Critical illness cover with pre-existing conditions

Critical illness cover could be the financial cover you deserve. But can you get critical illness cover with a pre-existing condition?

Recap: what is critical illness cover?

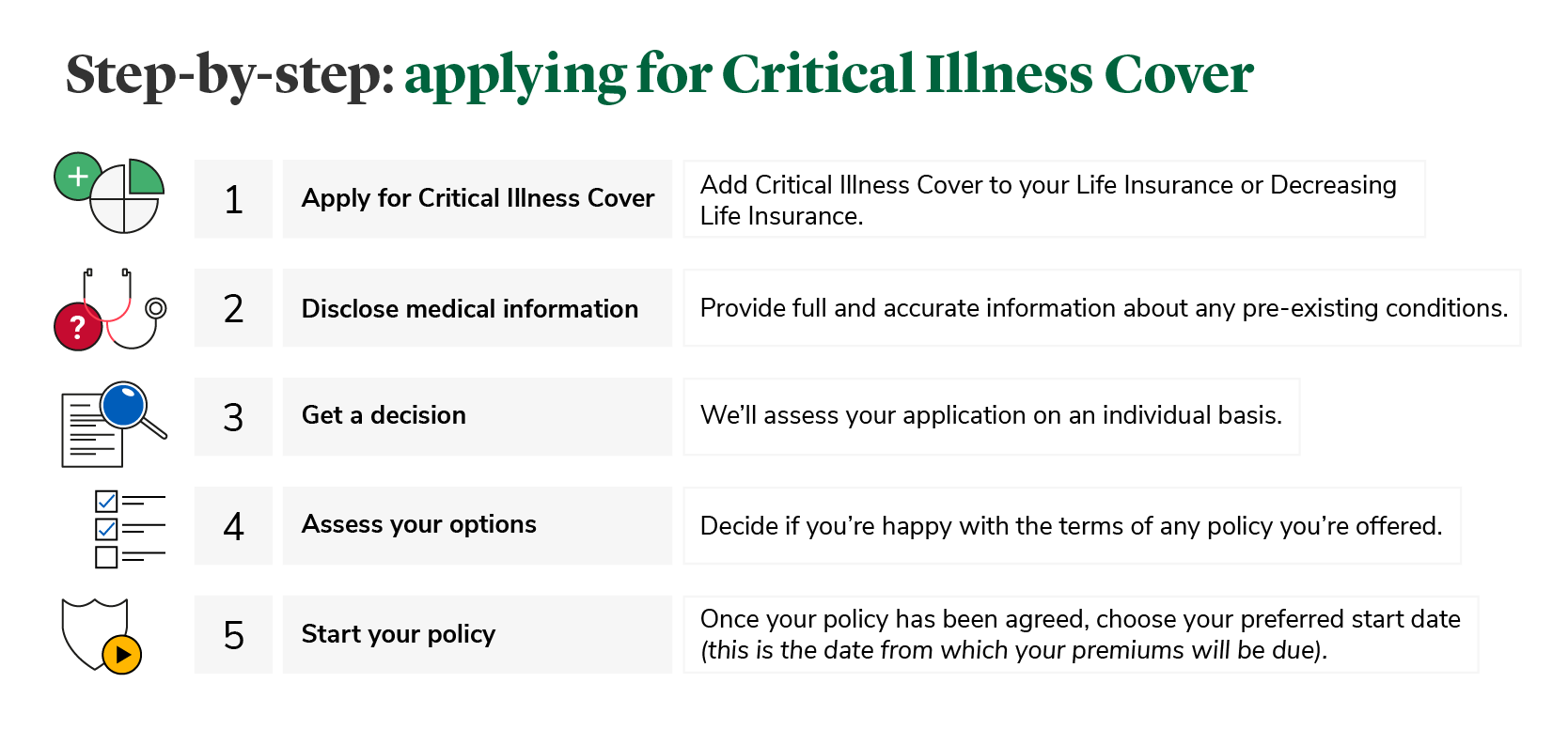

Critical Illness Cover is a type of insurance designed to pay a cash sum if you are diagnosed with or undergo a medical procedure for one of the listed critical illnesses during the length of the policy. L&G’s Critical Illness Cover is an add-on which can be purchased at the time of applying for Life Insurance or Decreasing Life Insurance, for an extra cost.

A pre-existing condition refers to any illness or injury in your medical history – or that you’re currently experiencing – when you apply for policies such as Life Insurance and Critical Illness Cover.

Yes, it’s possible to get critical illness cover even if you have a pre-existing condition. But it’s important to note that the cover you receive may exclude the condition in question.

Pre-existing conditions aren't the only factor we take into account. We'll also consider things like your age, occupation, health and medical history. This helps us decide whether we can offer you Critical Illness Cover and how much it should cost.

Critical illness cover for cancer

If you have cancer or a history of cancer, it’s important that you disclose this pre-existing condition when you apply for critical illness cover.

L&G Critical Illness Cover includes many types of cancer, such as those which are considered non-invasive. We do exclude some less advanced cases. For more information, read our guide to life insurance and cancer.

What to expect when you apply for Critical Illness Cover

Depending on whether you have a pre-existing condition, there are various potential outcomes when you apply for L&G Critical Illness Cover. You might be offered any of the following:

- Critical Illness Cover, the cover you applied for at the quoted price

- Critical Illness Cover, the cover you applied for at a higher price

- Critical Illness Cover, cover for some, but not all of the listed conditions. We’ll give you details and confirm price

Alternatively, with some pre-existing conditions you might be ineligible for Critical Illness Cover. Remember this is an optional extra when you buy life insurance. It’s possible that we could still protect you with Life Insurance or Decreasing Life Insurance if this happens.

What happens if I don’t disclose a pre-existing condition?

If you apply for critical illness cover and you don’t disclose a pre-existing condition, your policy could be invalid. So it’s really important that you give accurate information, such as the name of your pre-existing condition and the date you were diagnosed.