Is Critical Illness Cover worth it?

If you take out Life Insurance or Decreasing Life Insurance, you can choose to add Critical Illness Cover for an extra cost. Depending on the cover you choose, that cost could be quite significant. But what exactly is the benefit of critical illness cover and is it worth it? While no two applicants are the same, this article outlines some of the potential advantages and disadvantages of critical illness insurance.

Critical Illness Cover from L&G is designed to protect you and your loved ones from the financial impact of a critical illness. It could pay out a cash sum if you’re diagnosed with, or undergo a medical procedure for, one of the specified critical illnesses we cover during the length of your policy. You must survive for 14 days from diagnosis.

Critical Illness Cover can help pay for a range of expenses, such as:

You may find more information in our Critical Illness Cover FAQs.

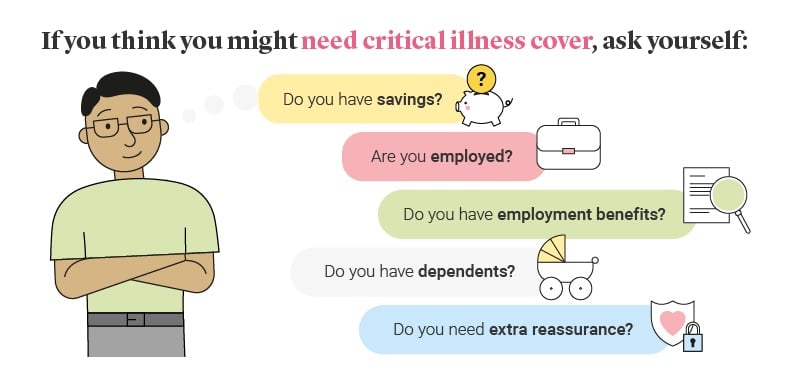

A critical illness can affect anyone at any age and can turn lives upside down. If you think you might need Critical Illness Cover, here are some questions to ask yourself first:

- Your income? Critical Illness Cover can protect you financially if you’re no longer able to work. Some people take time to recover from a life changing illness, others may have to adjust to a new normal. What affect will this have on your income?

- Do you have savings? Some people may use their savings to supplement their loss of income following a critical illness. Could you afford to take time off work? Do you have other plans for your savings?

- Do you have employment benefits? Some may rely on an employment benefit package instead of a critical illness policy. However, this will only cover you if you remain an employee of the organisation in question.

- What outgoings do you have? If you’re mortgage-free and your children have left home, you may feel confident about relying on existing funds, assets or savings if you became critically ill. But if your loved ones rely on you financially, Critical Illness Cover could provide a lifeline.

- Do you want extra reassurance? Having a back-up plan in place can alleviate some of the financial stress of the situation. A cash sum could help if you need to adapt your home or pay for treatment that’s not available on the NHS.

If you have Critical Illness Cover, you can get full payment of a cash sum if you’re diagnosed with or undergo a medical procedure for a range of critical illnesses. These include:

- Many types of cancer

- Heart problems (such as heart attacks of specified severity and heart valve replacement or repair)

- Kidney failure

- Stroke (if the symptoms last at least 24 hours)

- Traumatic brain injuries that result in permanent symptoms.

Read a comprehensive list of what’s covered by Legal & General Critical Illness Cover.

Critical Illness Cover pros and cons

To give you a better understanding of Critical Illness Cover, we’ve summarised some of the key pros and cons below.

What are the benefits of Critical Illness Cover?

What are the downsides of Critical Illness Cover?

No cash value

Your policy has no cash value unless a valid claim is made, so even if you survive the policy, you won’t get any money back.

It doesn’t pay out if you're diagnosed with an illness that isn't covered

Our Critical Illness Cover is designed to pay out if you’re diagnosed with certain critical illnesses and a successful claim is made. See the full list of illnesses that we cover.

Not every illness is covered

While there are a wide range of critical illnesses covered, there are exceptions. For example, some types of cancer are not included. Deafness must be permanent and irreversible; and kidney failure must require permanent dialysis. In order to make a claim you’d need to meet the full definition for the critical illness, which can be found in the policy documents.

Premiums may cost more for some people

Life insurance products are generally cheaper when you’re younger, or in good health, and the same goes for Critical Illness Cover. But of course, it isn’t always the best solution for each individual. It’s important to get the right policy for your needs and to understand how much Critical Illness Cover you may need.

How much Critical Illness Cover do I need?

If you decide that you need Critical Illness Cover, you should consider the protection you need. This includes:

- How much you can afford to pay in premiums each month

- The amount of Critical Illness Cover you need.

- How long you need the protection to last

In truth, none of us know when we might become critically ill, so it can be hard to judge how much Critical Illness Cover we might need. But a good place to start is thinking about how much you and your family would need if you were unable to work after a critical illness diagnosis. Would you need to cover your mortgage or rent, household bills or any childcare costs? If your circumstances change in the future, you can always review your cover.

The price is personalised. Here are some of the factors that will determine how much you will pay

- Whether or not you smoke, or have previously smoked in the last 12 months

- Your age

- How much cover you want and how long you need it to last

- Your health and lifestyle, including your weight and family medical history

- Your job – if there’s a higher than normal change of you getting hurt at work, your policy may cost more.

If you’re ready, it’s easy to get a quote so you can see for yourself.

Life Insurance offers financial protection if you die while covered by the policy. Critical Illness Cover can help minimise the financial impact on you and your family if you become critically ill. It also includes Children's Critical Illness Cover. This offers some financial protection if your children become critically ill. This isn't included if you buy life insurance without Critical Illness Cover. Terms and conditions apply.

- How do I buy? You can buy life insurance on its own. But you cannot buy Critical Illness Cover without life insurance. Instead, its an option that's available for an extra cost when you buy life insurance. You cannot add Critical Illness Cover after your life insurance policy starts.

- What happens if there's a claim? A life Insurance policy pays out to your beneficiaries. This is usually paid out to your loved ones. With Legal & General, it's easy to put your life insurance policy in a trust. This allows you to choose you should receive the cash sum. With Critical Illness Cover, you would receive the cash sum and can decide how best to use it.

You just need to remember that these policies are not savings and investment plans and have no cash value unless a valid claim is made.