Benefits of life insurance

Depending on your circumstances, you may wish to explore the benefits of being insured through a life insurance policy. If you’re asking yourself questions like do I need life insurance or when should I get life insurance then it may be time to look into the potential advantages of life cover. But which type? And what are the benefits of having life insurance? Our guide may shed some light.

You may also be interested in...

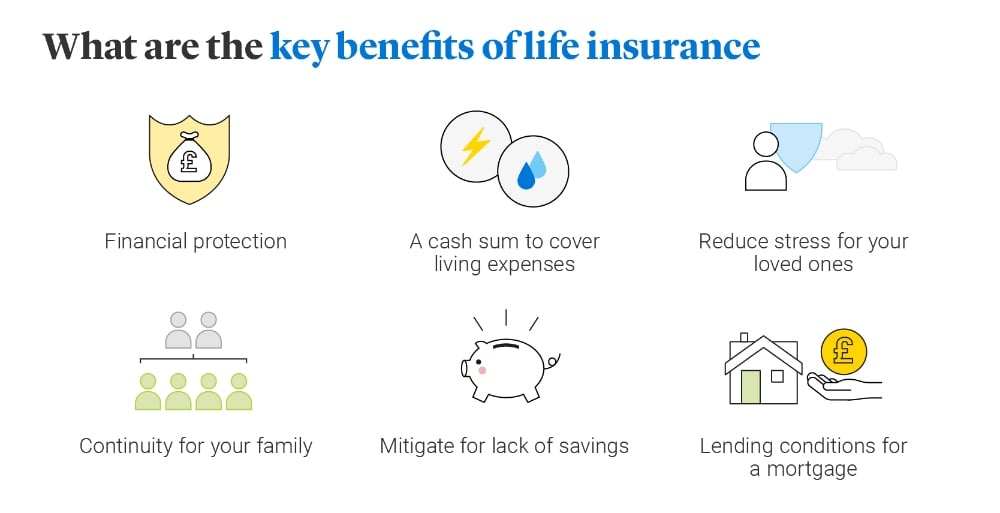

Below are some of the main reasons people tend to take a life insurance policy:

A life insurance policy, such as Legal & General Life Insurance, offers a cash lump sum if you die while covered by the policy. But what are the advantages?

- Life Insurance can be cheaper than a policy that covers the whole of a life. Our Life Insurance starts from just £5 a month depending on the cover you need.

- The amount you pay each month and the cash sum stay the same, unless you make any changes, making it easy to budget for.

- The payout can help with ongoing costs like childcare, school fees, unpaid bills and repaying any debts or mortgage.

For many people, the first time they think about life insurance is when they start climbing the housing ladder. Why do you need to get life insurance if you’re buying a property? While life insurance is not a legal requirement, some lenders will make it a condition of taking out a mortgage.

Decreasing life insurance is one option if you’re a homebuyer looking to financially protect the future of your loved ones. This is where the amount of cover you have roughly decreases in line with the way a repayment mortgage decreases. The potential advantages of this type of life insurance include:

- The amount you pay tend to be lower as the amount of cover decreases during the length of the plan.

- Flexibility – you can choose the right length of time for your life insurance cover to fit with the duration of your mortgage.

- It could be suitable for first time buyers, or for families with a long term still left to pay on their repayment mortgage.

Get a quote, learn more about additional Decreasing Life Insurance benefits, or read the FAQs.

One of the advantages of life insurance is that you can sometimes add on extra protection, like Critical Illness Cover, which can help with a cash sum if you become critically ill. The possible benefits include:

- A cash sum which can be used to help towards anything from childcare costs to household bills.

- Reassurance in knowing that you have a back-up plan in the event you experience a critical illness.

- Could help maintain your standard of living if you were forced to take time off work to recover.

This protection is available for an additional cost when you take out our Life Insurance or Decreasing Life Insurance policies and will pay out if you are diagnosed with, or undergo a medical procedure for one of the illnesses listed during the length of the policy, and you survive for 14 days from diagnosis.

Not sure whether Critical Illness Cover is worth it? it Find out what’s covered, read the FAQs or the additional benefits here.

Whole of life insurance can cover you for the whole of the rest of your life and will pay out whenever you die. This type of policy can be used to cover an expected inheritance tax bill or provide financial support to your dependants. As the policy doesn’t have a fixed end date, your loved ones receive money from the policy, providing premiums are paid and the claim is valid. On the one hand, the advantage of this type of life insurance is the security of a guaranteed payout regardless of when you pass away, but on the other hand, premiums are generally higher for this type of insurance. Speak with your financial adviser to learn more about whole of life insurance.

Perhaps one of the lesser known types of life insurance policy is ‘increasing life insurance’. This means your cover amount is reviewed against measures of inflation, or a fixed rate so it rises over time. Premiums are normally reviewed annually or at set yearly intervals and also rise over time. This type of life insurance is normally designed to protect against inflation and the rising costs of living. Speak with your financial adviser to learn more about increasing life insurance.

Terminal Illness Cover is included at no extra cost with our Life Insurance, Increasing Life Insurance and Decreasing Life Insurance policies. This is where your policy can pay out the full amount when life expectancy is less than 12 months, and your condition meets the definition of terminal illness. Terminal illness cover can help to make an extremely difficult situation a little more manageable. No further claim could then be made after the death of the person insured.

Customers are automatically protected by Terminal Illness Cover if they have a term of two years or more.

There are some potential tax advantages in taking out a life insurance policy. The lump sum is not liable to either income or capital gains tax. However, if the proceeds from your estate (assets and property) exceed £325,000, your estate could be liable to pay 40% Inheritance Tax on whatever is left. It is important to remember money used to cover any personal debt and funeral costs are exempt.

However, one of the benefits of being insured is that you make arrangements to put your life insurance in to a trust. This gives you greater control over who will benefit from your policy (the beneficiaries). You appoint trustees to hold the cash sum from your policy, they will have discretion about which one of the beneficiaries to pass it on t, how much each will get and when.

Protect your beneficiaries from Inheritance Tax

Writing life insurance in trust means the money paid out from your policy should not be considered part of your estate.

Read more about life insurance and tax.

It's important to remember that life insurance is not a savings or investment plan and has no cash value unless a valid claim is made.