Is decreasing life insurance worth it?

For millions of UK mortgage holders, decreasing life insurance is a way of getting some financial protection and reassurance. But how does it work, and what are the pros and cons?

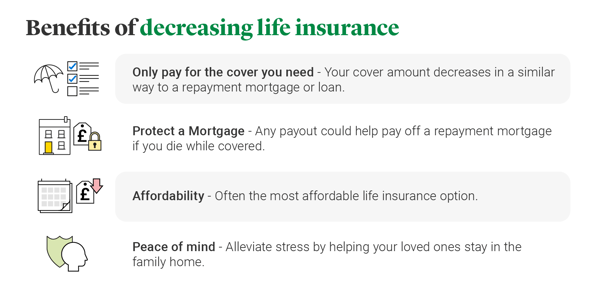

Decreasing life insurance is designed to protect a repayment mortgage if you die. As the name suggests, decreasing life insurance is where the amount of cover decreases over time as the amount left on your mortgage decreases.

If you own a property with a repayment mortgage, decreasing life insurance is one way of protecting your family’s finances if you were to pass away.

There are certain situations in life where decreasing life insurance could prove to be invaluable. If the answer to the following questions is ‘yes’, you may want to consider L&G Decreasing Life Insurance.

But before you get a quote, there are alternatives to consider. If you want to protect more than just a mortgage, Life Insurance could offer the comprehensive cover you need.

Additionally, if you’ve paid off the mortgage or your adult children have left home, you may feel that you no longer need life insurance.

For more guidance, read our article: ‘Do I need life insurance?’

Decreasing life insurance offers you peace of mind in knowing that your dependants – such as children or a spouse – could pay off the repayment mortgage and stay in the family home if you were to die whilst covered by the policy.

No, decreasing life insurance doesn’t have to be used for mortgage protection. Some people use these policies to cover other debts, such as loans. But remember, your cover will reduce over time, which is why it’s often used to protect a repayment mortgage.

Of course, every person has different priorities, so it’s worth learning about the various types of life insurance, then find a policy that provides the right cover at a price you can afford. For example, if you rent, our guide to life insurance for renters can help you assess your options.

While all types of life insurance provide financial protection in challenging times, there are subtle differences between policies.

A ‘level term’ life insurance policy provides a fixed cash sum if a valid claim is made, whereas the payout from decreasing life insurance reduces roughly in line with a repayment mortgage.

While a ‘level term’ policy can also be used to protect a mortgage, the policy is designed to cover a wide range of outgoings – from childcare costs to household bills.

Read more on the differences between ‘level term’ and decreasing life insurance.

If you’re only looking to get financial protection for a repayment mortgage, decreasing life insurance could be worth it.

But like any policy, there are pros and cons of decreasing life insurance. On the one hand, it can be more affordable than a ‘level term’ life insurance policy. When we work out the price of L&G Decreasing Life Insurance, it often costs less than Life Insurance.

But remember – while your cover reduces, your decreasing life insurance premiums stay the same. And it’s worth bearing in mind that costs such as household bills will remain the same or increase over time. So, if you want a policy that provides the same level of protection for as long as the policy is active, you could consider Life Insurance.

Decreasing life insurance can give your family the protection they need to protect a repayment mortgage. But before you apply for a policy, here are some factors that could influence the amount of cover you take out.

We all have a different financial landscape, and no two life insurance applicants have exactly the same requirements. Try our life insurance calculator for an estimate of how much decreasing life insurance cover you need, or if you’re ready, get a quote.

A L&G Decreasing Life Insurance policy does not have a cash value unless a valid claim is made. Your policy will not accumulate cash value over its lifespan.

Your mortgage interest rate may differ to the interest rate that is applied to your decreasing life insurance policy. This means that any payout may not necessarily cover the debt, such as outstanding mortgage payments.

It’s important to check that the interest rate on your mortgage doesn’t become higher than the rate applied to your decreasing life insurance policy. This can give you some peace of mind in knowing that your cover will be sufficient in the event of a valid claim.

Decreasing vs 'increasing' life insurance

With a decreasing life insurance policy, your cover reduces over time. But with ‘increasing’ life insurance, the opposite is true – the cover amount is reviewed against measures of inflation, or a fixed rate, and rises over time.

L&G does offer ‘increasing life insurance’ through our team of advisers. It’s designed to help you get financial support for your dependants, protected against inflation, if you die or become terminally ill while covered by the policy.

Learn more about increasing life insurance.

L&G's Decreasing Life Insurance

Decreasing Life Insurance can be a cost-effective way of giving your loved ones the financial protection they deserve.

If you’d like to know more, read our Decreasing Life Insurance FAQs.

Or learn more about L&G’s Decreasing Life Insurance.

It’s available from just £5 a month, but tell us about the cover you need and we’ll give you a personal quote.

Related products and articles

Want to learn more?

More articles and guides

Types of life insurance

How are life insurance premiums calculated?