Level term or decreasing life insurance

If you want peace of mind that your loved ones have financial support if you die, life insurance could be for you.

Life insurance policies come in all shapes and sizes, and you can be forgiven for not knowing the difference between ‘level term’ and ‘decreasing life insurance’. So to make matters easier, we’ve put together a simple guide to explain what level term vs decreasing term actually means, and which policy might be right for you.

Level term life insurance is where the potential payout stays the same while you're covered by the policy. Before you take out a level term policy, you can choose how much cover you need and how long you need it for, and neither will change during the policy, unless you make any changes to it.

Decreasing life insurance is sometimes referred to as ‘mortgage life insurance', as the payout is often used to help pay off a repayment mortgage. Unlike a level term life insurance policy, the amount of cover decreases roughly in line with how a repayment mortgage decreases.

Both level term life insurance and decreasing life insurance are designed to protect your loved ones financially if you pass away. The main difference is that ‘level term’ policies have a fixed payout amount for the length of the policy. The payout on a ‘decreasing’ policy reduces over the length of the policy.

Whether you choose level or decreasing life insurance, the monthly cost will remain the same for the duration of the policy, unless you make any changes.

These products are not savings or investment products and have no cash value unless a valid claim is made.

It’s worth remembering that you may not always see these policies described as ‘level term’ or ‘decreasing term’. In fact, our level term policy is simply known as Life Insurance while our decreasing term policy is called Decreasing Life Insurance.

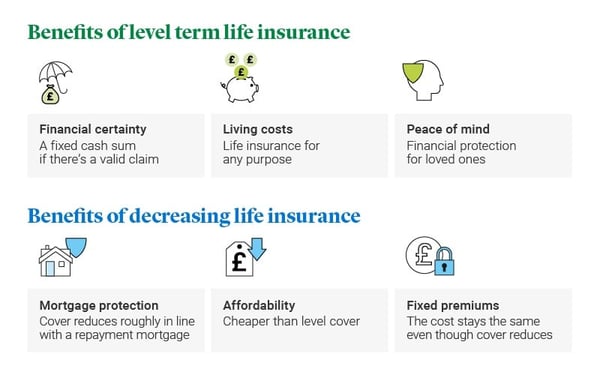

Benefits of level term life insurance

Benefits of decreasing life insurance

Should I choose level term or decreasing life insurance?

Everyone’s situation is different, so your decision to get level term or decreasing life insurance will depend on what you need protection for. If your family have substantial living costs – from school fees to recreational activities – or you have debts to settle, you might wish to get level term life insurance to give you the extensive financial cover you need. If, however, your children are financially independent, or you only wish to protect a repayment mortgage, a decreasing life insurance policy may be sufficient.

For an accurate picture of how much life insurance cover you might need, our life insurance calculator can help inform your decision.

Want to learn more?

Related articles

Single vs joint life insurance

Types of life insurance

Life insurance for your family

Explore our products

Our Insurance products are designed to protect what matters most - you and your loved ones. There are things you can do to help financially protect your futures. And we’re here to help.