What is life insurance?

Life insurance is a type of policy that protects your loved ones with financial support if you die. It can help minimise the financial impact that your death could have on your family and offer peace of mind to those you care about most.

Most life insurance policies pay out a cash sum to your loved ones if you die while covered by the policy. It can help them deal with everyday money worries such as household bills, childcare costs or mortgage payments.

You choose the amount of cover you need, how long you need it for, and whether you want joint or single life insurance policies. For more help, take a look at our life insurance calculator or speak to your financial adviser.

As the name suggests, life insurance is designed to provide your dependants with financial support in the event you lose your life. So if you or a joint policyholder were to pass away, the payout could be used to pay for various ongoing living costs, such as:

Watch: Life insurance explained

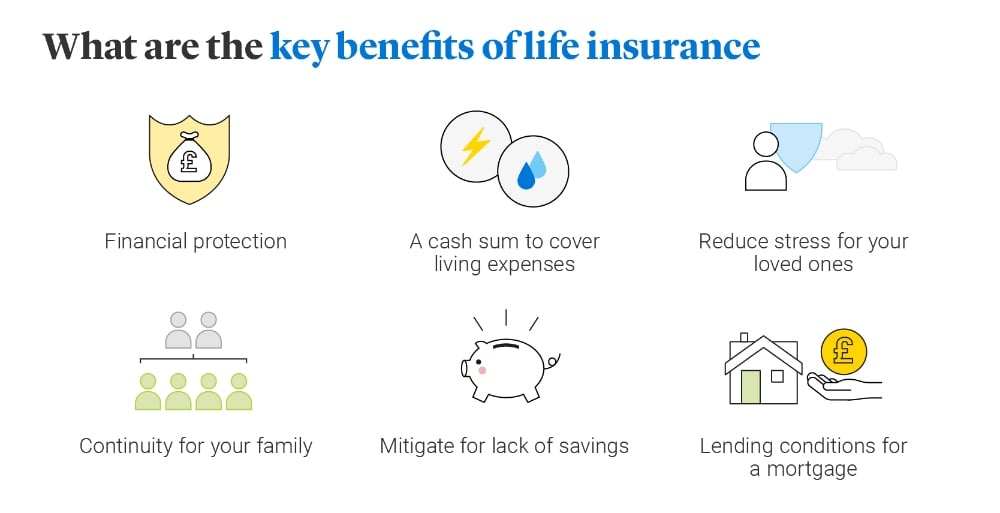

Life insurance: the key benefits

For many people, life insurance provides financial certainty and a back-up plan. Below are some of the main reasons people tend to take out life insurance:

Learn more about life insurance and get a quote today

How much does life insurance cost?

You can get L&G life insurance from just £5 a month. In truth, the cost of life insurance depends on a number of factors. As a rule of thumb, higher amounts of protection or policies that cover you for a long time will cost more. Your health and lifestyle also affect the price, such as:

- Your age

- Your health history, including family medical history

- Your alcohol usage and smoker status, including vaping

- Your weight (Body Mass Index)

- Any risks linked to your occupation or hobbies.

To get an idea of how much life insurance you might need, try our life insurance calculator.

Whether you need life insurance is a personal decision. But if there are people that depend on you financially, such as children or a partner who require your financial support, then life insurance could be a way of helping to protect them.

One simple way to explain life insurance is to think of it as a financial safety net if you were no longer around. How much money would your loved one need to cover childcare costs, household bills and day-to-day living expenses?

If you’re retired and your children have long since flown the nest, you may have less need for life insurance. However, for couples, homeowners, young families and parents with older children, getting life insurance can be a smart idea.

Legal & General life insurance could pay out a cash sum if you die while covered by your policy. If you add Critical Illness Cover for an extra cost when taking out cover, you could receive a cash sum if you’re diagnosed with, or undergo a medical procedure for one of the specified critical illnesses that we cover, and you survive for 14 days from diagnosis.

You choose the amount of cover you need and how long you need it for. You can take out life insurance under joint or single names and you can pay your premiums monthly or annually.

Put simply, it covers your life, but there are different types of life insurance and the cash sum from a payout can cover various needs.

Our Decreasing Life Insurance is often used to help protect a repayment mortgage. The amount of cover reduces roughly in line with the way a repayment mortgage decreases.

In contrast, our Life Insurance is usually chosen to help financially protect loved ones for different reasons. The cash sum could be used by your family to help cover everyday living expenses such as household bills, rent or childcare. It could also be used to help pay off a mortgage.

These policies include Terminal Illness Cover at no extra cost. This means you could receive the life insurance payout while you’re alive if you have a terminal illness with a life expectancy of less than 12 months.

We also offer Care Concierge to our life insurance policyholders. Care Concierge is a confidential telephone advisory service that can help you understand and find adult care and the options that are available.

What other types of life insurance are available in the market?

Whole of life insurance

The difference with whole of life insurance, sometimes called life assurance, is that the cover lasts for the whole of your life so the cash sum from a valid claim will be paid whenever you pass away, rather than during a specific period of cover.

Over 50s Life Insurance

Legal & General also offer a policy which can help you leave some extra cash to your loved ones after you die – Over 50s Life Insurance.

If you’re aged between 50 and 80, Over 50s Life Insurance can help you leave behind some money which can be used by your family to pay unpaid bills, contribute towards funeral costs or buy a small gift. Other types of life insurance may be available if you can answer health and lifestyle questions. Speak to an adviser if you need help.

Can I choose who the money goes to when I pass away?

Yes, you can decide which person, or people, should receive any life insurance payout when you pass away – these are known as your life insurance beneficiaries. You can choose anyone you like to be a beneficiary, but they will need to be at least 18 years-old to receive any funds.

To ensure your chosen beneficiaries receive any payout, you would need to write your life insurance policy in trust or make sure your chosen beneficiaries are written in your will. Otherwise, any cash sum from a life insurance payout would be paid to the estate and would be distributed according to the terms of the will, if there is one, or failing that, the law of intestacy.

Whose life would my insurance cover?

Customers can only insure their own life. A couple can ask us to insure both their lives on the same policy. So there is a choice between a single or joint life insurance policy.

As the names suggest, a single life insurance policy covers one person, whereas joint life insurance covers two lives. In the event of a valid claim, life insurance pays out once and ends. For a couple with a joint policy, that means the other person isn't covered anymore. If a couple has single life policies, a claim on one doesn't affect the other person's cover.

Why might life insurance not pay out?

A life insurance payout is not guaranteed. Here are some of the circumstances where you wouldn’t receive a cash sum after making a claim.

- If you provided inaccurate information when you applied for life insurance, such as misrepresenting your smoker status.

- If your premiums aren’t paid and up to date.

- If you die as a result of suicide within the first year of the policy, or an event where in our reasonable opinion, you took your own life.

Can I get life insurance if I have a pre-existing condition?

You can still get life insurance even if you have suffered from ill health and have a pre-existing medical condition. However, if this applies to you, you may be asked to take a medical exam before any cover is offered, and your premiums may be higher to reflect the greater risk to your life.

If you’re still wondering how life insurance works, read our life insurance FAQs for more information.