How are life insurance premiums calculated?

When you research the cost of life insurance, you may hear the word ‘premiums’ and wonder what this means. So, what is a life insurance premium and how are life insurance costs calculated? To help you get the protection you need, let’s take a look at some of the factors that affect life insurance rates.

You might also be interested in...

A life insurance ‘premium’ is the amount of money you pay for being covered by a life insurance policy.

The word 'premium' originates from Latin, 'praemium', and means 'gift', 'reward', or 'prize'. Historically, Latin was used in formal situations in the legal profession, and when the first English life insurance policy was written in 1583, the word 'praemium' was written into common law to describe the payment for insurance. In a modern life insurance context, 'premium' refers to the 'rate' or price of life insurance.

Life insurance rates are a less commonly used term than life insurance premiums.

When you encounter the term ‘premium’, think of it as the price you pay in exchange for keeping your life insurance policy active.

Strictly speaking, life insurance rates are the pricing measurement used by insurers to balance the cost of doing business with the policyholder’s value for money. So for example, your life insurance rate might be a £1 charge for every £100 of insurance, or £5 for every £500 of insurance.

When you make a life insurance application, the insurer tells you how much your cover will cost. If you want to go ahead, you’ll pay the agreed price at the agreed frequency. The price is fixed unless you make changes to the policy.

The payment you make to the insurer is your ‘premium’. It’s important to pay your life insurance premiums when they’re due, or your insurer could cancel the policy.

L&G makes it easy for customers to keep their premiums up to date with Direct Debits.

Understanding the cost of life insurance

If you’re thinking about the cost of life insurance, there are a few things to consider. You’ll choose a cash sum to protect your loved ones, and you’ll decide how long your cover lasts. You’ll receive a personalised quote from your insurer based on the cover you’ve chosen.

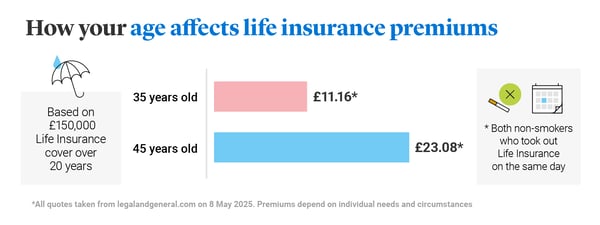

The average cost of Life Insurance was £27.95 per month, according to L&G figures from 2024. But it’s important to remember that age influences the level of protection that customers receive. A younger customer paying average premiums will have more cover than someone older. You also need to be comfortable that you can afford to pay for your policy while it’s in force.

Paying the average premium doesn’t necessarily mean you’ll have the right level of protection. You can get a better picture of how much your life insurance will cost by taking the following steps:

With L&G you can pay your premiums monthly or annually. This applies for the duration of your term length, such as 25 years.

Your life insurance costs reflect how likely it is that you would make a valid claim.The more likely you are to make a life insurance claim, the more likely it is that an insurer will have to pay out; therefore, you would pay more for your policy than someone less likely to make a claim.

Below, we summarise ten personal factors that determine how life insurance costs are calculated, followed by five factors that are linked to specific policy details.

2. Health status

Your life insurance premiums will be calculated based on the medical information you provide when you apply. Any health condition that may make it more likely that the insurer will have to pay out during the policy will ultimately increase your premiums.

In order to assess the risk of a payout, your insurer may request to access your medical records before they decide whether to offer you life insurance. Note – they will need your permission before contacting your GP.

3. Family medical history

Your family medical history can also affect how your life insurance premiums are calculated by your insurer. This is because you could be more likely to develop a serious medical condition that has affected close relatives – see the examples below:

Note that your insurer may not cover you if you currently experience any of the above conditions, and depending on the severity of any symptoms, your premiums may be higher.

4. Weight

Insurers such as L&G will take your body mass index (BMI) into account when determining how your life insurance costs are calculated. A BMI of between 18.5 and 24.9 is considered to be healthy, according to the NHS. The higher your BMI, the greater the risk that you will experience health problems like diabetes, heart disease and high blood pressure, so your premiums would be higher if you’re above the normal range.

5. Smoker status

Smokers are statistically more likely to experience ill health, such as stroke, cancers and heart disease, which can increase the chances of an early death. So while you can still get life insurance as a smoker, you may pay higher premiums. And in case you’re wondering, vaping is treated the same as other types of smoking for insurance purposes.

6. Alcohol consumption

Alcohol consumption is also linked to how your life insurance premiums are calculated. The health risks from excessive alcohol include serious diseases like certain cancers and liver disease, as well as a greater risk of harm from accidents, injuries and violent incidents, according to the NHS. In England, among people aged 15 to 49 years, alcohol is the leading cause of ill-health, disability, and death.

7. Occupation

Some jobs carry a greater risk to your life than others, such as working in the police or armed forces, or working at heights. If an insurer deems your occupation to be ‘high risk’, you may be charged higher premiums for your life insurance.

8. Hobbies

If you have certain hobbies that are deemed hazardous, such as extreme sports, then your insurer may take this into account when calculating your life insurance premiums.

However, your participation in these activities would not automatically prevent you from getting life insurance. The exact cost of your life insurance premiums would be calculated based on factors like the frequency that you take part; your age and experience level; where the activity takes place; and whether you’re a member of a professional body that oversees aspects of the activity.

Here are some examples of sports, hobbies and activities that an insurer might view as a life insurance risk:

- Paragliding

- Climbing

- Skydiving

- Mountaineering

- Trekking

- Caving and potholing

- Canyoning

- White water rafting

- Motor car sports

- Private or club flying.

9. Mental health

If you have a history of mental illness or experience conditions like depression or anxiety, this may affect the calculations of your life insurance premiums. You can still get cover, but the decision will be made on the basis of your recent medical history and the nature of your condition. Read more in our guide to life insurance and mental health.

10. Where you live

If you intend to live overseas for a period of time, the cost of your life insurance premiums may be affected by factors like the accessibility of healthcare, armed conflict in the region, or the prevalence of certain diseases or infections. You will need to be a UK resident in order to qualify for Legal & General life insurance, and we class that as someone who lives in the UK and has spent at least 183 days in the country over the last tax year.

Policy factors that affect your premiums

If you wish to renew your life insurance when your policy expires, you will need to take out a new policy from scratch. The terms of that policy would be offered on the basis of your health status at the time, and since you would be older than when you first took out life insurance, your premiums would likely be more expensive.

However, you can request to make changes to your policy or you may be able to increase your cover without answering further medical questions following certain life events, such as the birth of a child or getting married or entering into a civil partnership. Any changes you make will affect the premiums that you pay. Eligibility criteria applies.

No – your life insurance premiums must be paid through the policyholder’s UK bank account.

How to make life insurance premiums more affordable

Your life insurance costs will be fixed when you take out a policy. But here are some ways you may be able to lower your life insurance premiums.

Quit smoking

If you have a life insurance policy already and you stop smoking for 12 months, you may be able to reduce your life insurance rates by taking out a new policy as a non-smoker.

Review your needs

If your life circumstances have changed – for example, following a divorce or your adult children have left home – you could reassess how much cover you require.

Compare quotes before you apply

Your life insurance premiums will be based on the information you provide at the time you apply. You could shop around to get the best prices before you take out a policy.

Read our guide on how to keep the cost of life insurance down.

Want to learn more about Life Insurance?

Other related articles

Life insurance with pre-existing medical conditions

Does your job affect your life insurance?