Estate planning means working out how you’d like your assets to be managed and passed on after your death. It’s as important as making a will because it can:

- Make your executors and loved ones' lives easier

- Protect your estate for your beneficiaries

- Help you understand how much Inheritance Tax (IHT) might be due

That final point is particularly important. When you're estate planning, it's very important to understand IHT, which may be due if your estate is:

- Worth more than the IHT threshold (AKA the nil rate band - it's currently £325,000)

- Not going to a spouse, civil partner or other exempt beneficiary, like a charity

IHT regulations can change at any time, and the rules around tax, gifts and trust funds are complex. So, we're not going to talk about it in too much detail in this article. It's a good idea to consult a professional financial adviser and a solicitor (ideally an estate planning law specialist) to get some expert estate planning advice before you make any decisions.

You may also be interested in...

To plan your estate, there are some basic steps you’ll probably need to work through:

- Assess your net worth by adding up all your assets and taking away any liabilities

- Work out where you want everything to go after your death – for example:

- Making the right arrangements (like a will) to make sure your wishes are legally binding

That’s a simple list but in practice estate planning can be a complex task. And because individual estates vary so much, it’ll be different for everyone.

As we’ve noted above, many financial and legal professionals offer estate planning services and can offer very useful advice and support. If you’re not already getting that sort of advice, you can visit Unbiased.co.uk to find a financial adviser or for legal advice go to Solicitors Regulation Authority.

What should your estate plan include?

What else can you do before you pass on?

Making other financial plans for friends and family

Careful financial planning is an important way of protecting your estate. It can make sure that your financial wishes are followed if you become incapacitated before you pass on. It can also help you understand how much IHT might be due on your estate, which could affect how you share it out.

Gifting money before you pass on

You can give up to £3,000 in any one tax year IHT free. And if you don't give some or all of that amount, you can carry the balance forward to the next tax year.

For example, if Mary gifts £1,500 in tax year 1, she can carry forward £1,500 and have a £4,500 IHT exemption in tax year 2. But if she doesn't use it in year 2 she can't carry it forward to year 3.

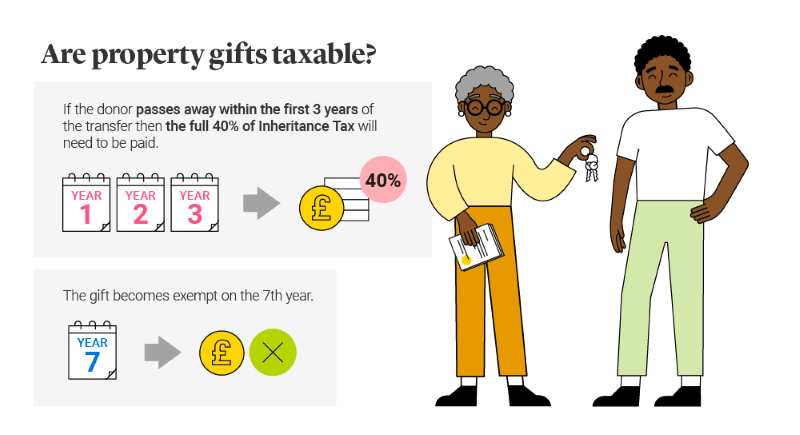

Some types of gift might be completely exempt from IHT. They include gifts between spouses or civil partners and those given over seven years before your death. And if you're thinking about helping your grandchildren, read our guide to gifting as a grandparent.

Your executors will need to declare any cash gifts you make in the seven years before your death. So, it's important to keep records of them and make sure the relevant people know where to find them.

Setting up a power of attorney

A power of attorney is a very important wealth planning tool. It's a legal document that lets you appoint one or more people to either:

It's usually set up as a peace of mind measure, so (for example) you know everything's taken care of if you run into mental incapacity problems. It can be a good opportunity to chat through your wishes with your loved ones and deal with any questions or worries they may have.

Planning ahead with Over 50 Life Insurance

Our Over 50 Life Insurance can help you with your estate financial planning, letting you leave a small fixed cash sum to your loved ones when you pass away. Putting it in trust can be tax efficient too.

To find out more:

- Visit our Online Trust Hub for more information about trusts in general.

- You can read about our Digital Discretionary Trust and how you can set this up online for an existing policy with us. You can access our trust form here.

The cash sum from your Over 50s Life Insurance policy could be used to help contribute towards your funeral costs. If this is the case, you could choose to add the Funeral Benefit Option to your plan at no extra cost. Terms and Conditions apply.