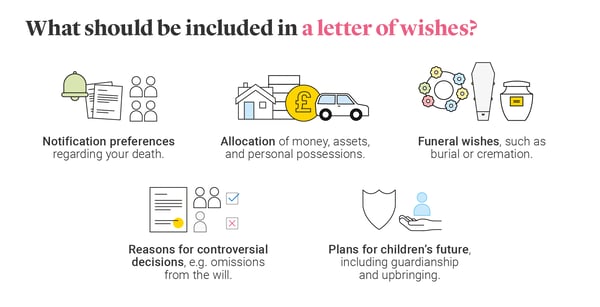

Anything relating to the management of your estate can be covered by your letter of wishes. Here are some examples:

- Information about how you’d like your money, assets and personal possessions to be allocated when you’re no longer around.

- Details about who should be informed of your death, and if anyone in particular should not be informed.

- Guidance on whether you’d like to be buried or cremated, plus any relevant detail about the funeral service you’d like (for example, if you wish to have a humanist funeral).

- Explanations about decisions you’ve made that may be considered controversial; for example, if you’ve omitted someone from the will.

- Details about your children’s future, such as who they should live with, and any ‘leaving wishes’ in relation to their religious upbringing or education.

Letter of wishes format

There is no set format for a letter of wishes, and the contents should ultimately be determined by you and your loved ones’ circumstances. But as a rule of thumb, you could format your expression of wishes as follows:

The date of the declaration, and the names of your executors or trustees.

The letter, which could begin with a summary of your aims, followed by a priority list of beneficiaries. It can then describe the factors you’ve taken into account, the age at which beneficiaries should receive their inheritance, and other information, such as whether the partners of your children should have a claim to inheritance in the event of a divorce.

Your signature as the settlor, and of any other settlor, if applicable.

Your letter of wishes is a confidential document, whereas a will can potentially become public. If you wish to withhold sensitive information from family members, your letter of wishes can prove beneficial. It’s an opportunity to state any preferences so that any disputes can be resolved more easily when you’re no longer around.

There is no defined moment in your life that you should write a letter of wishes, so essentially, you can write one at any time. Typically, people choose to write a letter of wishes when they create a will, as the details will be easier to remember and there is less chance of omitting key information.

Your list of wishes should ideally be stored with the will, so that the documents are easier to locate. Some people choose to store their will at home, or at a bank, solicitors, or with the Probate Service. Read our guide to storing important documents.

Yes – since the letter of wishes is not a legally binding document, you can rewrite sections at any stage. You may wish to check the letter at regular intervals, as your personal and family circumstances may have changed, not to mention any new legislation relating to inheritance.

Unlike a will, your letter of wishes doesn’t need to be witnessed. As a non-legally binding document, a witness isn’t required.

Learn more about writing a will

Writing a letter of wishes is one thing, but you’ll want to accompany the document with a legally binding will. Read our guide on how to make a will, and discover more about Over 50 Life Insurance.

Find out more about our life cover

More article and guides

What happens to debt when you die?

Estate planning

What are the duties of the executor of a will?