Is Critical Illness Cover worth it?

If you take out Life Insurance or Decreasing Life Insurance, you can choose to add Critical Illness Cover for an extra cost. Depending on the cover you choose, that cost could be quite significant. But what exactly is the benefit of critical illness cover and is it worth it? While no two applicants are the same, this article outlines some of the potential advantages and disadvantages of critical illness insurance.

Critical Illness Cover pros and cons

To give you a better understanding of Critical Illness Cover, we’ve summarised some of the key pros and cons below.

What are the benefits of Critical Illness Cover?

What are the downsides of Critical Illness Cover?

No cash value

Your policy has no cash value unless a valid claim is made, so even if you survive the policy, you won’t get any money back.

It doesn’t pay out if you're diagnosed with an illness that isn't covered

Our Critical Illness Cover is designed to pay out if you’re diagnosed with certain critical illnesses and a successful claim is made. See the full list of illnesses that we cover.

Not every illness is covered

While there are a wide range of critical illnesses covered, there are exceptions. For example, some types of cancer are not included. Deafness must be permanent and irreversible; and kidney failure must require permanent dialysis. In order to make a claim you’d need to meet the full definition for the critical illness, which can be found in the policy documents.

Premiums may cost more for some people

Life insurance products are generally cheaper when you’re younger, or in good health, and the same goes for Critical Illness Cover. But of course, it isn’t always the best solution for each individual. It’s important to get the right policy for your needs and to understand how much Critical Illness Cover you may need.

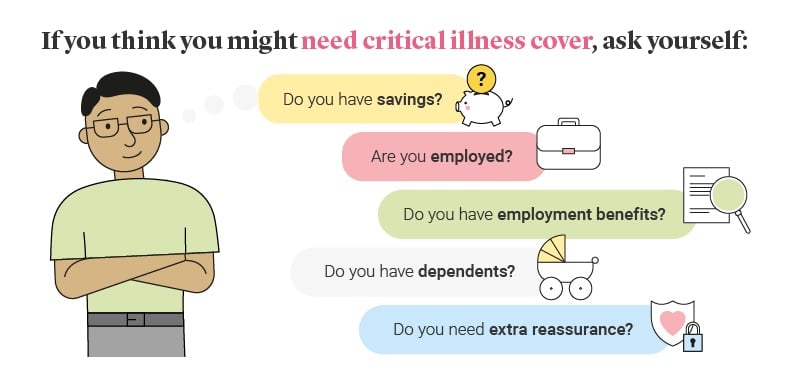

How much Critical Illness Cover do I need?

If you decide that you need Critical Illness Cover, you should consider the protection you need. This includes:

- How much you can afford to pay in premiums each month

- The amount of Critical Illness Cover you need.

- How long you need the protection to last

In truth, none of us know when we might become critically ill, so it can be hard to judge how much Critical Illness Cover we might need. But a good place to start is thinking about how much you and your family would need if you were unable to work after a critical illness diagnosis. Would you need to cover your mortgage or rent, household bills or any childcare costs? If your circumstances change in the future, you can always review your cover.