Average cost of life insurance

Some things in life are priceless and that includes spending time with our loved ones. We don't want to worry about them facing an uncertain financial future. That's where life insurance can help by paying a cash sum if you die while covered by the policy. Given life insurance comes at a cost, how much can you expect to pay on average?

What is the average cost of life insurance?

If you're thinking about life insurance, there's a few things to consider. You'll want to make sure the cash sum you choose is enough to protect your loved ones. You also have to decide how long you want your policy to last. Finally, you'll need to be comfortable that you can afford to pay for your policy while it's in place.

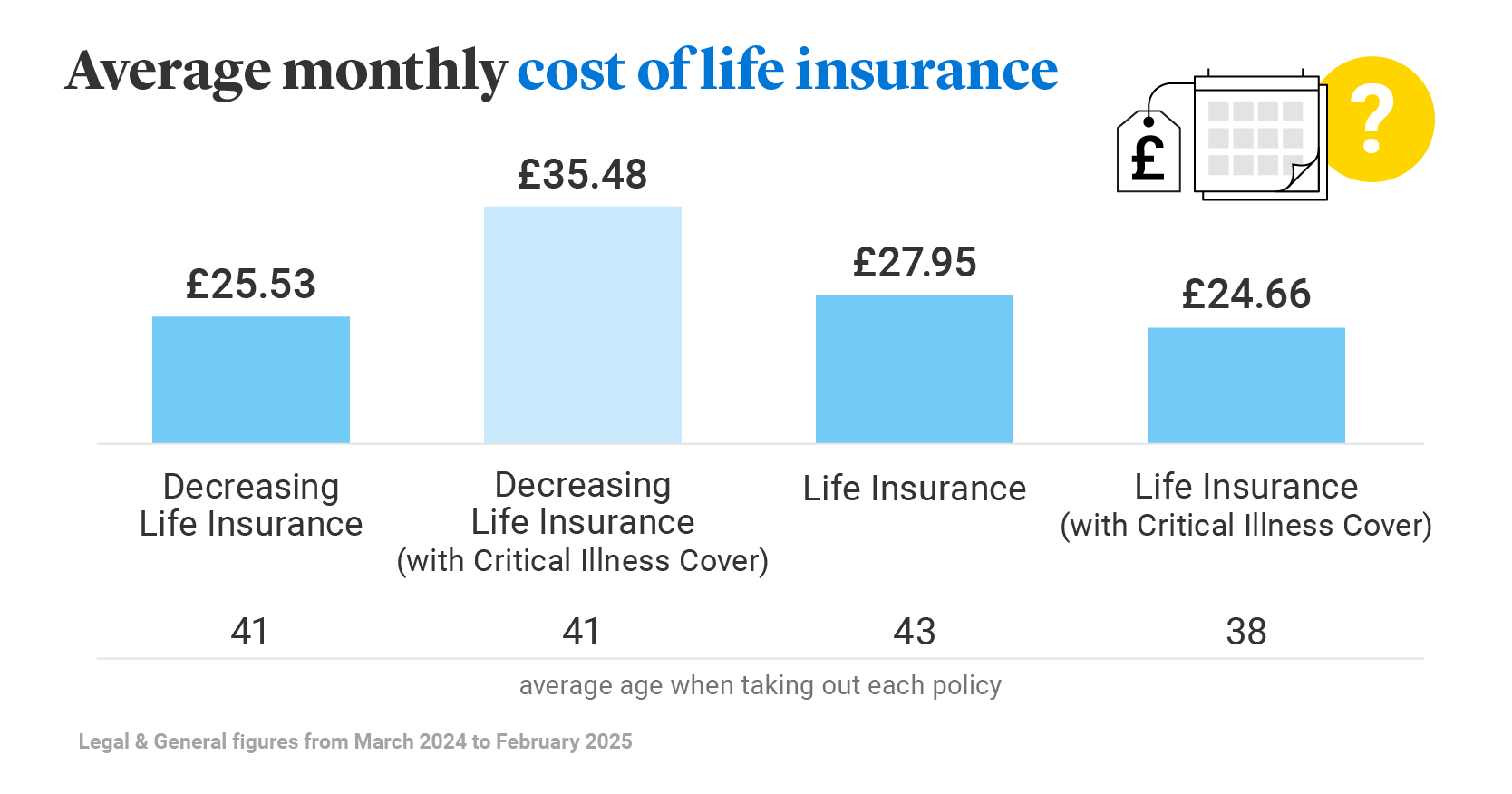

The average cost of Life Insurance is £27.95 per month, according to Legal & General figures from 2024. For Decreasing Life Insurance policies, the average cost is £25.53 per month.

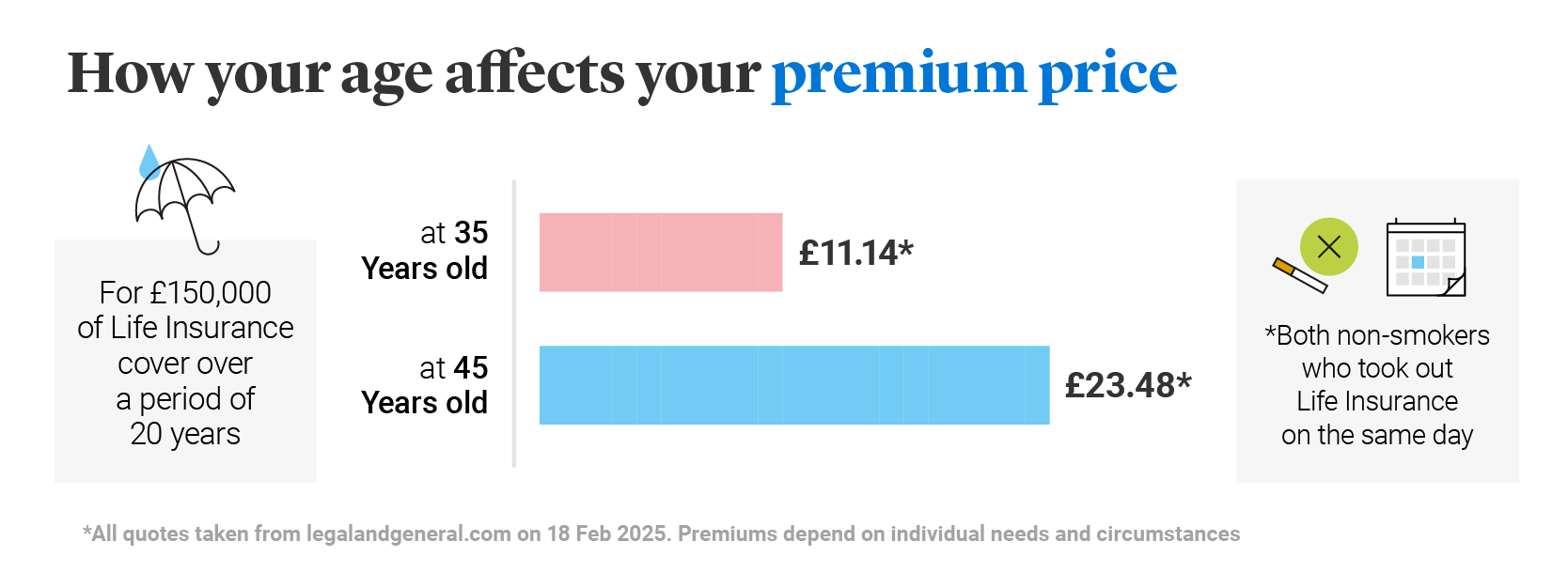

Life insurance rates by age

As our chart shows, in the UK, age affects the cost of life insurance (also known as the 'premium').

But of course, age is only one factor behind your monthly life insurance costs.

Revealed: average price of life insurance per month

Here’s how the monthly cost of life insurance differs depending on your policy.

While it’s useful to know the average cost of life insurance, it doesn’t tell us everything. Customers who took out Life Insurance with Critical Illness Cover were younger than those with Life Insurance. This is one reason why the average cost is lower. This table illustrates average cost, the amount of protection customers have will vary.

Critical Illness Cover can be added to Life Insurance or Decreasing Life Insurance for an extra cost. It could pay out a cash sum if you’re diagnosed with one of the specified critical illnesses that we cover during the length of your policy, and you survive for 14 days from diagnosis.

How much will life insurance cost me?

If you’re offered a life insurance policy, your monthly payments will be based on a range of factors, for example:

- Your age, health and lifestyle. Including age, smoker status, weight (Body Mass Index), occupation and family medical history.

- How much life insurance do you need? This will depend on factors like your mortgage or rental costs, and other financial commitments like childcare and outstanding debts.

- How long do you want your policy to last? Some people like to choose a life insurance term length for a certain number of years; for example, to cover the length of a mortgage, or the period before a child leaves home as an adult.

- Which type of life insurance works for you? When you apply, you can opt for a ‘level term’ or ‘decreasing’ life insurance policy. On average, the payout for a ‘decreasing’ policy will be lower, since it reduces over the course of the policy.

You will have to decide how much cover you need and for how long. Our life insurance calculator can help you estimate how much cover you may need.

In 2023, the average payout for a valid L&G Life Insurance claim was £39,916. Additionally, 97% of life claims were paid, totalling £519 million.

Learn more about how life insurance payouts work.

When you get a life insurance quote, you'll have the choice of getting a policy on your own or with your partner. The figures in our table combined single and joint life premium averages. It's worth point out that a joint life policy is likely to be less than two equivalent single life policies. It isn't only a question of price. You'll have to decide what option is right for you and there could be more to it than price.

- Joint life policies can be a good choice if you and another person need life insurance for the same reason. For example to cover a joint mortgage. If there was a valid claim, the policy would pay once and end.

- Single life policies can be right for couples with different protection shortfalls. If there's a claim on one policy, there other person's protection would still be in place.

For more information, read our guide to single versus joint life insurance.